Wells Fargo 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

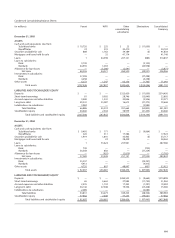

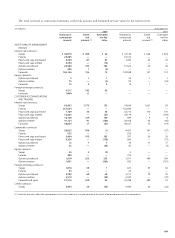

(in millions) December 31,

2005 2004

Carrying Estimated Carrying Estimated

amount fair value amount fair value

FINANCIAL ASSETS

Mortgages held for sale $ 40,534 $ 40,666 $ 29,723 $ 29,888

Loans held for sale 612 629 8,739 8,972

Loans, net 306,966 307,721 283,824 285,488

Nonmarketable equity investments 5,090 5,533 5,229 5,494

FINANCIAL LIABILITIES

Deposits 314,450 314,301 274,858 274,900

Long-term debt

(1)

79,654 78,868 73,560 74,085

(1) The carrying amount and fair value exclude obligations under capital leases of $14 million and $20 million at December 31, 2005 and 2004, respectively.

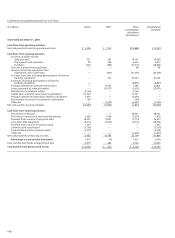

Financial Liabilities

DEPOSIT LIABILITIES

FAS 107 states that the fair value of deposits with no stated

maturity, such as noninterest-bearing demand deposits,

interest-bearing checking and market rate and other savings,

is equal to the amount payable on demand at the measurement

date. The amount included for these deposits in the following

table is their carrying value at December 31, 2005 and 2004.

The fair value of other time deposits is calculated based on

the discounted value of contractual cash flows. The discount

rate is estimated using the rates currently offered for like

wholesale deposits with similar remaining maturities.

SHORT-TERM FINANCIAL LIABILITIES

Short-term financial liabilities include federal funds pur-

chased and securities sold under repurchase agreements,

commercial paper and other short-term borrowings.

The carrying amount is a reasonable estimate of fair

value because of the relatively short time between the

origination of the instrument and its expected realization.

LONG-TERM DEBT

The discounted cash flow method is used to estimate the

fair value of our fixed-rate long-term debt. Contractual

cash flows are discounted using rates currently offered

for new notes with similar remaining maturities.

Derivatives

The fair values of derivatives are reported in Note 26.

Limitations

We make these fair value disclosures to comply with the

requirements of FAS 107. The calculations represent man-

agement’s best estimates; however, due to the lack of broad

markets and the significant items excluded from this disclosure,

the calculations do not represent the underlying value of the

Company. The information presented is based on fair value

calculations and market quotes as of December 31, 2005

and 2004. These amounts have not been updated since year

end; therefore, the valuations may have changed significantly

since that point in time.

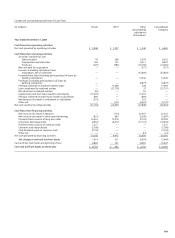

As discussed above, some of our asset and liability financial

instruments are short-term, and therefore, the carrying amounts

in the Consolidated Balance Sheet approximate fair value.

Other significant assets and liabilities, which are not consid-

ered financial assets or liabilities and for which fair values

have not been estimated, include mortgage servicing rights,

premises and equipment, goodwill and other intangibles,

deferred taxes and other liabilities.

This table is a summary of financial instruments, as

defined by FAS 107, excluding short-term financial assets

and liabilities, for which carrying amounts approximate

fair value, and trading assets, securities available for sale

and derivatives, which are carried at fair value.