Wells Fargo 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

We earn trust, investment and IRA fees from managing and

administering assets, including mutual funds, corporate trust,

personal trust, employee benefit trust and agency assets. At

December 31, 2005, these assets totaled $783 billion, up 11%

from $705 billion at December 31, 2004. At December 31, 2004,

we acquired $24 billion in mutual fund assets and $5 billion

in institutional investment accounts from Strong Financial

Corporation (Strong Financial). When the Wells Fargo

Funds®and certain Strong Financial funds merged in April

2005, we renamed our mutual fund family the Wells Fargo

Advantage FundsSM. Generally, trust, investment and IRA

fees are based on the market value of the assets that are

managed, administered, or both. The increase in these fees

was due to additional revenue from the December 31, 2004,

acquisition of assets from the Strong Financial transaction

and our successful efforts to grow our investment businesses.

Also, we receive commissions and other fees for providing

services for retail and discount brokerage customers. At

December 31, 2005 and 2004, brokerage balances were

$97 billion and $86 billion, respectively. Generally, these

fees are based on the number of transactions executed at

the customer’s direction.

Card fees increased 19% to $1,458 million in 2005 from

$1,230 million in 2004, predominantly due to increases in credit

card accounts and credit and debit card transaction volume.

Mortgage banking noninterest income increased to

$2,422 million in 2005 from $1,860 million in 2004, due to

an increase in net gains on mortgage loan origination/sales

activities partly offset by the decline in net servicing income.

Net gains on mortgage loan origination/sales activities

were $1,085 million in 2005, up from $539 million in 2004,

primarily due to higher origination volume. Originations were

$366 billion in 2005 and $298 billion in 2004. The 1-4 family

first mortgage unclosed pipeline was $50 billion at both

year-end 2005 and 2004.

Net servicing income was $987 million in 2005 compared

with $1,037 million in 2004. Servicing income includes net

derivative gains and losses and is net of amortization and

impairment of MSRs, which are all influenced by both the

level and direction of mortgage interest rates. The Company’s

portfolio of loans serviced for others was $871 billion at

December 31, 2005, up 27% from $688 billion at year-end

2004. Given a larger servicing portfolio year over year,

the increase in servicing income was partly offset by higher

amortization of MSRs. Servicing fees increased to

$2,457 million in 2005 from $2,101 million in 2004 and

amortization of MSRs increased to $1,991 million in 2005

from $1,826 million in 2004. Servicing income in 2005

also included a higher MSRs valuation allowance release of

$378 million in 2005 compared with $208 million in 2004,

due to higher long-term interest rates in certain quarters

of 2005. The increase in fee revenue and the higher MSRs

valuation allowance release were mostly offset by the

decrease in net derivative gains to $143 million in 2005

from $554 million in 2004.

Net losses on debt securities were $120 million for 2005,

compared with $15 million for 2004. Net gains from equity

investments were $511 million in 2005, compared with

$394 million in 2004, primarily reflecting the continued

strong performance of our venture capital business.

We routinely review our investment portfolios and recognize

impairment write-downs based primarily on issuer-specific

factors and results, and our intent to hold such securities.

We also consider general economic and market conditions,

including industries in which venture capital investments

are made, and adverse changes affecting the availability of

venture capital. We determine impairment based on all of the

information available at the time of the assessment, but new

information or economic developments in the future could

result in recognition of additional impairment.

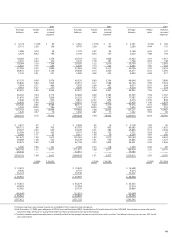

Noninterest Income

Table 4: Noninterest Income

(in millions) Year ended December 31,___% Change

2005 2004 2003 2005/ 2004/

2004 2003

Service charges on

deposit accounts $ 2,512

$ 2,417 $ 2,297 4% 5%

Trust and investment fees:

Trust, investment and IRA fees 1,855

1,509 1,345 23 12

Commissions and all other fees

581 607 592 (4) 3

Total trust and

investment fees

2,436 2,116 1,937 15 9

Card fees

1,458 1,230 1,079 19 14

Other fees:

Cash network fees

180 180 179 —1

Charges and fees on loans

1,022 921 756 11 22

All other

727 678 625 78

Total other fees

1,929 1,779 1,560 814

Mortgage banking:

Servicing income,net of amortization

and provision for impairment

987 1,037 (954) (5) —

Net gains on mortgage loan

origination/sales activities

1,085 539 3,019 101 (82)

All other

350 284 447 23 (36)

Total mortgage banking

2,422 1,860 2,512 30 (26)

Operating leases

812 836 937 (3) (11)

Insurance

1,215 1,193 1,071 211

Trading assets

571 523 502 94

Net gains (losses) on debt

securities available for sale

(120) (15) 4 700 —

Net gains from

equity investments

511 394 55 30 616

Net gains on sales of loans

511 28 (55) (61)

Net gains (losses) on dispositions

of operations

14 (15) 29 ——

All other

680 580 371 17 56

Total

$14,445 $12,909 $12,382 12 4