Wells Fargo 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Critical Accounting Policies

Our significant accounting policies (see Note 1 (Summary of

Significant Accounting Policies) to Financial Statements) are

fundamental to understanding our results of operations and

financial condition, because some accounting policies require

that we use estimates and assumptions that may affect the

value of our assets or liabilities and financial results. Three

of these policies are critical because they require management

to make difficult, subjective and complex judgments about

matters that are inherently uncertain and because it is likely

that materially different amounts would be reported under

different conditions or using different assumptions. These

policies govern the allowance for credit losses, the valuation

of mortgage servicing rights and pension accounting.

Management has reviewed and approved these critical

accounting policies and has discussed these policies with

the Audit and Examination Committee.

Allowance for Credit Losses

The allowance for credit losses, which consists of the

allowance for loan losses and the reserve for unfunded credit

commitments, is management’s estimate of credit losses

inherent in the loan portfolio at the balance sheet date. We

have an established process, using several analytical tools and

benchmarks, to calculate a range of possible outcomes and

determine the adequacy of the allowance. No single statistic

or measurement determines the adequacy of the allowance.

Loan recoveries and the provision for credit losses increase

the allowance, while loan charge-offs decrease the allowance.

PROCESS TO DETERMINE THE ADEQUACY OF THE ALLOWANCE

FOR CREDIT LOSSES

While we allocate a portion of the allowance to specific loan

categories (the allocated allowance), the entire allowance

(both allocated and unallocated) is used to absorb credit

losses inherent in the total loan portfolio.

Approximately two-thirds of the allocated allowance is

determined at a pooled level for consumer loans and some

segments of commercial small business loans. We use

forecasting models to measure the losses inherent in these

portfolios. We frequently validate and update these models to

capture recent behavioral characteristics of the portfolios, as

well as changes in our loss mitigation or marketing strategies.

The remaining allocated allowance is for commercial

loans, commercial real estate loans and lease financing. We

initially estimate this portion of the allocated allowance by

applying historical loss factors statistically derived from

tracking loss content associated with actual portfolio move-

ments over a specified period of time, using a standardized

loan grading process. Based on this process, we assign loss

factors to each pool of graded loans and a loan equivalent

amount for unfunded loan commitments and letters of credit.

These estimates are then adjusted or supplemented where

necessary from additional analysis of long term average loss

experience, external loss data, or other risks identified from

current conditions and trends in selected portfolios. Also, we

individually review nonperforming loans over $3 million for

impairment based on cash flows or collateral. We include

impairment on these nonperforming loans in the allocated

allowance unless it has already been recognized as a loss.

The allocated allowance is supplemented by the unallo-

cated allowance to adjust for imprecision and to incorporate

the range of probable outcomes inherent in estimates used

for the allocated allowance. The unallocated allowance is

the result of our judgment of risks inherent in the portfolio,

economic uncertainties, historical loss experience and other

subjective factors, including industry trends, not reflected in

the allocated allowance.

The ratios of the allocated allowance and the unallocated

allowance to the total allowance may change from period to

period. The total allowance reflects management’s estimate

of credit losses inherent in the loan portfolio at the balance

sheet date.

The allowance for credit losses, and the resulting provision,

is based on judgments and assumptions, including:

• general economic conditions;

• loan portfolio composition;

• loan loss experience;

• management’s evaluation of the credit risk relating to

pools of loans and individual borrowers;

• sensitivity analysis and expected loss models; and

• observations from our internal auditors, internal loan

review staff or banking regulators.

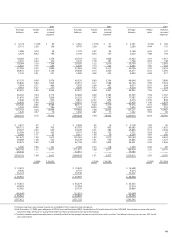

To estimate the possible range of allowance required at

December 31, 2005, and the related change in provision

expense, we assumed the following scenarios of a reasonably

possible deterioration or improvement in loan credit quality.