Wells Fargo 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

On August 11, 2005, the FASB issued for public

comment an Exposure Draft that would amend FAS 140,

Accounting for Transfers and Servicing of Financial Assets

and Extinguishments of Liabilities. This Exposure Draft,

Accounting for Servicing of Financial Assets – An Amendment

of FASB Statement No. 140, would require that all separately

recognized servicing rights be initially measured at fair value,

if practicable. For each class of separately recognized servicing

assets and liabilities, this proposed standard would permit an

entity to choose from two subsequent measurement methods.

Specifically, an entity could amortize servicing assets and

liabilities in proportion to and over the period of estimated

net servicing income or servicing loss (effectively the existing

requirement in FAS 140) or an entity could report servicing

assets or liabilities at fair value at each reporting date with

any changes reported currently in operations. We expect this

guidance to be finalized and issued in early 2006. Based on

the guidance in the current Exposure Draft, it is likely that

we will adopt the fair value alternative upon issuance of

the standard. We will continue to monitor this emerging

guidance in order to finalize our decision and determine

the impact on our financial statements.

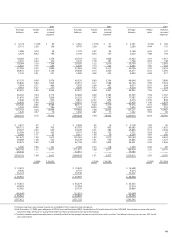

Table 2: Six-Year Summary of Selected Financial Data

(in millions, except % Change Five-year

per share amounts) 2005/ compound

2005 2004 2003 2002 2001 2000 2004 growth rate

INCOME STATEMENT

Net interest income $ 18,504 $ 17,150 $ 16,007 $ 14,482 $ 11,976 $ 10,339 8% 12%

Noninterest income 14,445 12,909 12,382 10,767 9,005 10,360 12 7

Revenue 32,949 30,059 28,389 25,249 20,981 20,699 10 10

Provision for credit losses 2,383 1,717 1,722 1,684 1,727 1,284 39 13

Noninterest expense 19,018 17,573 17,190 14,711 13,794 12,889 88

Before effect of change in

accounting principle (1)

Net income $ 7,671 $ 7,014 $ 6,202 $ 5,710 $ 3,411 $ 4,012 914

Earnings per common share 4.55 4.15 3.69 3.35 1.99 2.35 10 14

Diluted earnings

per common share 4.50 4.09 3.65 3.32 1.97 2.32 10 14

After effect of change in

accounting principle

Net income $ 7,671 $ 7,014 $ 6,202 $ 5,434 $ 3,411 $ 4,012 914

Earnings per common share 4.55 4.15 3.69 3.19 1.99 2.35 10 14

Diluted earnings

per common share 4.50 4.09 3.65 3.16 1.97 2.32 10 14

Dividends declared

per common share 2.00 1.86 1.50 1.10 1.00 .90 817

BALANCE SHEET

(at year end)

Securities available for sale $ 41,834 $ 33,717 $ 32,953 $ 27,947 $ 40,308 $ 38,655 24 2

Loans 310,837 287,586 253,073 192,478 167,096 155,451 815

Allowance for loan losses 3,871 3,762 3,891 3,819 3,717 3,681 31

Goodwill 10,787 10,681 10,371 9,753 9,527 9,303 13

Assets 481,741 427,849 387,798 349,197 307,506 272,382 13 12

Core deposits (2) 253,341 229,703 211,271 198,234 182,295 156,710 10 10

Long-term debt 79,668 73,580 63,642 47,320 36,095 32,046 820

Guaranteed preferred beneficial

interests in Company’s

subordinated debentures (3) —— — 2,885 2,435 935 ——

Stockholders’ equity 40,660 37,866 34,469 30,319 27,175 26,461 79

(1) Change in accounting principle is for a transitional goodwill impairment charge recorded in 2002 upon adoption of FAS 142, Goodwill and Other Intangible Assets.

(2) Core deposits consist of noninterest-bearing deposits, interest-bearing checking, savings certificates and market rate and other savings.

(3) At December 31, 2003, upon adoption of FIN 46 (revised December 2003), Consolidation of Variable Interest Entities (FIN 46R), these balances were reflected in long-term

debt. See Note 12 (Long-Term Debt) to Financial Statements for more information.