Wells Fargo 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

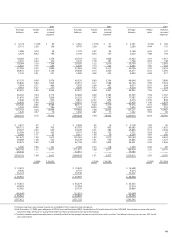

ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses, which consists of the

allowance for loan losses and the reserve for unfunded credit

commitments, is management’s estimate of credit losses

inherent in the loan portfolio at the balance sheet date. We

assume that our allowance for credit losses as a percentage

of charge-offs and nonaccrual loans will change at different

points in time based on credit performance, loan mix and

collateral values. Any loan with past due principal or interest

that is not both well-secured and in the process of collection

generally is charged off (to the extent that it exceeds the fair

value of any related collateral) based on loan category after a

defined period of time. Also, a loan is charged off when clas-

sified as a loss by either internal loan examiners or regulatory

examiners. The detail of the changes in the allowance for

credit losses, including charge-offs and recoveries by loan

category, is in Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements.

At December 31, 2005, the allowance for loan losses

was $3.87 billion, or 1.25% of total loans, compared

with $3.76 billion, or 1.31%, at December 31, 2004, and

$3.89 billion, or 1.54%, at December 31, 2003. The decrease

in the ratio of the allowance for loan losses to total loans was

primarily due to a continued shift toward a higher percentage

of consumer loans in our portfolio, including consumer loans

and some small business loans, which have shorter loss

emergence periods, and home mortgage loans, which have

inherently lower losses that emerge over a longer time frame

compared to other consumer products. We have historically

experienced lower losses on our residential real estate secured

consumer loan portfolio.

The allowance for credit losses was $4.06 billion at

December 31, 2005, and $3.95 billion at December 31, 2004.

The ratio of the allowance for credit losses to net charge-offs

was 178% and 237% at December 31, 2005 and 2004,

respectively. This ratio fluctuates from period to period and

the decrease in 2005 reflects increased loss rates within the

various consumer and small business portfolios impacted by

higher consumer bankruptcies in fourth quarter 2005.

The ratio of the allowance for credit losses to total nonac-

crual loans was 303% and 291% at December 31, 2005 and

2004, respectively. This ratio may fluctuate significantly from

period to period due to such factors as the mix of loan types

in the portfolio, borrower credit strength and the value and

marketability of collateral. Over half of nonaccrual loans

were home mortgages and other consumer loans at

December 31, 2005. Nonaccrual loans are generally written

down to a net realizable value at the time they are placed on

nonaccrual and accounted for on a cost recovery basis.

The provision for credit losses totaled $2.38 billion in

2005, and $1.72 billion in both 2004 and 2003. In 2005, the

provision included $100 million in excess of net charge-offs,

which was our estimate of probable credit losses related

to Hurricane Katrina. We continue to work with customers

under various payment moratoriums and forbearance

programs to re-evaluate and refine our estimates as more

information becomes available and can be confirmed in

subsequent quarters.

Net charge-offs in 2005 were .77% of average total

loans, compared with .62% in 2004 and .81% in 2003.

Higher net charge-offs in 2005 included the additional credit

losses from the change in bankruptcy laws and conforming

Wells Fargo Financial to FFIEC charge-off rules. A portion

of these bankruptcy charge-offs represent an acceleration of

charge-offs that would have likely occurred in 2006. The

increase in consumer bankruptcies primarily impacted our

credit card, unsecured consumer loans and lines, auto and

small business portfolios.

The reserve for unfunded credit commitments was

$186 million at December 31, 2005, and $188 million at

December 31, 2004, less than 5% of the total allowance for

credit losses related to this potential risk for both years.

The allocated component of the allowance for credit losses

was $3.41 billion at December 31, 2005, and $3.06 billion at

December 31, 2004, an increase of $347 million year over

year. Changes in the allocated allowance reflect changes in

statistically derived loss estimates, historical loss experience,

and current trends in borrower risk and/or general economic

activity on portfolio performance. The unallocated allowance

decreased to $648 million, or 16% of the allowance for credit

losses, at December 31, 2005, from $888 million, or 22%, at

December 31, 2004.

We consider the allowance for credit losses of $4.06 billion

adequate to cover credit losses inherent in the loan portfolio,

including unfunded credit commitments, at December 31, 2005.

The process for determining the adequacy of the allowance

for credit losses is critical to our financial results. It requires

difficult, subjective and complex judgments, as a result of

the need to make estimates about the effect of matters that

are uncertain. (See “Financial Review – Critical Accounting

Policies – Allowance for Credit Losses.”) Therefore, we

cannot provide assurance that, in any particular period, we

will not have sizeable credit losses in relation to the amount

reserved. We may need to significantly adjust the allowance

for credit losses, considering current factors at the time,

including economic conditions and ongoing internal and

external examination processes. Our process for determining

the adequacy of the allowance for credit losses is discussed

in Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements.