Wells Fargo 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

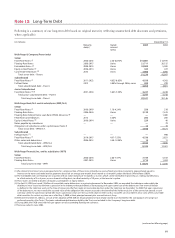

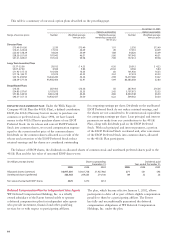

Following is a summary of our long-term debt based on original maturity (reflecting unamortized debt discounts and premiums,

where applicable):

Note 12: Long-Term Debt

(in millions) December 31,

Maturity Stated 2005 2004

date(s) interest

rate(s)

Wells Fargo & Company (Parent only)

Senior

Fixed-Rate Notes (1) 2006-2035 2.20-6.875% $16,081 $12,970

Floating-Rate Notes 2006-2015 Varies 21,711 20,155

Extendable Notes (2) 2008-2015 Varies 10,000 5,500

Equity-Linked Notes (3) 2006-2014 Varies 444 472

Convertible Debenture (4) 2033 Varies 3,000 3,000

Total senior debt – Parent 51,236 42,097

Subordinated

Fixed-Rate Notes (1) 2011-2023 4.625-6.65% 4,558 4,502

FixFloat Notes 2012 4.00% through 2006, varies 300 299

Total subordinated debt – Parent 4,858 4,801

Junior Subordinated

Fixed-Rate Notes (1)(5) 2031-2034 5.625-7.00% 3,247 3,248

Total junior subordinated debt – Parent 3,247 3,248

Total long-term debt – Parent 59,341 50,146

Wells Fargo Bank, N.A. and its subsidiaries (WFB, N.A.)

Senior

Fixed-Rate Notes (1) 2006-2019 1.16-4.24% 256 218

Floating-Rate Notes 2006-2034 Varies 3,138 7,615

Floating-Rate Federal Home Loan Bank (FHLB) Advances (6) —— —1,400

FHLB Notes and Advances 2012 5.20% 203 200

Equity-Linked Notes (3) 2006-2014 Varies 229 40

Notes payable by subsidiaries —— —79

Obligations of subsidiaries under capital leases (Note 7) 14 19

Total senior debt – WFB, N. A. 3,840 9,571

Subordinated

FixFloat Notes (7) —— —998

Fixed-Rate Notes (1) 2010-2015 4.07-7.55% 4,330 2,821

Other notes and debentures 2006-2013 4.50-12.00% 13 11

Total subordinated debt – WFB, N.A. 4,343 3,830

Total long-term debt – WFB, N.A. 8,183 13,401

Wells Fargo Financial, Inc., and its subsidiaries (WFFI)

Senior

Fixed-Rate Notes 2006-2034 2.06-7.47% 7,159 5,343

Floating-Rate Notes 2007-2010 Varies 1,714 1,303

Total long-term debt – WFFI $ 8,873 $ 6,646

(1) We entered into interest rate swap agreements for a major portion of these notes, whereby we receive fixed-rate interest payments approximately equal to

interest on the notes and make interest payments based on an average one-month, three-month or six-month London Interbank Offered Rate (LIBOR).

(2) The extendable notes are floating-rate securities with an initial maturity of 13 months or 2 years, which can be extended, respectively, on a rolling monthly basis,

to a final maturity of 5 or 6 years, or, on a 6 month rolling basis, to a final maturity of 10 years, at the investor’s option.

(3) These notes are linked to baskets of equities, commodities or equity indices.

(4) On April 15, 2003, we issued $3 billion of convertible senior debentures as a private placement. In November 2004, we amended the indenture under which the

debentures were issued to eliminate a provision in the indenture that prohibited us from paying cash upon conversion of the debentures if an event of default

as defined in the indenture exists at the time of conversion. We then made an irrevocable election under the indenture on December 15, 2004, that upon conversion

of the debentures, we must satisfy the accreted value of the obligation (the amount accrued to the benefit of the holder exclusive of the conversion spread) in cash

and may satisfy the conversion spread (the excess conversion value over the accreted value) in either cash or stock.We can also redeem all or some of the convertible

debt securities for cash at any time on or after May 5, 2008, at their principal amount plus accrued interest, if any.

(5) Effective December 31, 2003, as a result of the adoption of FIN 46R we deconsolidated certain wholly-owned trusts formed for the sole purpose of issuing trust

preferred securities (the Trusts).The junior subordinated debentures held by the Trusts are included in the Company’s long-term debt.

(6) During 2005, the FHLB exercised their put options on all outstanding floating-rate advances.

(7) Note was called in June 2005.

(continued on following page)