Wells Fargo 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

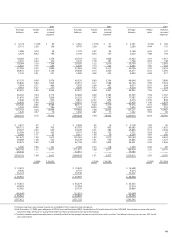

LOANS 90 DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans in this category are 90 days or more past due as to

interest or principal and still accruing, because they are

(1) well-secured and in the process of collection or (2) real

estate 1-4 family first mortgage loans or consumer loans exempt

under regulatory rules from being classified as nonaccrual.

The total of loans 90 days or more past due and still

accruing was $3,606 million, $2,578 million, $2,337 million,

$672 million and $698 million at December 31, 2005, 2004,

2003, 2002 and 2001, respectively. At December 31, 2005, 2004,

and 2003, the total included $2,923 million, $1,820 million

and $1,641 million, respectively, in advances pursuant to

our servicing agreements to Government National Mortgage

Association (GNMA) mortgage pools whose repayments are

insured by the Federal Housing Administration or guaranteed

by the Department of Veterans Affairs. Before clarifying

guidance issued in 2003 as to classification as loans, GNMA

advances were included in other assets. Table 11 provides

detail by loan category excluding GNMA advances.

Table 11: Loans 90 Days or More Past Due and Still Accruing

(Excluding Insured/Guaranteed GNMA Advances)

(in millions) December 31,

2005 2004 2003 2002 2001

Commercial and

commercial real estate:

Commercial $18 $26 $87 $92 $60

Other real estate

mortgage 13 69 722

Real estate construction 9 6 611 47

Total commercial

and commercial

real estate 40 38 102 110 129

Consumer:

Real estate

1-4 family

first mortgage 103 148 117 104 145

Real estate

1-4 family junior

lien mortgage 50 40 29 18 17

Credit card 159 150 134 130 116

Other revolving credit

and installment 290 306 271 282 268

Total consumer 602 644 551 534 546

Foreign 41 76 43 28 23

Total $683 $758 $696 $672 $698

Table 10: Nonaccrual Loans and Other Assets

(in millions) December 31,

2005 2004 2003 2002 2001

Nonaccrual loans:

Commercial and commercial real estate:

Commercial $ 286 $ 345 $ 592 $ 796 $ 827

Other real estate mortgage 165 229 285 192 210

Real estate construction 31 57 56 93 145

Lease financing 45 68 73 79 163

Total commercial and commercial real estate 527 699 1,006 1,160 1,345

Consumer:

Real estate 1-4 family first mortgage 471 386 274 230 205

Real estate 1-4 family junior lien mortgage 144 92 87 49 22

Other revolving credit and installment 171 160 88 48 59

Total consumer 786 638 449 327 286

Foreign 25 21 3 5 9

Total nonaccrual loans (1) 1,338 1,358 1,458 1,492 1,640

As a percentage of total loans .43% .47% .58% .78% .98%

Foreclosed assets 191 212 198 195 160

Real estate investments (2) 2 2 6 4 2

Total nonaccrual loans and other assets $1,531 $1,572 $1,662 $1,691 $1,802

As a percentage of total loans .49% .55% .66% .88% 1.08%

(1) Includes impaired loans of $190 million, $309 million, $629 million, $612 million and $823 million at December 31, 2005, 2004, 2003, 2002 and 2001, respectively.

(See Note 1 (Summary of Significant Accounting Policies) and Note 6 (Loans and Allowance for Credit Losses) to Financial Statements for further discussion of impaired loans.)

(2) Real estate investments (contingent interest loans accounted for as investments) that would be classified as nonaccrual if these assets were recorded as loans.

Real estate investments totaled $84 million, $4 million, $9 million, $9 million and $24 million at December 31, 2005, 2004, 2003, 2002 and 2001, respectively.