Wells Fargo 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3 To Our Owners

For 20 years,Wells Fargo has achieved

double-digit growth in almost every

economic environment.Chairman/CEO

Dick Kovacevich explains how our

team did it.

11 How Do We Picture the

Next Stage of Success?

We believe—and many industry

observers agree—that we have the

strongest management team in all

of financial services. Here’s how they

picture success for their customers,

their businesses and their teams.

24 Picturing the Next Stage of Success

for Our Communities

We’re one of corporate America’s top

10 givers—but it’s the time, talent

and creativity of our team member

volunteers that really sets us apart.

31 Board of Directors, Senior Management

33 Financial Review

58 Controls, Procedures

60 Financial Statements

112 Report of Independent Registered

Public Accounting Firm

116 Stockholder Information

Which Measures Really Matter?

2005 Update (inside back cover)

Wells Fargo & Company

Wells Fargo & Company (NYSE:WFC)

is a diversified financial services company

providing banking, insurance,investments,

mortgage loans and consumer finance. Our

corporate headquarters is in San Francisco,

but we’re decentralized so all Wells Fargo

“convenience points”—including stores,

regional commercial banking centers,

ATMs, Wells Fargo Phone BankSM centers,

internet—are headquarters for satisfying

all our customers’financial needs and

helping them succeed financially.

“Aaa”

Wells Fargo Bank, N.A. is the only U.S. bank to

receive the highest possible credit rating from

Moody’s Investors Service.

Assets: $482 billion (5th among U.S. peers)

Market value of stock: $105 billion

(4th among U.S. peers)

Fortune 500: Profit,17th; Market Cap, 18th

Team members: 153,500

(one of U.S.’s 40 largest private employers)

Customers: 23+ million

Stores: 6,250

Reputation

Barron’s

World’s most admired financial

services company

Business Ethics

Ranked top 10 corporate citizen

BusinessWeek

Among corporate America’s top 10

corporate givers

Fortune

“Most Admired Megabank”

52nd in revenue among all U.S.

companies in all industries

World’s 29th most profitable company

Mergent, Inc.

“Dividend Achiever”*

Moody’s Investors Service

Only U.S. bank rated “Aaa,”

highest possible credit rating

Watchfire GomezPro

#1 internet bank

Our Market Leadership

#1, 2 or 3 in deposit market share in 15 of

our 23 banking states; #4 nationally (6/30/05)

#1 retail mortgage originator;

#2 mortgage servicer

#2 in mortgages to low-to-moderate income

home buyers

#1 home equity lender

#1 small business lender

#1 small business lender in low-to-moderate

income neighborhoods

#1 insurance broker owned by bank

holding company (world’s 5th largest

insurance brokerage)

#1 agricultural lender

#1 financial services provider to

middle-market businesses in

our banking states

#2 debit card issuer

#2 bank auto lender

#3 ATM network

One of U.S.’s leading commercial

real estate lenders

One of North America’s premier

consumer finance companies

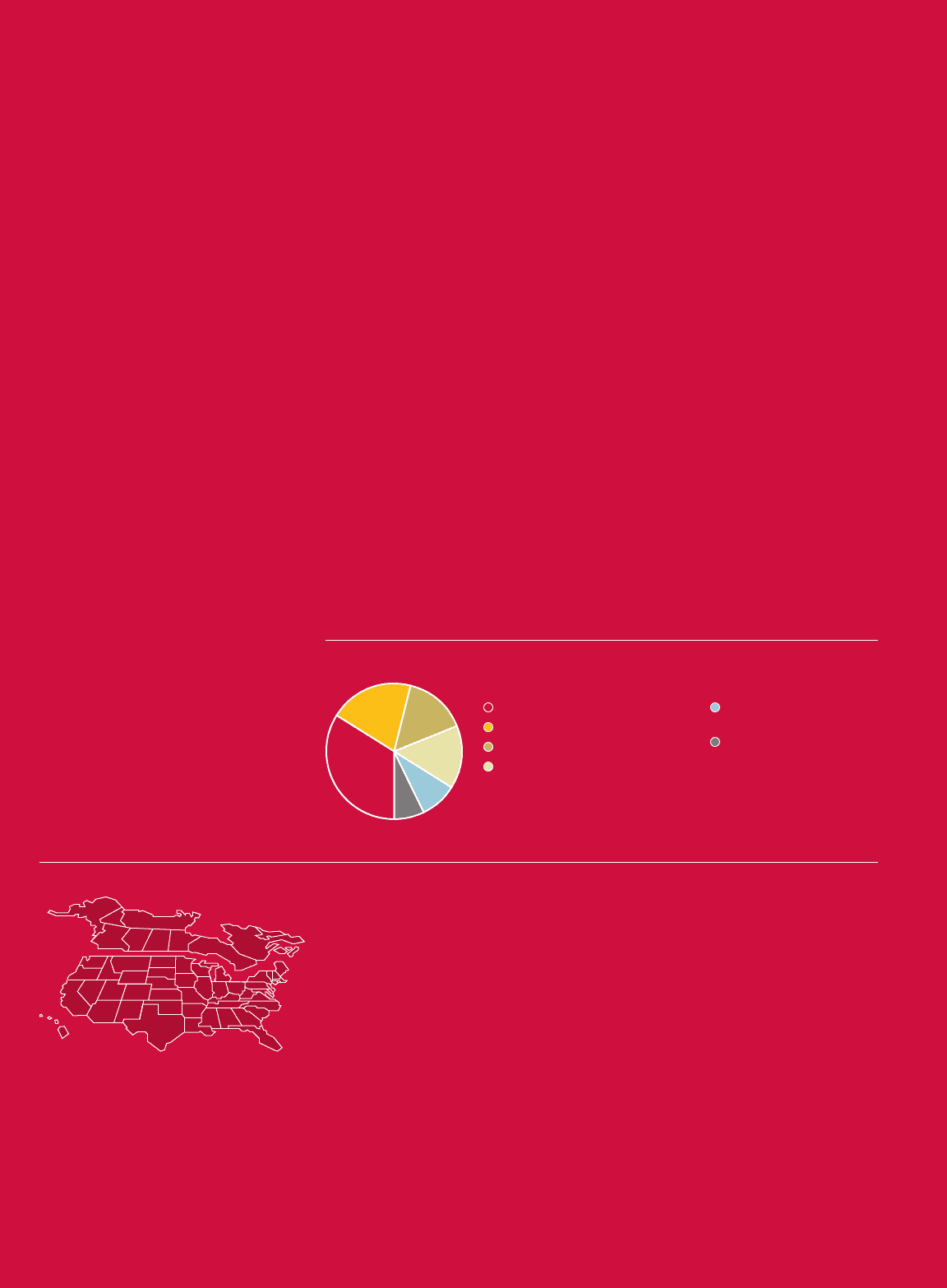

Our Earnings Diversity

Earnings based on historical averages and near future year expectations

Banking, insurance, investments,

mortgage loans, and consumer finance—

we span North America and beyond.

Community Banking . . . . . . . . . . . . . 34%

Home Mortgage/Home Equity . . . 20%

Investments & Insurance . . . . . . . . . 15%

Specialized Lending . . . . . . . . . . . . . . 15%

Wholesale Banking/

Commercial Real Estate . . . 9%

Consumer Finance . . . . . . . . 7%

* Publicly traded companies that increased dividends for last

10+ consecutive years;Wells Fargo has increased dividends

for 18 consecutive years, 23 increases since 1988.