Wells Fargo 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

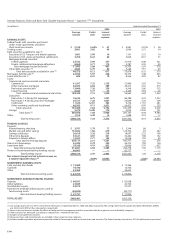

Quarterly Financial Data

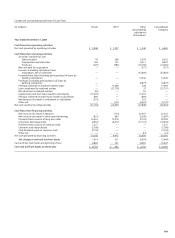

Condensed Consolidated Statement of Income — Quarterly (Unaudited)

(in millions, except per share amounts) 2005 2004

Quarter ended Quarter ended

Dec. 31 Sept. 30 June 30 Mar. 31 Dec. 31 Sept. 30 June 30 Mar. 31

INTEREST INCOME $ 7,244 $ 6,645 $ 6,200 $ 5,873 $ 5,635 $ 5,405 $ 5,069 $ 4,858

INTEREST EXPENSE 2,405 1,969 1,664 1,420 1,179 987 843 808

NET INTEREST INCOME 4,839 4,676 4,536 4,453 4,456 4,418 4,226 4,050

Provision for credit losses 703 641 454 585 465 408 440 404

Net interest income after provision for credit losses 4,136 4,035 4,082 3,868 3,991 4,010 3,786 3,646

NONINTEREST INCOME

Service charges on deposit accounts 655 654 625 578 594 618 611 594

Trust and investment fees 623 614 597 602 543 508 530 535

Card fees 394 377 361 326 321 319 308 282

Other fees 478 520 478 453 479 452 437 411

Mortgage banking 628 743 237 814 790 262 493 315

Operating leases 200 202 202 208 211 207 209 209

Insurance 272 248 358 337 265 264 347 317

Net gains (losses) on debt securities available for sale (124) (31) 39 (4) 3 10 (61) 33

Net gains from equity investments 93 146 201 71 170 48 81 95

Other 434 354 231 251 336 212 245 306

Total noninterest income 3,653 3,827 3,329 3,636 3,712 2,900 3,200 3,097

NONINTEREST EXPENSE

Salaries 1,613 1,571 1,551 1,480 1,438 1,383 1,295 1,277

Incentive compensation 663 676 562 465 526 449 441 391

Employee benefits 428 467 432 547 451 390 391 492

Equipment 328 306 263 370 410 254 271 301

Net occupancy 344 354 310 404 301 309 304 294

Operating leases 161 159 157 158 164 158 156 155

Other 1,346 1,356 1,279 1,268 1,681 1,277 1,495 1,119

Total noninterest expense 4,883 4,889 4,554 4,692 4,971 4,220 4,353 4,029

INCOME BEFORE INCOME TAX EXPENSE 2,906 2,973 2,857 2,812 2,732 2,690 2,633 2,714

Income tax expense 976 998 947 956 947 942 919 947

NET INCOME $ 1,930 $ 1,975 $ 1,910 $ 1,856 $ 1,785 $ 1,748 $ 1,714 $ 1,767

EARNINGS PER COMMON SHARE $ 1.15 $ 1.17 $ 1.14 $ 1.09 $ 1.06 $ 1.03 $ 1.02 $ 1.04

DILUTED EARNINGS PER COMMON SHARE $ 1.14 $ 1.16 $ 1.12 $ 1.08 $ 1.04 $ 1.02 $ 1.00 $ 1.03

DIVIDENDS DECLARED PER COMMON SHARE $ .52 $ .52 $ .48 $ .48 $ .48 $ .48 $ .45 $ .45

Average common shares outstanding 1,675.4 1,686.8 1,687.7 1,695.4 1,692.7 1,688.9 1,688.1 1,699.3

Diluted average common shares outstanding 1,693.9 1,705.3 1,707.2 1,715.7 1,715.0 1,708.7 1,708.3 1,721.2

Market price per common share (1)

High $ 64.70 $ 62.87 $ 62.22 $ 62.75 $ 64.04 $ 59.86 $ 59.72 $ 58.98

Low 57.62 58.00 57.77 58.15 57.55 56.12 54.32 55.97

Quarter end 62.83 58.57 61.58 59.80 62.15 59.63 57.23 56.67

(1) Based on daily prices reported on the New York Stock Exchange Composite Transaction Reporting System.