Wells Fargo 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

The ratio of stockholders’ equity to total assets was

8.44% at December 31, 2005, compared with 8.85% at

December 31, 2004. Our total risk-based capital (RBC)

ratio at December 31, 2005, was 11.64% and our Tier 1

RBC ratio was 8.26%, exceeding the minimum regulatory

guidelines of 8% and 4%, respectively, for bank holding

companies. Our RBC ratios at December 31, 2004, were

12.07% and 8.41%, respectively. Our Tier 1 leverage ratios

were 6.99% and 7.08% at December 31, 2005 and 2004,

respectively, exceeding the minimum regulatory guideline of

3% for bank holding companies.

stock plans, performance-based awards, stock appreciation

rights, and employee stock purchase plans. FAS 123R requires

that we measure the cost of employee services received in

exchange for an award of equity instruments based on the

fair value of the award on the grant date. That cost must be

recognized in the income statement over the vesting period

of the award. Under the “modified prospective” transition

method, awards that are granted, modified or settled begin-

ning at the date of adoption will be measured and accounted

for in accordance with FAS 123R. In addition, expense must

be recognized in the income statement for unvested awards

that were granted prior to the date of adoption. The expense

will be based on the fair value determined at the grant date.

Taking into account our February 2006 option grant, we

anticipate that total stock option expense will reduce 2006

earnings by approximately $.06 per share.

On March 30, 2005, the FASB issued Interpretation No. 47,

Accounting for Conditional Asset Retirement Obligations –

An Interpretation of FASB Statement No. 143 (FIN 47). FIN

47 was issued to address diverse accounting practices that

developed with respect to the timing of liability recognition

for legal obligations associated with the retirement of tangible

long-lived assets, such as building and leasehold improvements,

when the timing and/or method of settlement of the obligations

are conditional on a future event. FIN 47 requires companies

to recognize a liability for the fair value of a conditional asset

retirement obligation when incurred if the liability’s fair value

can be reasonably estimated. We adopted FIN 47 in 2005

and recorded a $25 million charge to noninterest expense.

We continuously monitor emerging accounting issues,

including proposed standards issued by the FASB, for any

impact on our financial statements. We are currently aware

of a proposed FASB Staff Position (FSP) related to the

accounting for leveraged lease transactions for which there

have been cash flow estimate changes based on when income

tax benefits are recognized. Certain leveraged lease transac-

tions have been challenged by the Internal Revenue Service

(IRS). While we have not made investments in a broad class

of transactions that the IRS commonly refers to as “Lease-In,

Lease-Out” (LILO) transactions, we have previously invested

in certain leveraged lease transactions that the IRS labels as

“Sale-In, Lease-Out” (SILO) transactions. We have paid the

IRS the income tax associated with our SILO transactions.

However, we are continuing to vigorously defend our initial

filing position as to the timing of the tax benefits associated

with these transactions. If the draft FSP had been effective at

December 31, 2005, we would have been required to record

a pre-tax charge of approximately $125 million as a cumula-

tive effect of change in accounting principle. However, subse-

quent deliberations by the FASB could significantly change

the draft FSP, which, in turn, could affect our estimate and

the method of adoption. We will continue to monitor the

FASB’s deliberations regarding this proposal.

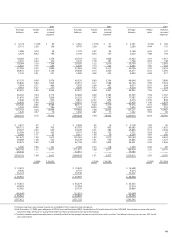

Table 1: Ratios and Per Common Share Data

Year ended December 31,

2005 2004 2003

PROFITABILITY RATIOS

Net income to average total assets (ROA) 1.72%

1.71% 1.64%

Net income applicable to common stock to

average common stockholders’ equity (ROE) 19.57

19.56 19.36

Net income to average stockholders’ equity 19.59

19.57 19.34

EFFICIENCY RATIO

(1)

57.7

58.5 60.6

CAPITAL RATIOS

At year end:

Stockholders’ equity to assets 8.44

8.85 8.89

Risk-based capital

(2)

Tier 1 capital 8.26

8.41 8.42

Total capital 11.64

12.07 12.21

Tier 1 leverage

(2)

6.99

7.08 6.93

Average balances:

Stockholders’ equity to assets 8.78

8.73 8.49

PER COMMON SHARE DATA

Dividend payout

(3)

44.0

44.8 40.7

Book value $24.25

$22.36 $20.31

Market price

(4)

High $64.70

$64.04 $59.18

Low 57.62

54.32 43.27

Year end 62.83

62.15 58.89

(1) The efficiency ratio is noninterest expense divided by total revenue (net interest

income and noninterest income).

(2) See Note 25 (Regulatory and Agency Capital Requirements) to Financial

Statements for additional information.

(3) Dividends declared per common share as a percentage of earnings per

common share.

(4) Based on daily prices reported on the New York Stock Exchange Composite

Transaction Reporting System.

Current Accounting Developments

On December 16, 2004, the Financial Accounting Standards

Board (FASB) issued Statement of Financial Accounting

Standards No. 123 (revised 2004), Share-Based Payment

(FAS 123R), which replaced FAS 123, Accounting for Stock-

Based Compensation, and superceded Accounting Principles

Board Opinion No. 25, Accounting for Stock Issued to

Employees. We adopted FAS 123R on January 1, 2006,

using the “modified prospective” transition method. The

scope of FAS 123R includes a wide range of stock-based

compensation arrangements including stock options, restricted