Wells Fargo 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

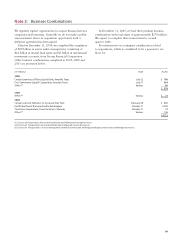

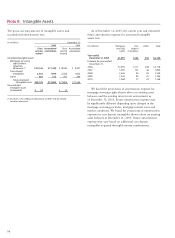

(in millions) December 31,

2005 2004

Impairment measurement based on:

Collateral value method $115 $183

Discounted cash flow method 75 126

Total (1) $190 $309

(1) Includes $56 million and $107 million of impaired loans with a related allowance

of $10 million and $17 million at December 31, 2005 and 2004, respectively.

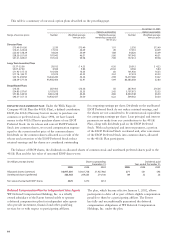

The average recorded investment in impaired loans during

2005, 2004 and 2003 was $260 million, $481 million and

$668 million, respectively.

All of our impaired loans are on nonaccrual status. When

the ultimate collectibility of the total principal of an impaired

loan is in doubt, all payments are applied to principal, under

the cost recovery method. When the ultimate collectibility

of the total principal of an impaired loan is not in doubt,

contractual interest is credited to interest income when

received, under the cash basis method. Total interest income

recognized for impaired loans in 2005, 2004 and 2003 under

the cash basis method was not significant.

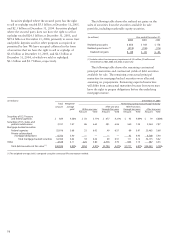

Nonaccrual loans were $1,338 million and $1,358 million

at December 31, 2005 and 2004, respectively. Loans past due

90 days or more as to interest or principal and still accruing

interest were $3,606 million at December 31, 2005, and

$2,578 million at December 31, 2004. The 2005 and 2004

balances included $2,923 million and $1,820 million,

respectively, in advances pursuant to our servicing agree-

ments to the Government National Mortgage Association

mortgage pools whose repayments are insured by the Federal

Housing Administration or guaranteed by the Department of

Veteran Affairs.

The recorded investment in impaired loans and the

methodology used to measure impairment was:

76