Wells Fargo 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

Our approach to managing interest rate risk includes the

use of derivatives. This helps minimize significant, unplanned

fluctuations in earnings, fair values of assets and liabilities,

and cash flows caused by interest rate volatility. This

approach involves modifying the repricing characteristics of

certain assets and liabilities so that changes in interest rates

do not have a significant adverse effect on the net interest

margin and cash flows. As a result of interest rate fluctuations,

hedged assets and liabilities will gain or lose market value.

In a fair value hedging strategy, the effect of this unrealized

gain or loss will generally be offset by income or loss on the

derivatives linked to the hedged assets and liabilities. In a

cash flow hedging strategy, we manage the variability of

cash payments due to interest rate fluctuations by the effective

use of derivatives linked to hedged assets and liabilities.

We use derivatives as part of our interest rate risk

management, including interest rate swaps, caps and floors,

futures and forward contracts, and options. We also offer

various derivatives, including interest rate, commodity,

equity, credit and foreign exchange contracts, to our customers

but usually offset our exposure from such contracts by

purchasing other financial contracts. The customer accom-

modations and any offsetting financial contracts are treated

as free-standing derivatives. Free-standing derivatives also

include derivatives we enter into for risk management that

do not otherwise qualify for hedge accounting. To a lesser

extent, we take positions based on market expectations

or to benefit from price differentials between financial

instruments and markets.

By using derivatives, we are exposed to credit risk if

counterparties to financial instruments do not perform as

expected. If a counterparty fails to perform, our credit risk

is equal to the fair value gain in a derivative contract. We

minimize credit risk through credit approvals, limits and

monitoring procedures. Credit risk related to derivatives is

considered and, if material, provided for separately. As we

generally enter into transactions only with counterparties

that carry high quality credit ratings, losses from counterparty

nonperformance on derivatives have not been significant.

Further, we obtain collateral, where appropriate, to reduce

risk. To the extent the master netting arrangements meet the

requirements of FASB Interpretation No. 39, Offsetting of

Amounts Related to Certain Contracts, as amended by

FASB Interpretation No. 41, Offsetting of Amounts Related

to Certain Repurchase and Reverse Repurchase Agreements,

amounts are shown net in the balance sheet.

Our derivative activities are monitored by the Corporate

Asset/Liability Management Committee. Our Treasury

function, which includes asset/liability management, is

responsible for various hedging strategies developed

through analysis of data from financial models and other

internal and industry sources. We incorporate the resulting

hedging strategies into our overall interest rate risk

management and trading strategies.

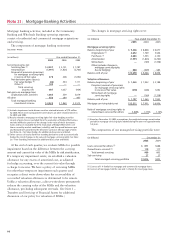

Fair Value Hedges

We use derivatives, such as interest rate swaps, swaptions,

Treasury futures and options, Eurodollar futures and options,

and forward contracts, to manage the risk of changes in the

fair value of MSRs and other retained interests. Derivative

gains or losses caused by market conditions (volatility) and

the spread between spot and forward rates priced into the

derivative contracts (the passage of time) are excluded from

the evaluation of hedge effectiveness, but are reflected in

earnings. Net derivative gains and losses related to our

mortgage servicing activities are included in “Servicing

income, net” in Note 21.

We use derivatives, such as Treasury and LIBOR futures

and swaptions, to hedge changes in fair value due to changes

in interest rates of our commercial real estate mortgages and

franchise loans held for sale. The ineffective portion of these

fair value hedges is recorded as part of mortgage banking

noninterest income in the income statement. We also enter

into interest rate swaps, designated as fair value hedges, to

convert certain of our fixed-rate long-term debt to floating-

rate debt. In addition, we enter into cross-currency swaps

and cross-currency interest rate swaps to hedge our exposure

to foreign currency risk and interest rate risk associated

with the issuance of non-U.S. dollar denominated debt.

For commercial real estate, long-term debt and foreign

currency hedges, all parts of each derivative’s gain or loss

are included in the assessment of hedge effectiveness.

At December 31, 2005, all designated fair value hedges

continued to qualify as fair value hedges.

Note 26: Derivatives

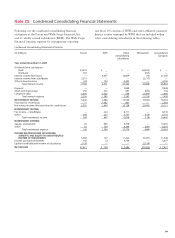

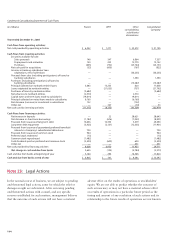

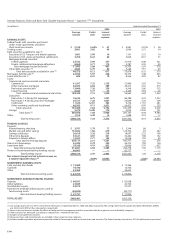

Management believes that, as of December 31, 2005, the

Company and each of the covered subsidiary banks met all

capital adequacy requirements to which they are subject.

The most recent notification from the OCC categorized

each of the covered subsidiary banks as well capitalized,

under the FDICIA prompt corrective action provisions

applicable to banks. To be categorized as well capitalized,

the institution must maintain a total risk-based capital ratio

as set forth in the table on the previous page and not be

subject to a capital directive order. There are no conditions

or events since that notification that management believes

have changed the risk-based capital category of any of the

covered subsidiary banks.

As an approved seller/servicer, Wells Fargo Bank, N.A.,

through its mortgage banking division, is required to maintain

minimum levels of shareholders’ equity, as specified by various

agencies, including the United States Department of Housing

and Urban Development, Government National Mortgage

Association, Federal Home Loan Mortgage Corporation and

Federal National Mortgage Association. At December 31,

2005, Wells Fargo Bank, N.A. met these requirements.