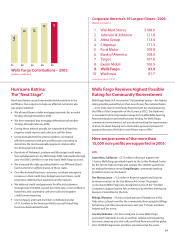

Wells Fargo 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

“We’ve partnered with entrepreneurs for 45 years to build great

technology businesses.We pride ourselves on doing whatever

it takes to help them build leading companies—facilitating

customer and partner relationships for these companies,helping

entrepreneurs evolve their business strategies, or working with

CEOs to drive their recruiting processes. If our portfolio companies

are successful, then we’re successful.What characterizes this

success? Extreme dedication to these entrepreneurs.Deep

operating experience.High integrity. And,a strong network of

domestic and international relationships.”

John Lindahl, Norwest Equity Partners

Years in financial services: 39

Resourceful, Approachable

“Our success is built on strong partnerships. Strong partnerships

with our portfolio companies. Strong partnerships with experienced

management teams to acquire leading middle-market companies.

To these relationships our investment professionals bring significant

resources to help management grow their business—including

adequate capital to grow organically and by acquisition.We can

supplement the company’s management team, provide operating

expertise, and,when we exit the investment,guidance to maximize

shareholder value. Our success,built on our 45-year history, requires

skill, ability and integrity — the skill to recognize great companies,

the ability to offer valuable expertise,the integrity to be resourceful,

resilient and reliable partners.We succeed when,during our time as

owners,the investors and our management partners create an even

better company.”

Promod Haque, Norwest Venture Partners

Years in financial services: 15

Dedicated Partners

Early stage investments in information

technology including semiconductor

and components, systems, software,

services and consumer/internet

technologies.

Invests in management buyouts,

recapitalizations, and growth financing

for middle-market companies; one of

oldest private equity firms in U.S.