Wells Fargo 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

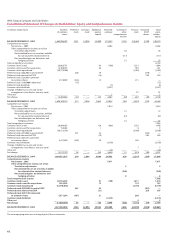

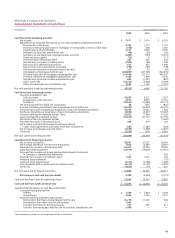

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Changes in Stockholders’ Equity and Comprehensive Income

(in millions, except shares)

Number Preferred Common Additional Retained Cumulative Treasury Unearned Total

of common stock stock paid-in earnings other stock ESOP stock-

shares capital comprehensive shares holders’

income equity

BALANCE DECEMBER 31, 2002 1,685,906,507 $ 251 $ 2,894 $ 9,498 $ 19,355 $ 976 $ (2,465)$(190)$ 30,319

Comprehensive income

Net income – 2003 6,202 6,202

Other comprehensive income, net of tax:

Translation adjustments 26 26

Net unrealized losses on securities available

for sale and other retained interests (117) (117)

Net unrealized gains on derivatives and

hedging activities 53 53

Total comprehensive income 6,164

Common stock issued 26,063,731 63 (190) 1,221 1,094

Common stock issued for acquisitions 12,399,597 66 585 651

Common stock repurchased (30,779,500) (1,482) (1,482)

Preferred stock (260,200) issued to ESOP 260 19 (279) —

Preferred stock released to ESOP (16) 240 224

Preferred stock (223,660) converted

to common shares 4,519,039 (224) 13 211 —

Preferred stock (1,460,000) redeemed (73) (73)

Preferred stock dividends (3) (3)

Common stock dividends (2,527) (2,527)

Change in Rabbi trust assets and similar

arrangements (classified as treasury stock) 97 97

Other, net ___________ ____ ______ ______ 5 _____ ______ _____ 5

Net change 12,202,867 (37) — 145 3,487 (38) 632 (39) 4,150

BALANCE DECEMBER 31, 2003 1,698,109,374 214 2,894 9,643 22,842 938 (1,833) (229) 34,469

Comprehensive income

Net income – 2004 7,014 7,014

Other comprehensive income, net of tax:

Translation adjustments 12 12

Net unrealized losses on securities available

for sale and other retained interests (22) (22)

Net unrealized gains on derivatives and

hedging activities 22 22

Total comprehensive income 7,026

Common stock issued 29,969,653 129 (206) 1,523 1,446

Common stock issued for acquisitions 153,482 1 8 9

Common stock repurchased (38,172,556) (2,188) (2,188)

Preferred stock (321,000) issued to ESOP 321 23 (344) —

Preferred stock released to ESOP (19) 284 265

Preferred stock (265,537) converted

to common shares 4,531,684 (265) 29 236 —

Common stock dividends (3,150) (3,150)

Change in Rabbi trust assets and similar

arrangements (classified as treasury stock) 77

Other, net ______________ _____ _______ _______ (18)____ _ _ _________ ______ (18)

Net change (3,517,737) 56 — 163 3,640 12 (414) (60) 3,397

BALANCE DECEMBER 31, 2004 1,694,591,637 270 2,894 9,806 26,482 950 (2,247) (289) 37,866

Comprehensive income

Net income – 2005 7,671 7,671

Other comprehensive income, net of tax:

Translation adjustments 55

Net unrealized losses on securities available

for sale and other retained interests (298) (298)

Net unrealized gains on derivatives and

hedging activities 8 8

Total comprehensive income 7,386

Common stock issued 28,764,493 91 (198) 1,617 1,510

Common stock issued for acquisitions 1,954,502 12 110 122

Common stock repurchased (52,798,864) (3,159) (3,159)

Preferred stock (363,000) issued to ESOP 362 25 (387) —

Preferred stock released to ESOP (21) 328 307

Preferred stock (307,100) converted

to common shares 5,071,264 (307) 21 286 —

Common stock dividends (3,375) (3,375)

Other, net _____________ _____ ______ ______ ________ _____ 3 _____ 3

Net change (17,008,605) 55 — 128 4,098 (285) (1,143) (59) 2,794

BALANCE DECEMBER 31, 2005 1,677,583,032 $325 $2,894 $9,934 $30,580 $ 665 $(3,390) $(348) $40,660

The accompanying notes are an integral part of these statements.