Wells Fargo 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

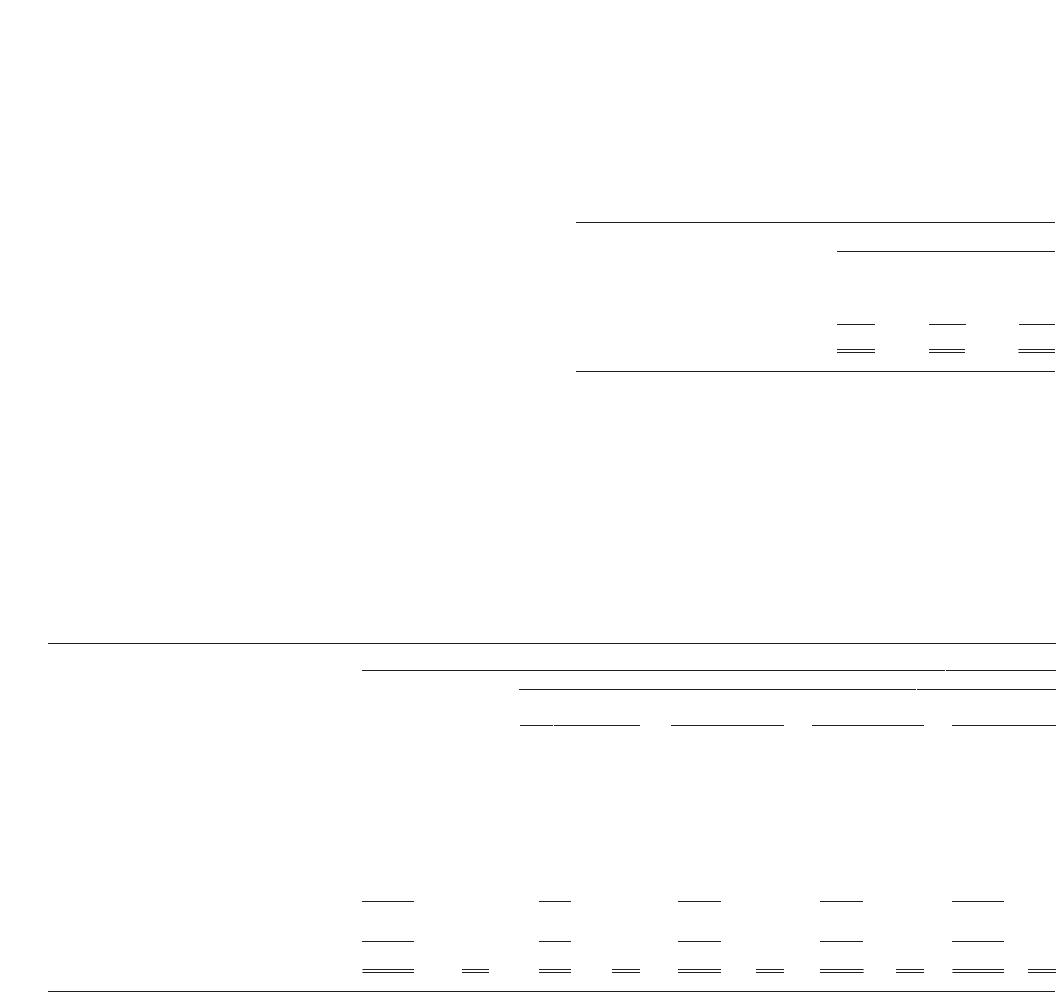

72

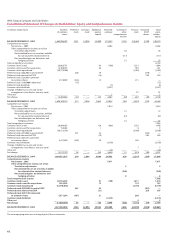

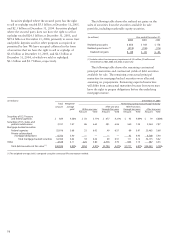

(in millions) December 31, 2005

Total Weighted- Remaining contractual principal maturity

amount average After one year After five years

yield Within one year through five years through ten years After ten years

Amount Yield Amount Yield Amount Yield Amount Yield

Securities of U.S. Treasury

and federal agencies $ 839 4.38% $ 50 5.11% $ 677 4.21% $ 93 4.69% $ 19 6.88%

Securities of U.S. states and

political subdivisions 3,191 7.57 86 6.63 281 6.06 560 7.25 2,264 7.87

Mortgage-backed securities:

Federal agencies 25,616 5.68 33 6.02 49 6.51 69 5.91 25,465 5.68

Private collateralized

mortgage obligations 6,750 5.40 — — — — 42 6.45 6,708 5.40

Total mortgage-backed securities 32,366 5.62 33 6.02 49 6.51 111 6.12 32,173 5.62

Other 4,538 6.11 225 5.80 2,773 5.70 953 7.13 587 6.53

Total debt securities at fair value (1) $40,934 5.80% $394 5.91% $3,780 5.47% $1,717 6.97% $35,043 5.78%

(1) The weighted-average yield is computed using the contractual life amortization method.

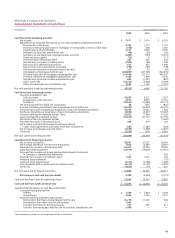

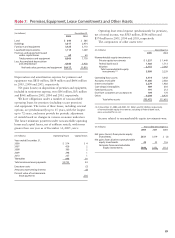

(in millions) Year ended December 31,

2005 2004 2003

Realized gross gains $ 355 $ 168 $ 178

Realized gross losses (1) (315) (108) (116)

Realized net gains $40 $60 $62

(1) Includes other-than-temporary impairment of $45 million, $9 million and

$50 million for 2005, 2004 and 2003, respectively.

Securities pledged where the secured party has the right

to sell or repledge totaled $5.3 billion at December 31, 2005,

and $2.3 billion at December 31, 2004. Securities pledged

where the secured party does not have the right to sell or

repledge totaled $24.3 billion at December 31, 2005, and

$19.4 billion at December 31, 2004, primarily to secure trust

and public deposits and for other purposes as required or

permitted by law. We have accepted collateral in the form

of securities that we have the right to sell or repledge of

$3.4 billion at December 31, 2005, and $2.5 billion at

December 31, 2004, of which we sold or repledged

$2.3 billion and $1.7 billion, respectively.

The following table shows the remaining contractual

principal maturities and contractual yields of debt securities

available for sale. The remaining contractual principal

maturities for mortgage-backed securities were allocated

assuming no prepayments. Remaining expected maturities

will differ from contractual maturities because borrowers may

have the right to prepay obligations before the underlying

mortgages mature.

The following table shows the realized net gains on the

sales of securities from the securities available for sale

portfolio, including marketable equity securities.