Wells Fargo 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

Wells Fargo & Company

Stock Listing

Wells Fargo & Company is listed and trades on the New York Stock

Exchange and the Chicago Stock Exchange in the United States.

Our trading symbol is WFC.

Common Stock

1,677,583,032 common shares outstanding (12/31/05)

Stock Purchase and Dividend Reinvestment

You can buy Wells Fargo stock directly from Wells Fargo, even if you’re

not a Wells Fargo stockholder, through optional cash payments or

automatic monthly deductions from a bank account.You can also have

your dividends reinvested automatically. It’s a convenient, economical

way to increase your Wells Fargo investment.

Call 1-877-840-0492 for an enrollment kit including a plan prospectus.

Form 10-K

We will send the Wells Fargo’s 2005 Annual Report on Form 10-K

(including the financial statements filed with the Securities and

Exchange Commission) without charge to any stockholder who

asks for a copy in writing. Stockholders also can ask for copies of

any exhibit to the Form 10-K. We will charge a fee to cover expenses

to prepare and send any exhibits. Please send requests to:

Corporate Secretary, Wells Fargo & Company, Wells Fargo Center,

MAC N9305-173, Sixth and Marquette, Minneapolis, MN 55479.

SEC Filings

Our annual reports on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K, and amendments to those reports,

are available free of charge on our website (www.wellsfargo.com),

as soon as reasonably practicable after they are electronically filed

with or furnished to the SEC.Those reports and amendments are

also available free of charge on the SEC’s website at www.sec.gov.

Independent Registered

Public Accounting Firm

KPMG LLP

San Francisco, CA

415-963-5100

Contacts

Investor Relations

1-888-662-7865

investorrelations@wellsfargo.com

Stockholder Communications

Shareholder Services and Transfer Agent

Wells Fargo Shareowner Services

P.O. Box 64854

Saint Paul, MN 55164-0854

1-877-840-0492

www.wellsfargo.com/com/shareowner_services

Corporate Information

Annual Stockholders’ Meeting

1:30 p.m.,Tuesday, April 25, 2006

The Stanford Court Hotel

905 California Street

San Francisco, CA

Proxy statement and form of proxy will be mailed to stockholders

beginning on or about March 17, 2006.

Certifications

Our chief executive officer certified to the New York Stock Exchange

(NYSE) that, as of May 23, 2005, he was not aware of any violation by

the Company of the NYSE’s corporate governance listing standards.

The certifications of our chief executive officer and chief financial officer

required under Section 302 of the Sarbanes-Oxley Act of 2002 were

filed as Exhibits 31(a) and 31(b), respectively, to our 2005 Form 10-K.

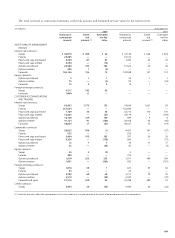

Market Fortune Rank*

Cap (Revenue)

1. General Electric (GE) $372 billion 5 11. Altria Group (MO) 157 17

2. Exxon Mobil (XOM) 363 2 12. Procter & Gamble (PG) 140 26

3. Microsoft (MSFT) 287 41 13. JP Morgan Chase (JPM) 139 20

4. Citigroup (C) 246 8 14. Berkshire Hathaway 138 12

5. Wal-Mart Stores (WMT) 190 1 15. ChevronTexaco (CVX) 131 6

6. Bank of America (BAC) 187 18 16. IBM (IBM) 130 10

7. Johnson & Johnson (JNJ) 185 30 17. Cisco Systems (CSCO) 113 91

8. AIG (AIG) 181 9 18. Wells Fargo (WFC) 105 52

9. Pfizer (PFE) 181 24 19. PepsiCo (PEP) 99 61

10. Intel (INTC) 158 50 20. Coca-Cola (KO) 98 92

*4/05

FORWARD-LOOKING STATEMENTS In this report we may make forward-looking statements about our company’s financial condition, results of operations,

plans, objectives and future performance and business. We make forward-looking statements when we use words such as “believe,” “expect,” “anticipate,”

“estimate,” “may,” “can,” “will” or similar expressions. Forward-looking statements involve risks and uncertainties. They are based on current expectations.

Several factors could cause actual results to differ significantly from expectations including • our ability to grow revenue by selling more products to our customers

• the effect of an economic slowdown on the demand for our products and services • the effect of a fall in stock market prices on fee income from our

brokerage and asset management businesses • the effect of changes in interest rates on our net interest margin and our mortgage originations and mortgage

servicing rights • the adequacy of our loan loss allowance • changes in the value of our venture capital investments • changes in our accounting policies or in

accounting standards • mergers and acquisitions • federal and state regulations • reputational damage from negative publicity • the loss of checking and

saving account deposits to other investments such as the stock market • fiscal and monetary policies of the Federal Reserve Board. For more information

about factors that could cause actual results to differ from expectations, refer to the Financial Review and the Financial Statements and related Notes in this

report and to the “Risk Factors” and “Regulation and Supervision” sections of our 2005 Annual Report on Form 10-K filed with the Securities and Exchange

Commission and available on the SEC’s website at www.sec.gov.

© 2006 Wells Fargo & Company. All rights reserved.

Highest Market Caps,Year-End 2005,

among Fortune 100