Wells Fargo 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

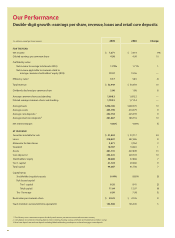

• At year-end, the total value of our stock was $105 billion—

again making us one of the nation’s 20 most valuable companies.

• Return on equity, 19.57 percent; return on assets, 1.72 percent.

• Our credit quality remained excellent. Nonperforming loans

were at or near historic lows.

•Fortune ranked Wells Fargo “Most Admired Megabank”;

Barron’s ranked us the world’s most admired financial services

company and we continue to be the only U.S. bank with the

highest possible credit rating, “Aaa.”

• Community Banking achieved record profit of $5.53 billion,

up 13 percent with revenue increasing nine percent.

• In consumer banking, we sold almost 16 million products

(or “solutions”)—checking, savings, debit cards, loans, etc.—

to our customers, up 15 percent.

• Our loans to small businesses, primarily less than $100,000,

grew 18 percent. For the third consecutive year, we were the

nation’s #1 small business lender in total dollars. In the past

10 years, we’ve loaned more than $26 billion to small

businesses owned by African-Americans, Asian-Americans,

Latinos and women, exceeding our publicly-stated goals.

• For the seventh consecutive year, our cross-sell reached record

highs—4.8 products per retail banking household, 5.7 products

per Wholesale Banking customer. Our average middle-market,

commercial banking customer now has almost 7.0 products

with us—up from almost five just two years ago. In fact, more

than one of every five of our commercial banking offices

nationwide averaged eight products per customer.

• For the seventh consecutive year, Wholesale Banking achieved

record net income of $1.73 billion—with double-digit loan

growth this year across its businesses.

• Our Wholesale Banking business now is truly coast-to-coast,

with more than 600 offices nationwide. Across the Eastern

U.S., we have 175 offices for commercial banking, commercial

real estate, corporate banking, asset-based lending and

equipment finance. We’re attracting new commercial

customers in markets such as Atlanta, Boston, Cleveland,

Hartford (Conn.), Indianapolis, New York and Tampa.

Our primary strategy, consistent for 20 years,

is to satisfy all our customers’financial needs,

help them succeed financially, and through

cross-selling earn 100 percent of their business.

• We funded $366 billion in mortgages—our second highest

annual total ever—and continued to be the nation’s #1 retail

mortgage originator. Our owned mortgage servicing portfolio,

the nation’s second largest, rose 23 percent to $989 billion. The

housing market remained strong because new home construction

continued to lag the pace of new household formation.

• Our National Home Equity Group’s loans were $72 billion at

year-end with continued very strong credit quality—ranking

us the nation’s #1 home equity lender for the fourth consec-

utive year.

• Wells Fargo Financial—our consumer finance business—

grew average receivables 25 percent.

• Watchfire GomezPro ranked Wells Fargo internet banking

#1 among all U.S. banks. Global Finance magazine named

wellsfargo.com best in the U.S. in six categories including

“best corporate/institutional internet bank.” Information

technology magazine CIO named Wells Fargo one of its

100 Bold winners for our innovative Commercial Electronic

Office®(CEO®) portal, now used by almost three-fourths of

our commercial customers for everything from loan payments

to foreign exchange.

Top 10 Consumer Internet Banks

1. Wells Fargo 6. First National Bank of Omaha

2. Citibank 7. HSBC

3. Bank of America 8. U.S. Bank

4. E*Trade Bank 9. Chase

5. Huntington 10. Wachovia

Source: Watchfire GomezPro,3Q05

• To be the financial services company of choice for remittance

customers, we expanded that service beyond Mexico, India

and the Philippines into El Salvador and Guatemala. The

number of accounts we opened for Mexican Nationals using

the Matricula Consular card as a form of identification

surpassed 600,000. We were the first financial institution

in the nation to promote the use of this card as a form of