Wells Fargo 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Noninterest expense in 2005 increased 8% to $19.0 billion

from $17.6 billion in 2004, primarily due to increased mort-

gage production and continued investments in new stores

and additional sales-related team members. Noninterest

expense in 2005 included a $117 million expense to adjust

the estimated lives for certain depreciable assets, primarily

building improvements, $62 million of airline lease write-

downs, $56 million of integration expense and $25 million

for the adoption of FIN 47, which relates to recognition

of obligations associated with the retirement of long-lived

assets, such as building and leasehold improvements. Home

Mortgage expenses increased $426 million from 2004,

reflecting higher production costs from an increase in loan

origination volume. For 2004, employee benefits included

a $44 million special 401(k) contribution and charitable

donations included a $217 million contribution to the

Wells Fargo Foundation.

See “Current Accounting Developments” for information

on accounting for share-based awards, such as stock option

grants. On January 1, 2006, we adopted FAS 123R, which

requires that we include the cost of such grants in our

income statement over the vesting period of the award.

Income Tax Expense

Our effective income tax rate for 2005 decreased to 33.57%

from 34.87% for 2004, due primarily to higher tax-exempt

income and income tax credits, and the tax benefit associated

with our donation of appreciated securities.

Noninterest Expense Operating Segment Results

Our lines of business for management reporting are Community

Banking, Wholesale Banking and Wells Fargo Financial.

For a more complete description of our operating segments,

including additional financial information and the underlying

management accounting process, see Note 19 (Operating

Segments) to Financial Statements.

COMMUNITY BANKING’S net income increased 13% to

$5.5 billion in 2005 from $4.9 billion in 2004. Total

revenue for 2005 increased 9%, driven by loan and deposit

growth and higher mortgage origination volumes. The

provision for credit losses for 2005 increased $108 million,

or 14%, reflecting incremental consumer bankruptcy filings

before the mid-October legislative reform. Noninterest

expense for 2005 increased $982 million, or 8%, driven

by mortgage production, growth in other businesses, and

investments in new stores, sales staff and technology.

Average loans were $187.0 billion in 2005, up 5% from

$178.9 billion in 2004.

WHOLESALE BANKING’S net income was a record $1.73 billion

in 2005, up 8% from $1.60 billion in 2004, driven largely

by a 15% increase in earning assets, as well as very low loan

losses. Average loans increased 17% to $62.2 billion in 2005

from $53.1 billion in 2004, with double-digit increases

across wholesale lending businesses. The provision for credit

losses decreased to $1 million in 2005 from $62 million in

2004, with loan charge-offs at very low levels throughout

2005. Noninterest income increased 13% to $3.4 billion

in 2005 from $3.0 billion in 2004, largely due to the

Strong Financial acquisition completed at the end of 2004.

Noninterest expense increased 16% to $3.17 billion in 2005

from $2.73 billion in 2004, due to the Strong Financial

acquisition and airline lease writedowns.

WELLS FARGO FINANCIAL’S net income decreased 34% to

$409 million in 2005 from $617 million in 2004. Net

income was reduced by incremental bankruptcies related

to the change in bankruptcy law and the $163 million first

quarter 2005 initial implementation of conforming to more

stringent FFIEC charge-off timing rules. Also, a $100 million

provision for credit losses was taken in third quarter 2005

for estimated losses from Hurricane Katrina. Total revenue

rose 12% in 2005, reaching $4.7 billion, compared with

$4.2 billion in 2004, due to higher net interest income.

Noninterest expense increased $202 million, or 9%, in 2005

from 2004, reflecting investments in new consumer finance

stores and additional team members.

Segment results for prior periods have been revised due

to the realignment of our automobile financing businesses

into Wells Fargo Financial in 2005, designed to leverage the

expertise, systems and resources of the existing businesses.

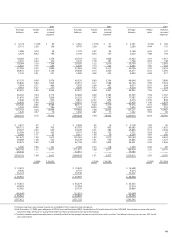

Table 5: Noninterest Expense

(in millions) Year ended December 31,_ _ % Change

2005 2004 2003 2005/ 2004/

2004 2003

Salaries $ 6,215 $ 5,393 $ 4,832 15% 12%

Incentive compensation 2,366 1,807 2,054 31 (12)

Employee benefits 1,874 1,724 1,560 911

Equipment 1,267 1,236 1,246 3(1)

Net occupancy 1,412 1,208 1,177 17 3

Operating leases 635 633 702 —(10)

Outside professional services 835 669 509 25 31

Contract services 596 626 866 (5) (28)

Travel and entertainment 481 442 389 914

Outside data processing 449 418 404 73

Advertising and promotion 443 459 392 (3) 17

Postage 281 269 336 4(20)

Telecommunications 278 296 343 (6) (14)

Insurance 224 247 197 (9) 25

Stationery and supplies 205 240 241 (15) —

Operating losses 194 192 193 1(1)

Security 167 161 163 4(1)

Core deposit intangibles 123 134 142 (8) (6)

Charitable donations 61 248 237 (75) 5

Net losses from debt

extinguishment 11 174 — (94) —

All other 901 997 1,207 (10) (17)

Total $19,018 $17,573 $17,190 82