Wells Fargo 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Operating Lease Assets

Operating lease rental income for leased assets, generally

automobiles, is recognized in other income on a straight-line

basis over the lease term. Related depreciation expense is

recorded on a straight-line basis over the life of the lease,

taking into account the estimated residual value of the leased

asset. On a periodic basis, leased assets are reviewed for

impairment. Impairment loss is recognized if the carrying

amount of leased assets exceeds fair value and is not recover-

able. The carrying amount of leased assets is not recoverable

if it exceeds the sum of the undiscounted cash flows expected

to result from the lease payments and the estimated residual

value upon the eventual disposition of the equipment. Auto

lease receivables are written off when 120 days past due.

Pension Accounting

We account for our defined benefit pension plans using an

actuarial model required by FAS 87, Employers’ Accounting

for Pensions. This model allocates pension costs over the

service period of employees in the plan. The underlying

principle is that employees render service ratably over this

period and, therefore, the income statement effects of

pensions should follow a similar pattern.

One of the principal components of the net periodic

pension calculation is the expected long-term rate of return on

plan assets. The use of an expected long-term rate of return

on plan assets may cause us to recognize pension income

returns that are greater or less than the actual returns of

plan assets in any given year.

The expected long-term rate of return is designed to

approximate the actual long-term rate of return over time

and is not expected to change significantly. Therefore, the

pattern of income/expense recognition should closely match

the stable pattern of services provided by our employees over

the life of our pension obligation. To determine if the expected

rate of return is reasonable, we consider such factors as

(1) the actual return earned on plan assets, (2) historical

rates of return on the various asset classes in the plan

portfolio, (3) projections of returns on various asset classes,

and (4) current/prospective capital market conditions and

economic forecasts. Differences in each year, if any, between

expected and actual returns are included in our unrecognized

net actuarial gain or loss amount. We generally amortize

any unrecognized net actuarial gain or loss in excess of a

5% corridor (as defined in FAS 87) in net periodic pension

calculations over the next five years.

We use a discount rate to determine the present value

of our future benefit obligations. The discount rate reflects

the rates available at the measurement date on long-term

high-quality fixed-income debt instruments and is reset

annually on the measurement date (November 30).

Income Taxes

We file a consolidated federal income tax return and, in

certain states, combined state tax returns.

We determine deferred income tax assets and liabilities

using the balance sheet method. Under this method, the net

deferred tax asset or liability is based on the tax effects of

the differences between the book and tax bases of assets and

liabilities, and recognizes enacted changes in tax rates and

laws. Deferred tax assets are recognized subject to manage-

ment judgment that realization is more likely than not.

Foreign taxes paid are generally applied as credits to reduce

federal income taxes payable.

Stock-Based Compensation

We have several stock-based employee compensation plans,

which are described more fully in Note 14. As permitted by

FAS 123, Accounting for Stock-Based Compensation, we have

elected to apply the intrinsic value method of Accounting

Principles Board Opinion 25, Accounting for Stock Issued to

Employees (APB 25), in accounting for stock-based employee

compensation plans through December 31, 2005. Pro forma

net income and earnings per common share information is

provided below, as if we accounted for employee stock

option plans under the fair value method of FAS 123.

On December 16, 2004, the FASB issued FAS 123

(revised 2004), Share-Based Payment (FAS 123R), which

replaced FAS 123 and superceded APB 25. We adopted FAS

123R on January 1, 2006, which requires us to measure the

cost of employee services received in exchange for an award

of equity instruments, such as stock options or restricted

stock, based on the fair value of the award on the grant

date. This cost must be recognized in the income statement

over the vesting period of the award.

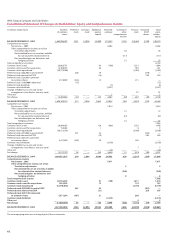

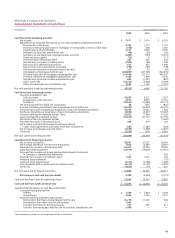

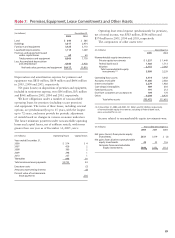

(in millions, except per Year ended December 31,

share amounts) 2005 2004 2003

Net income, as reported $7,671 $7,014 $6,202

Add: Stock-based employee

compensation expense

included in reported net

income, net of tax 123

Less:Total stock-based

employee compensation

expense under the fair value

method for all awards,

net of tax (188) (275) (198)

Net income, pro forma $7,484 $6,741 $6,007

Earnings per common share

As reported $4.55 $ 4.15 $ 3.69

Pro forma 4.44 3.99 3.57

Diluted earnings per common share

As reported $4.50 $ 4.09 $ 3.65

Pro forma 4.38 3.93 3.53