Volvo 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The fi nancial services of VFS are offered

with the sales of Volvo Group vehicles and

equipment and are available with service agree-

ments and aftermarket services through seam-

less integration at the point-of-sale with Volvo

Group dealers. This approach delivers a con-

venient one stop-shopping experience for the

customer.

Solid profi tability

In 2013, VFS provided fi nancial services in 40

markets around the globe. The global diversifi -

cation of the VFS portfolio proved to be a signif-

icant strength as assets under management

reached all-time highs. This profi table growth

along with stable portfolio performance, increased

operational effi ciency and good funding levels

yielded solid profi tability for VFS in 2013.

Operational consolidation, process standard-

ization and systems harmonization were key

activities during 2013. These activities allowed

VFS to capitalize on profi table growth opportu-

nities with scalable business platforms and high

service levels.

Portfolio development

Overall economic conditions continued to

improve during 2013 and demand for VFS prod-

ucts remained strong even though some mar-

kets struggled for growth.

In the Americas, record managed assets and

retail volumes were achieved and the portfolio

performed extremely well in terms of delinquen-

cies and write-offs.

EMEA (Europe, Middle East and Africa)

achieved a stable portfolio performance but

new volumes were impacted by the relatively

slow demand in truck and construction equip-

ment markets.

In APAC (Asia Pacifi c), profi tability remained

good despite delinquencies in China remaining

on elevated levels.

In all VFS markets, and particularly in devel-

oping markets, downturn preparedness is a key

objective regardless of the current business

cycle.

Customer fi nance operations

Total new fi nancing volume in 2013 amounted

to SEK 47.0 billion (46.6). Adjusted for changes

in exchange rates, new business volume increased

by 5.9% compared to 2012. In total, 51,466 new

Volvo Group vehicles and machines (50,994)

were fi nanced during the year. In the markets

where fi nancing is offered, the average penetra-

tion rate was 27% (27).

As of December 31, 2013, the net credit

portfolio amounted to SEK 103,873 M (99,690).

The funding of the credit portfolio is matched in

terms of maturity, interest rates and currencies

in accordance with Volvo Group policy. For further

information see note 4 to the Consolidated

fi nancial statements.

The operating income for the year amounted

to SEK 1,522 M compared to SEK 1,496 M in the

previous year. Return on shareholders’ equity was

12.1% (12.5). The equity ratio at the end of the

year was 8.1% (8.1). Improvements in gross in -

come and operating expenses were partially off-

set by higher credit provisions.

During the year, credit provision expenses

amounted to SEK 923 M (639) while write-offs

of SEK 719 M (577) were recorded. Third quarter

provisions and write-offs were higher than nor-

mal due to deterioration of collateral positions

and values related to non-performing loans and

leases in Spain stemming from the global fi nan-

cial crisis in 2009 and 2010 caused by the con-

tinuing recession and protracted legal pro-

cesses in that country. The write-off ratio for

2013 was 0.71% (0.58). At the end of Decem-

ber 31, 2013, credit reserves were 1.31% (1.23)

of the credit portfolio.

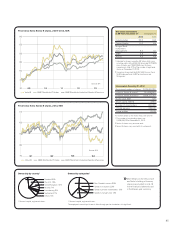

Operating income (loss)

SEK M

Return on shareholders’ equity

%

Penetration rate1, %

3030

Volvo

Trucks

Renault

Trucks

Mack

Trucks

Buses Volvo

CE

UD

Trucks

2123 2119 1621 3637 1213

12 13

1 Share of unit sales fi nanced

by Volvo Financial Services in

relation to total number units

sold by the Volvo Group in

markets where fi nancial ser-

vices are offered.

13

1,522

12

1,496

11

969

10

167

09

(680)

1,522

13

12.5 12.1

12

12.1

Distribution of credit portfolio

Volvo Trucks 45%

Volvo CE 28%

Renault Trucks 11%

Mack Trucks 9%

Buses 5%

UD Trucks 2%

81