Volvo 2013 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

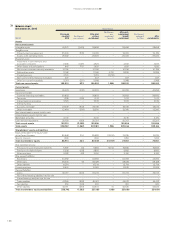

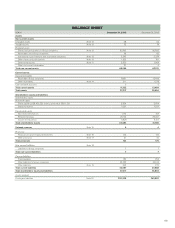

Parent Company AB Volvo

Corporate registration number 556012-5790.

Amounts in SEK M unless otherwise specifi ed. Amounts within parentheses refer to the preceding year, 2012.

Board of Directors’ report

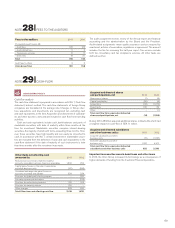

AB Volvo is the Parent Company of the Volvo Group and its operations

comprise of the Group’s head offi ce with staff together with some corpo-

rate functions.

Income from investments in Group companies include dividends amount-

ing to 1,689 (920) and transfer price adjustments and royalties amounting to

an expense of 1,128 (524). Dividend received from Volvo Financial Services

AB amounted to 1,080 and dividend received from Volvo China Investment

Co Ltd amounted to 312.

During the year subscription in Volvo Group Japan Co has been made

by 3,392 after which the holding was written down by 843. Shareholders’

contribution has been given to Volvo Information Technology AB by 600

and to VNA Holding Inc by 787, the latter in form of total shares in Prévost

Car (US) Inc.

The carrying value of shares and participations in Group companies

amounted to 60,763 (56,832), of which 59,870 (55,940) pertained to shares

in wholly owned subsidiaries. The corresponding shareholders’ equity in

the subsidiaries (including equity in untaxed reserves but excluding

minority interests) amounted to 101,937 (100,326).

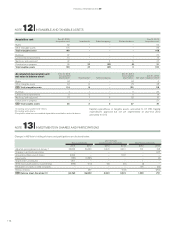

Investments in joint ventures and associated companies included 2,819

(1,752) in joint ventures and associated companies that are recognized in

accordance with the equity method in the consolidated accounts. The por-

tion of shareholders’ equity in joint ventures and associated companies

pertaining to AB Volvo amounted to 3,038 (1,419).

Financial net debt amounted to 33,685 (27,042).

AB Volvo’s risk capital (shareholders’ equity plus untaxed reserves)

amounted to 34,589 (41,241) corresponding to 45% (54%) of total assets.

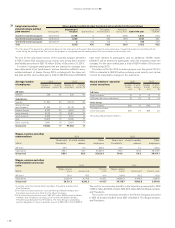

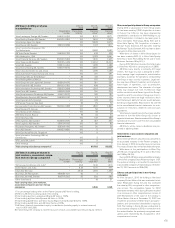

INCOME STATEMENT

SEK M 2013 2012

Net sales Note 2 659 670

Cost of sales Note 2 (659) (670)

Gross income 00

Administrative expenses Note 2, 3 (974) (1,026)

Other operating income and expenses Note 4 (83) 48

Income from investments in Group companies Note 5 (541) 3,151

Income from investments in joint ventures and associated companies Note 6 0 4

Income from other investments Note 7 1 9

Operating income (1,597) 2,186

Interest income and similar credits Note 8 8 0

Interest expenses and similar charges Note 8 (1,139) (1,509)

Other fi nancial income and expenses Note 9 (57) (112)

Income after fi nancial items (2,785) 565

Allocations Note 10 831 5,628

Income taxes Note 11 333 (1,092)

Income for the period (1,621) 5,101

OTHER COMPREHENSIVE INCOME

Income for the period (1,621) 5,101

Items that may be reclassifi ed subsequently to income statement:

Available-for-sale investments 415 313

Other comprehensive income, net of income taxes 415 313

Total comprehensive income for the period (1,206) 5,414

168

FINANCIAL INFORMATION 2013