Volvo 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

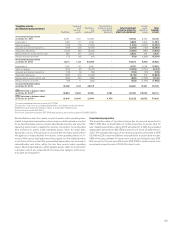

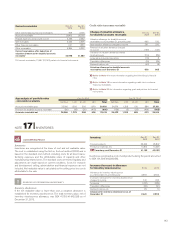

The Volvo Group recognizes valuation allowances for deferred tax assets

where management does not expect such assets to be realized based

upon current forecasts. In the event that actual results differ from these

estimates or adjustments are made to future periods in these estimates,

changes in the valuation allowance may be required, this could have sig-

nifi cant impact on the fi nancial position and the income for the period. As

of December 31, 2013, the valuation allowance amounted to 125 (191) of

the value of deferred tax assets. Most of the reserve consists of unused

loss carryforwards. Net of this valuation allowance, deferred tax assets of

22,326 (23,096) were recognized in the Volvo Group’s balance sheet.

The Volvo Group has signifi cant tax-loss carryforwards that are related

to countries with long or indefi nite periods of utilization, mainly Sweden,

France and Japan. The Volvo Group considers that suffi cient income will be

generated in the coming years for the tax-loss carryforwards to be utilized.

Income tax for the period includes current and deferred taxes. Current

taxes are calculated on the basis of the tax regulations prevailing in the

countries in which the Parent Company and subsidiaries are active and

generate taxable income.

Deferred taxes are recognized on differences that arise between the

taxable value and carrying value of assets and liabilities as well as on tax-

loss carryforwards. Furthermore are deferred taxes recognized to the

extent it is probable that they will be utilized against taxable income.

Deferred taxes on temporary differences on participations in subsidiar-

ies and associated companies are only recognized when it is probable that

the difference will be recovered in the near future.

Tax laws in Sweden and certain other countries allow companies to defer

payment of taxes through allocations to untaxed reserves. However, in the

consolidated fi nancial statements untaxed reserves are reclassifi ed to

deferred tax liability and equity. In the consolidated income statements a

provision to, or reversal of, untaxed reserves split between deferred taxes

and net income for the year.

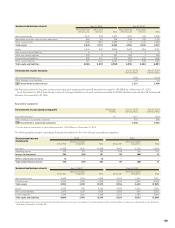

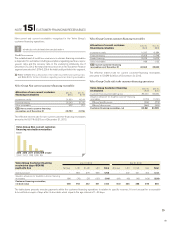

Income taxes were distributed as follows:

2013 2012

Current taxes relating to the period (3,453) (3,584)

Adjustment of current taxes for prior periods 327 (144)

Deferred taxes originated or reversed during the

period 2,048 (568)

Remeasurementsof deferred tax assets 158 180

I/S Total income taxes (919) (4,116)

Provisions have been made for estimated tax charges that may arise as

a result of prior tax audits. Tax processes are evaluated on a regular basis

and provisions are made for possible outcome when it is probable that the

Volvo Group will have to pay more taxes and when it is possible to make

a reasonably assessment of the possible outcome. Tax claims for which no

provision was deemed necessary were recognized as contingent liabilities.

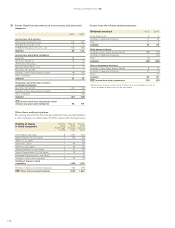

At year-end 2013, the Volvo Group’s unused tax-loss carryforwards

amounted to 23,382 (18,396). These loss carryforwards expire according

to the table below:

Due date Dec 31,

2013 Dec 31,

2012

after 1 year 91 76

after 2 years 104 148

after 3 years 183 267

after 4 years 533 950

after 5 years 752 466

after 6 years or more 21,719 16,489

Total 23,382 18,396

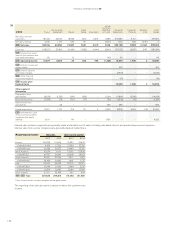

The Swedish corporate income tax rate amounted to 22.0% (26.3) in

2013. The table below discloses the principal reasons for the difference

between this rate and the Volvo Group’s income tax rate, based on income

after fi nancial items.

2013,

%2012,

%

Swedish corporate income tax rate 22 26

Difference in tax rate in various countries 6 3

Other non-taxable income (7) (3)

Other non-deductible expenses 5 1

Current taxes attributable to prior years (7) 1

Remeasurementof deferred tax assets (3) (1)

Otherdifferences 4 0

Income tax rate for the Group 20 27

Due to transfer of intellectual property within the Volvo Group, deferred

tax assets and tax liabilities have been revalued which has affected the

income tax in the income statement positively by 236.

ACCOUNTING POLICY

SOURCES OF ESTIMATION UNCERTAINTY

!

NOTE 10 INCOME TAXES

134

FINANCIAL INFORMATION 2013