Volvo 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

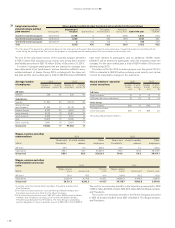

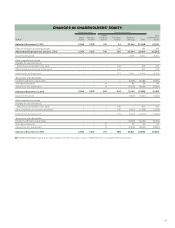

NOTE 31 CHANGES IN THE VOLVO GROUP’S FINANCIAL REPORTING 2013

As from January 1, 2013 Volvo applies IFRS 11 Joint Arrangements,

amendments in IAS 28 Investments in Associates and Joint Ventures and

the amendments in IAS 19 Employee Benefi ts. These standards are

applied retrospectively and hence the income statement and balance

sheet for 2012 are adjusted to refl ect the changes in these new and

amended accounting standards. None of the other new or amended

accounting standards or interpretations effective from January 1, 2013

have had any material effect on the Volvo Group.

Read more about all new applied accounting principles in Note 1.

Restatement of Joint ventures

IFRS 11 Join Arrangements has replaced IAS 31 Interests in Joint Ventures.

Under IFRS 11, joint arrangements are classifi ed as joint operations or

joint ventures. A joint operation is a joint arrangement whereby the parties

to the arrangement have rights to the assets, and obligations for the lia-

bilities. A joint venture is a joint arrangement whereby the parties to the

arrangement have rights to the net assets of the arrangement. The

Volvo Group’s joint arrangements are classifi ed as joint ventures. The

Volvo Group has previously accounted for joint ventures using the propor-

tional method and consolidated the assignable part item by item in the

income statement and balance sheet.

Under IFRS 11, the option of proportional consolidation of joint ven-

tures included in IAS 31 has been removed, and joint ventures shall be

accounted for using the equity method in accordance with IAS 28 Invest-

ments in Associates and Joint Ventures (revised 2011). Assets and liabil-

ities relating to joint ventures have been derecognized from the balance

sheet and the carrying amount as of January 1, 2012, corresponds to the

net assets derecognized and goodwill. Goodwill has been allocated to

each joint venture and any possible write-down requirement have been

considered in accordance with the transition rules in IFRS 11. In accord-

ance with the equity method, the Volvo Group’s share of the joint venture’s

profi t or loss is recognized as an one line item in the income statement,

i.e. “Income from investments in joint ventures and associates”. The corre-

sponding amount is recognized in the balance sheet as “Investment in

joint ventures and associates”.

The Volvo Group’s equity share in the joint venture VE Commercial Vehi-

cles (VECV) amounts to 45.6 %. The 8.4 % share in the other joint partner,

the listed company Eicher Motors Ltd, is recognized as Other shares and

participations and is revalued over other comprehensive income.

Read more about Volvo Group’s Joint Ventures in Note 5.

Restatement of Employee benefi ts

As from January 1, 2013 the amendments to IAS 19 Employee benefi ts

are effective. The revised standard is applied retrospectively, and hence

the opening balance for 2012 is adjusted in accordance with the revised

IAS 19, and the reported numbers for 2012 are restated accordingly for

comparison purposes.

The revised standard removes the option to use the corridor method

which is used by the Volvo Group up to and including the fi nancial year

2012. According to the revised IAS 19, discount rate is used when calcu-

lating the net interest income or expense on the net defi ned benefi t liabil-

ity (asset), hence the expected return is no longer used. All changes in the

net defi ned liability (asset) are recognized when they occur. Service cost

and net interest are recognized in the income statement, while remeas-

urements such as actuarial gains and losses are recognized in other com-

prehensive income. Special payroll tax is included in the pension liability,

special payroll tax is applicable for pension plans in Sweden and Belgium.

Amortization of actuarial gains and losses will cease with the removal of

the corridor method.

Read more about provision for post-employment benefi t in Note 20.

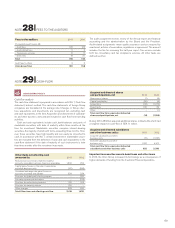

Restatement of Hedging of commercial fl ows

As from January 1, 2013 there is a change in the presentation of fi nancial

instruments relating to hedging effects on commercial fl ows, from Oper-

ating income to Other fi nancial income and expenses except for gains and

losses from derivatives hedging currency risks of future cash fl ows for

specifi c orders. Financial instruments related to hedging of commercial

fl ows are presented in the fi nance net to be able to enhance the possibil-

ity to net all internal fl ows before entering into external hedging contracts.

The new accounting princple has been applied retrospectively and the

income statement for 2012 has been adjusted.

Read more about hedging of commercial fl ows in Note 30.

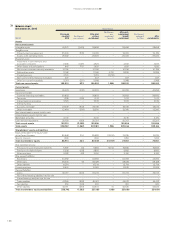

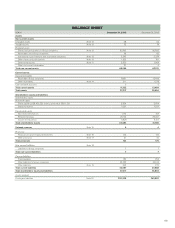

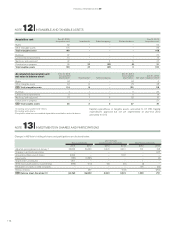

The effect on the Volvo Group’s balance sheets as of January 1, 2012 and

as of December 31, 2012 and the the income statement 2012 due to the

restatements of joint ventures, employee benefi ts and hedging of com-

mercial fl ows are presented below.

164

FINANCIAL INFORMATION 2013