Volvo 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

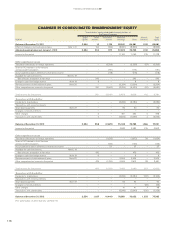

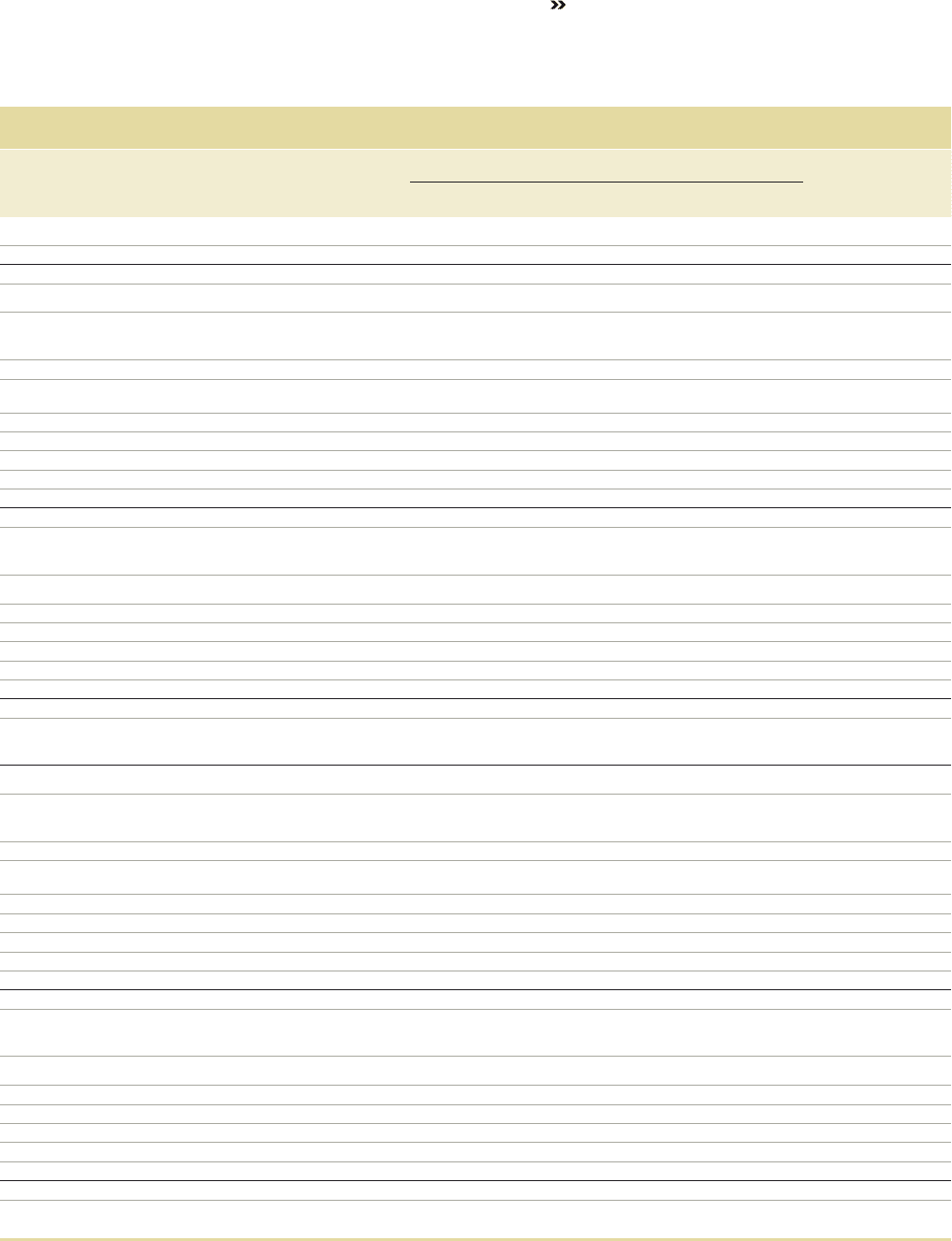

CHANGES IN CONSOLIDATED SHAREHOLDERS’ EQUITY

Shareholders’ equity attributable to equity holders of

the Parent Company

SEK M Share

capital Other

reserves1Translation

reserve Retained

earnings Total Minority

interests Total

equity

Balance at December 31, 2011 2,554 10 1,176 80,841 84,581 1,100 85,681

Effect of changes in accounting principles Note 1, 31 – 194 (199) (8,821) (8,826) – (8,826)

Adjusted opening balance at January 1, 2012 2,554 204 977 72,020 75,755 1,100 76,855

Income for the period – – – 11,160 11,160 219 11,378

Other comprehensive income

Translation differences on foreign operations – – (3,338) – (3,338) (57) (3,395)

Share of OCI related to Joint Ventures

and associated companies – – (191) – (191) – (191)

Accumulated translation differences reversed to income – – (118) – (118) – (118)

Available-for-sale investments: Note 5, 19

Gains/losses at valuation to fair value – 343 – – 343 – 343

Change incash fl ow hedge reserve Note 19 – 8 – – 8 – 8

Remeasurements of defi ned benefi t plans Note 20 – – – (2,234) (2,234) – (2,234)

Other comprehensive income for the period – 351 (3,647) (2,234) (5,530) (57) (5,587)

Total income for the period – 351 (3,647) 8,925 5,629 162 5,791

Transactions with shareholders

Dividends to shareholders – – – (6,083) (6,083) – (6,083)

Transactions with minority interests –– – ––––

Share based payments Note 27 – – – 90 90 – 90

Changes in minority interests –– – ––––

Other changes – 3 – 391 394 4 398

Transactions with shareholders – 3 – (5,602) (5,599) 4 (5,595)

Balance at December 31, 2012 2,554 558 (2,670) 75,343 75,785 1,266 77,051

Income for the period – – – 3,583 3,583 219 3,802

Other comprehensive income

Translation differences on foreign operations – – (1,672) – (1,672) 38 (1,634)

Share of OCI related to Joint Ventures

and associated companies – – (135) – (135) – (135)

Accumulated translation differences reversed to income – – 37 – 37 – 37

Available-for-sale investments: Note 5, 19

Gains/losses at valuation to fair value – 470 – – 470 – 470

Change incash fl ow hedge reserve Note 19 – 9 – – 9 – 9

Remeasurements of defi ned benefi t plans Note 20 – – – 3,904 3,904 – 3,904

Other comprehensive income for the period – 479 (1,770) 3,904 2,613 38 2,651

Total income for the period – 479 (1,770) 7,487 6,196 257 6,453

Transactions with shareholders

Dividends to shareholders – – – (6,084) (6,084) (162) (6,246)

Transactions with minority interests – – – – – – –

Share based payments Note 27 – – – 94 94 – 94

Changes in minority interests – – – – – (35) (35)

Other changes – – – 41 41 7 48

Transactions with shareholders – – – (5,949) (5,949) (190) (6,139)

Balance at December 31, 2013 2,554 1,037 (4,440) 76,881 76,032 1,333 77,365

1 For specifi cation of other reserves, see Note 19.

116

FINANCIAL INFORMATION 2013

116