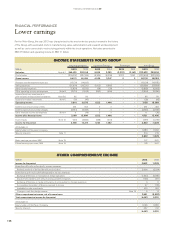

Volvo 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

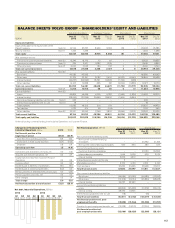

The Volvo Group’s cash, cash equivalents and

marketable securities combined, amounted to

SEK 29.6 billion at December 31, 2013 which

includes SEK 0.2 billion not available for use by

the Volvo Group and SEK 7.7 billion where other

limitations exist, mainly liquid funds in countries

where exchange controls or other legal restric-

tions apply. In addition to this, granted but not util-

ized credit facilities amounted to SEK 31.9 billion.

Total assets in the Volvo Group amounted to

SEK 344.8 billion as of December 31, 2013, an

increase of SEK 5.7 billion compared to year-

end 2012. The increase is mainly a result of

in creased customer fi nancing receivables due

to portfolio growth in the Customer Finance

Operations which is offset by changes in cur-

rency rates.

Net debt in the Volvo Group’s Industrial Operations amounted to SEK 32.1 billion at December 31, 2013,

equal to 46.8% of shareholders’ equity. Excluding provisions for post-employment benefi ts the Industrial

Operation’s net debt amounted to SEK 19.8 billion, which equal to 29.0% of shareholders’ equity.

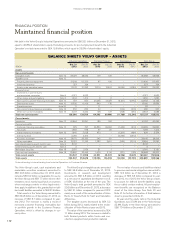

FINANCIAL POSITION

Maintained fi nancial position

BALANCE SHEETS VOLVO GROUP – ASSETS

Industrial Operations Customer Finance Eliminations Volvo Group

SEK M

Dec 31

2013 Dec 31

2012

Dec 31

2013 Dec 31

2012

Dec 31

2013 Dec 31

2012

Dec 31

2013 Dec 31

2012

Assets

Non-current assets

Intangible assets Note 12 36,479 38,592 109 106 – – 36,588 38,698

Tangible assets Note 13

Property, plant and equipment 51,819 53,330 87 105 – – 51,906 53,435

Investment property 327 754 – – – – 327 754

Assets under operating leases 17,013 21,263 13,714 12,543 (5,055) (4,784) 25,672 29,022

Financial assets

Investments in joint ventures

and associated companies Note 5 4,377 4,523 – – – – 4,377 4,523

Other shares and participations Note 5 1,944 1,614 6 6 – – 1,950 1,620

Non-current customer-fi nancing receivables Note 15 727 600 49,466 47,329 (6,401) (6,773) 43,792 41,156

Deferred tax assets Note 10 12,326 15,106 840 770 – – 13,166 15,876

Prepaid pensions Note 20 11 – 11 – – – 22 –

Non-current interest-bearing receivables Note 16 550 653 34 – (104) (316) 480 337

Other non-current receivables Note 16 3,017 3,334 128 127 (208) (373) 2,937 3,088

Total non-current assets 128,590 139,769 64,395 60,986 (11,768) (12,246) 181,217 188,510

Current assets

Inventories Note 17 40,964 39,741 189 352 – – 41,153 40,093

Current receivables

Customer-fi nancing receivables Note 15 679 797 40,854 39,946 (1,464) (910) 40,069 39,833

Tax assets 1,692 978 57 35 – – 1,749 1,013

Interest-bearing receivables Note 16 1,645 3,038 473 – (1,209) (464) 909 2,574

Internal funding12,2564,612––(2,256)(4,612)––

Accounts receivable Note 16 29,170 26,395 245 121 – – 29,415 26,516

Other receivables Note 16 12,207 11,753 1,383 2,651 (936) (2,114) 12,654 12,290

Non interest-bearing assets held for sale Note 3 8,102 – – – – – 8,102 –

Interest-bearing assets held for sale Note 3 2 – – – – – 2 –

Marketable securities Note 18 2,570 3,129 21 1 – – 2,591 3,130

Cash and cash equivalents Note 18 25,660 23,465 1,679 2,116 (371) (374) 26,968 25,207

Total current assets 124,947 113,908 44,901 45,222 (6,236) (8,474) 163,612 150,656

Total assets 253,537 253,678 109,296 106,208 (18,004) (20,720) 344,829 339,166

1 Internal funding is internal lending from Industrial Operations to Customer Finance.

The Volvo Group’s intangible assets amounted

to SEK 36.6 billion as of December 31, 2013.

Investments in research and development

amounted to SEK 3.8 billion in 2013, resulting

in a net value of capitalized development costs

of SEK 13.8 billion at the end of the year. The

Volvo Group’s total goodwill amounted to SEK

20.0 billion as of December 31, 2013, a decrease

by SEK 2.1 billion compared to year-end 2012

mainly as a result of the reclassifi cation of Volvo

Rents to “Assets Held for Sale” and translation

differences.

The tangible assets decreased by SEK 5.3

billion during 2013, mainly related to the reclas-

sifi cation of Volvo Rents at year end 2013.

The value of the inventories increased by SEK

1.1 billion during 2013. The increase is related to

both fi nished products within trucks and con-

struction equipment and production material.

The net value of assets and liabilities related

to pensions and similar obligations amounted to

SEK 12.3 billion as of December 31, 2013, a

decrease of SEK 6.5 billion compared to year-

end 2012. As of 2013 the Volvo Group ceases

to account for defi ned benefi t liabilities using

the so called corridor method. All post-employ-

ment benefi ts are recognized on the Balance

sheet of the Volvo Group. See Note 20 and

Note 31 for further information. A third balance

sheet is presented in Note 31.

At year-end, the equity ratio in the Industrial

Operations was 27.0% and in the Volvo Group

22.4%. Equity in the Volvo Group amounted to

SEK 77.4 billion at December 31, 2013.

112

FINANCIAL INFORMATION 2013

112