Volvo 2013 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

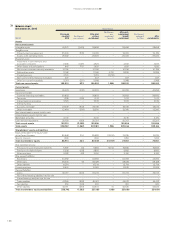

Amounts in SEK M unless otherwise specifi ed. The amounts within

parentheses refer to the preceding year, 2012.

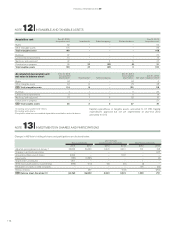

The Parent Company has prepared its fi nancial statements in accordance

with the Swedish Annual Accounts Act (1995:1554) and RFR 2, Account-

ing for Legal entities. According to RFR 2, the Parent Company shall apply

all the International Financial Reporting Standards endorsed by the EU as

far as this is possible within the framework of the Swedish Annual

Accounts Act. The changes in RFR 2 applicable to the fi scal year begin-

ning January 1, 2013, have had no material impact on the fi nancial state-

ments of the Parent Company.

The accounting principles applied by the Volvo Group are described in

note 1 Accounting principles to the consolidated fi nancial statements.

The main deviations between the accounting principles applied by the

Volvo Group and the Parent Company are described below.

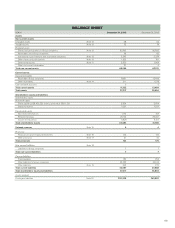

Shares and participations in Group companies and investments in joint

ventures and associated companies are recognized at cost in the Parent

Company and test for impairment is performed annually. Dividends is rec-

ognized in the income statement.

The Parent Company applies the exception in the application of IAS 39

which concerns accounting and measurement of fi nancial contracts of

guarantee in favour of subsidiaries and associated companies. The Parent

Company recognizes the fi nancial contracts of guarantee as contingent

liabilities.

The Volvo Group applies IAS 19 Employee Benefi ts in the consolidated

fi nancial statements. The Parent Company is applying the principles of

FAR’s Recommendation RedR4 “Accounting of pension liabilities and

pension costs”. Consequently there are differences between the Volvo

Group and the Parent Company in the accounting of defi ned benefi t pen-

sion plans as well as in the measurement of plan assets invested in the

Volvo Pension Foundation.

The Parent Company recognizes the difference between depreciation

according to plan and tax depreciation as accumulated additional depre-

ciation, included in untaxed reserves.

Reporting of Group contributions is recognized in accordance with the

alternative rule in RFR 2. Group contributions are reported as Allocations.

As from January 1, 2013, the holding in the listed company Eicher

Motors Ltd is recognized at fair value. The holding is classifi ed as “Finan-

cial assets available for sale” and changes in fair value are recognized in

Other comprehensive income. Comparative fi gures for 2012 have been

restated.

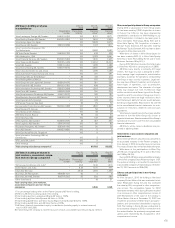

Change in accounting principle have had the following impact on the

fi nancial statements of the Parent Company:

Other shares and participations Jan 1, 2012 Dec 31, 2012

Carrying value according to previous Annual Report 552 248

Change in value of fi nancial assets available for sale 196 543

Carrying value after change of accounting principle 748 791

Shareholders’s equity Jan 1, 2012 Dec 31, 2012

Carrying value according to previous Annual Report 42,159 41,237

Change in value of fi nancial assets available for sale 196 543

Carrying value after change of accounting principle 42,355 41,780

Other comprehensive income Dec 31, 2012

Carrying value according to previous Annual Report 5,067

Items that may be reclassifi ed subsequently to

income statement:

Change in value of fi nancial assets available for sales 347

Carrying value after change of accounting principle 5,414

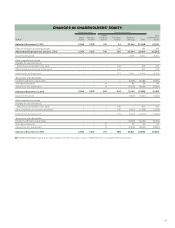

Other operating income and expenses include costs for legal processes,

donations and grants.

OTHER OPERATING INCOME

AND EXPENSES

NOTE 4

INCOME FROM INVESTMENTS

IN GROUP COMPANIES

NOTE 5

Dividends from Group companies amounted to 1,689 (920). Of dividends,

1,080 (–) pertain to dividend from Volvo Financial Services AB, 312 (55)

from Volvo China Investment Co Ltd, 105 (–) from Volvo East Asia (Pte)

Ltd, 85 (–) from Volvo Group UK Ltd, 59 (–) from Volvo Malaysia Sdn Bhd,

37 (258) from Volvo Construction Equipment NV, 11 (–) from Volvo UK

Holding Ltd and – (572) from Volvo Aero AB.

Shares in subsidiaries were written down by 996 (110). 843 (–) pertain

to shares in Volvo Group Japan Co, 63 (110) pertain to shares in Volvo

Italia Spa, 50 (–) pertain to shares in Volvo Parts AB and 40 (–) pertains

to shares in Volvo Business Services AB.

Income 2012 included 2,865 referring to the gain on sale of shares in

Volvo Aero AB. An adjustment of the gain has been made by an expense of

106 during 2013.

Transfer price adjustments and royalties amount to an expense of 1,128

(524).

172

FINANCIAL INFORMATION 2013

NOTES TO FINANCIAL STATEMENTS

NOTE 1 ACCOUNTING PRINCIPLES The Parent Company’s net sales amounted to 659 (670), of which 514

(559) pertained to Group companies. Purchases from Group companies

amounted to 351 (353).

NOTE 2 INTRA-GROUP TRANSACTIONS

Depreciation

Administrative expenses include depreciation of 16 (16) of which 1 (1)

pertains to machinery and equipment, 1 (1) to buildings and 14 (14) to

other intangible assets.

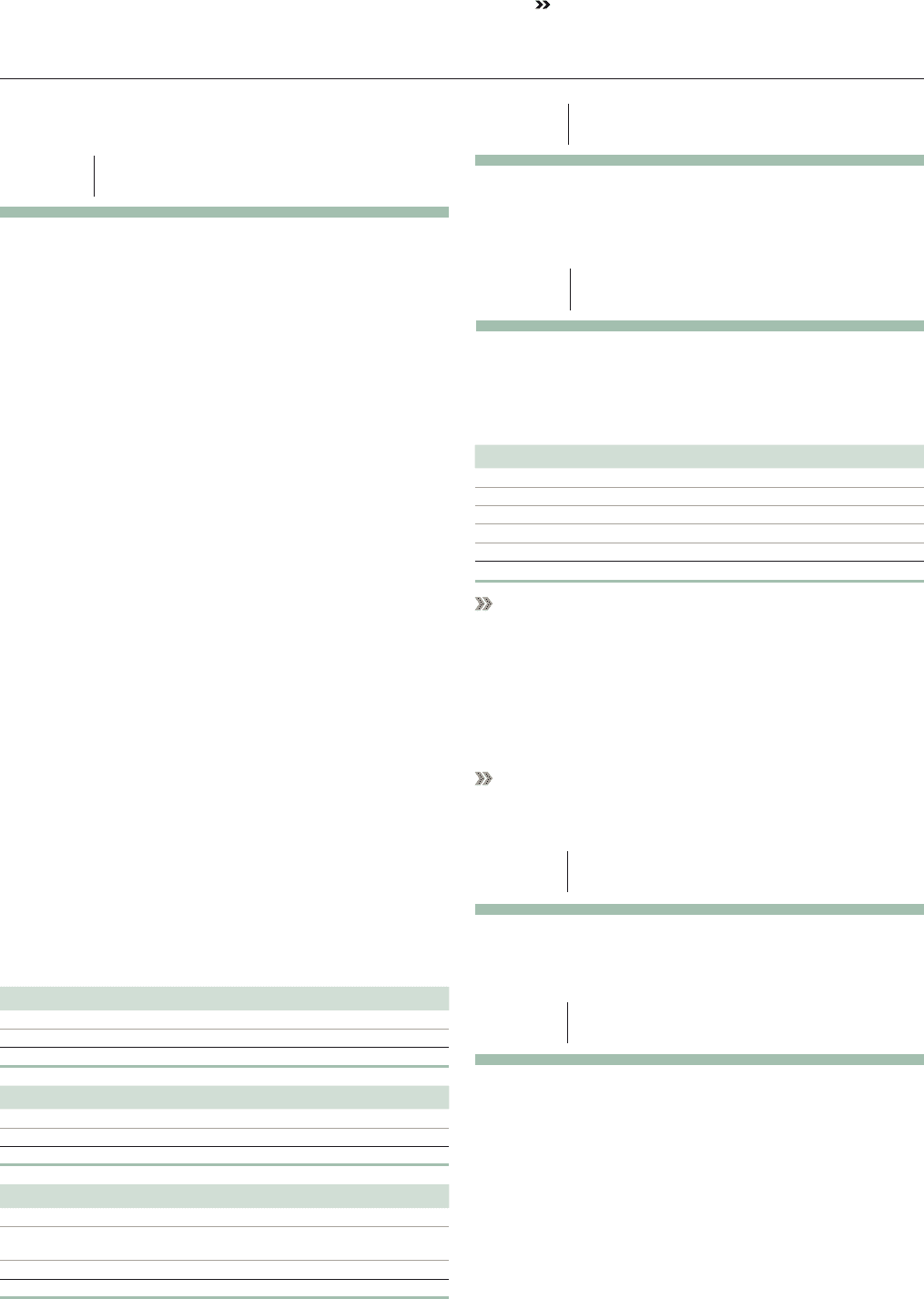

Fees to the auditors 2013 2012

PricewaterhouseCoopers AB

– Audit fees 18 23

– Audit-related fees 2 2

– Tax advisory services 1 3

– Other fees 5 23

Total 26 51

See Note 28 to the consolidated fi nancial statements for a description of the

different categories of fees to the auditors.

Personnel

Wages, salaries and other remunerations amounted to 289 (295), social

costs to 87 (90) and pension costs to 100 (90). Pension cost of 6 (6)

pertained to Board members and the President. The Parent Company has

outstanding pension obligations of 1 (0) to these individuals.

The number of employees at year-end was 279 (258).

Read more about the average number of employees, wages, salaries and other

remunerations including incentive program as well as Board members and

senior executives by gender in Note 27 to the consolidated fi nacial statements.

NOTE 3 ADMINISTRATIVE EXPENSES