Volvo 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

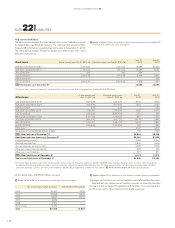

Contingent liabilities

A contingent liability is recognized for a possible obligation, for which it is

not yet confi rmed that a present obligation exists that could lead to an

outfl ow of resources; or for a present obligation that does not meet the

defi nitions of a provision or a liability as it is not probable that an outfl ow

of resources will be required to settle the obligation or when a suffi ciently

reliable estimate of the amount cannot be made.

Contingent liabilities Dec 31,

2013 Dec 31,

2012

Credit guarantees issued for customers and others 8,823 9,540

Tax claims 1,250 861

Residual value guarantees 3,389 3,317

Other contingent liabilities 3,828 4,045

Contingent liabilities as of December 31 17,290 17,763

Total contingent liabilities at December 31, 2013, amount to net 17,290

(17,763) and include contingent assets of 285 (307).

Credit guarantees amount to 8,823 (9,540) and a major part are issued

as a result of sales in emerging markets.

Tax claims amounting to 1,250 (861) pertain to charges against the

Volvo Group for which provisions are not considered necessary.

Other contingent liabilities include for example bid and performance

clauses and legal proceedings.

The recognized amounts for contingent liabilities have not been reduced

because of counter guarantees received or other collaterals in cases where

a legal offsetting right does not exist. As of December 31, 2013, the estimated

value of counter guarantees received and other collaterals, for example the

estimated net selling price of used products, amounted to 3,825 (4,216)

and mainly pertains to credit guarantees and residual value guarantees.

For more information regarding residual value guarantees, see note 21.

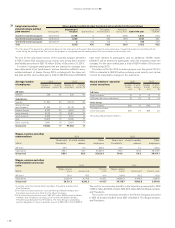

Legal proceedings

In July 1999, Volvo Truck Corporation (VTC) and Volvo Construction

Equipment (VCE) entered into a Consent Decree with the U.S. Environ-

mental Protection Agency (EPA). The Consent Decree stipulated, among

other provisions, that new stricter emission requirements for certain engines

that would come into effect on January 1, 2006, should be applied by VTC

and VCE from January 1, 2005. The Consent Decree was later transferred

from VTC and VCE to Volvo Powertrain Corporation. During 2008, the EPA

demanded stipulated penalties from Volvo Powertrain Corporation in the

amount, including interest, of appr. USD 72 M, alleging that the stricter

standards under the Consent Decree should have been applied to engines

manufactured by Volvo Penta during 2005. Volvo Powertrain disagrees with

EPA’s interpretation and is defending the case vigorously based on, among

other grounds, the fact that the Volvo Penta engines were not subject to the

Consent Decree. The dispute was referred to a U.S. court. On April 13,

2012, The United District Court of the District of Colombia handed down a

decision in favor of EPA, and ordered Volvo Powertrain to pay penalties and

interest of appr. USD 72 M. Volvo Powertrain has appealed the decision.

As of December 31, 2013, an amount of appr. SEK 65 M remains as a

provision and appr. SEK 401 M as a contingent liability.

Volvo Group is subject to the below investigations by competition

authorities. Volvo Group is cooperating fully with the respective authority.

In April 2011, the Volvo Group’s truck business in Korea and a number

of other truck companies became the subject of an investigation by the

Korean Fair Trade Commission. The Korean Fair Trade Commission has

issued a decision, received by Volvo on December 19, 2013, imposing a

fi ne in the amount of appr. SEK 104 M. Volvo has appealed the decision

and a contingent liability in a corresponding amount has been disclosed.

In January 2011, the Volvo Group and a number of other companies in

the truck industry became part of an investigation by the European Com-

mission regarding a possible violation of EU antitrust rules.

The Volvo Group is currently of the view that it is probable that the

Group’s result and cash fl ow may be materially adversely affected as a

result of the ongoing investigation initiated in Europe. It is too early to

assess the amounts and timing of the possible fi nes, and hence to what

amount and when it could be accounted for. The Volvo Group has there-

fore not reported any contingent liability or any provision for the investiga-

tion initiated in Europe.

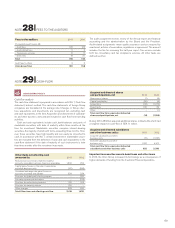

Global companies such as the Volvo Group are occasionally involved in

tax processes of varying scope and in various stages. Volvo Group regu-

larly assesses these tax processes. When it is probable that additional

taxes must be paid and the outcome can be reasonably estimated, the

required provision is made.

The Volvo Group is also involved in a number of legal proceedings other

than those described above. The Volvo Group does not assess that these

in aggregate are likely to entail any risk of having a material effect on the

Volvo Group’s fi nancial position.

ACCOUNTING POLICY

NOTE 24 CONTINGENT LIABILITIES

154

FINANCIAL INFORMATION 2013