Volvo 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

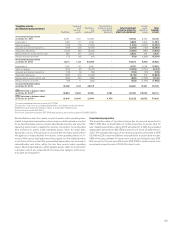

Assumptions applied for actuarial

calculations, % Dec 31,

2013 Dec 31,

2012

Sweden

Discount rate14.00 3.25

Expected salary increase 3.00 3.00

Infl ation 1.50 1.50

United States

Discount rate1 2 2.50–4.75 1.75–3.75

Expected salary increase 3.50 3.50

Infl ation 2.50 2.00

France

Discount rate13.25 3.75

Expected salary increase 3.00 3.00

Infl ation 1.50 1.50

Great Britain

Discount rate14.25–4.40 4.25–4.60

Expected salary increases 3.70–3.75 3.20–3.30

Infl ation 3.25 2.70

1 The discount rate for each country is determined by reference to market yields on

high-quality corporate bonds. In countries where there is no functioning market in

such bonds, the market yields on government bonds are used. The discount rate

for the Swedish pension obligation is determined by reference to mortgage bonds.

2 For all plans except one the discount rate used is within the range 3.75–4.75

(3.00–3.75).

Pension costs 2013 2012

Current year service costs 1,297 1,071

Interest expense 1,319 1,415

Interest income (842) (944)

Past service costs 144 32

Gain (loss) on settlements 0 35

Pension costs for the period,

defi ned-benefi t plans 1,918 1,609

Pension costs for defi ned-contribution plans 2,226 2,356

Total pension costs for the period 4,144 3,965

Costs for the period, post–employment

benefi ts other than pensions 2013 2012

Current year service costs 82 141

Interest costs 116 142

Interest income (2) (2)

Past service costs 82 11

(Gain) loss on settlements 1 6

Remeasurements 7 0

Total costs for the period, post–employment

benefi ts other than pensions 286 298

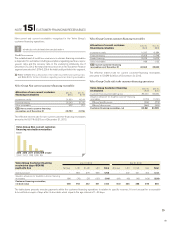

− +

Effect on obligation, SEK M

If discount rate increases 0.5% If discount rate decreases 0.5%

Sweden Pensions

Sweden Pensions

US Pensions

US Pensions

US Other benefits

US Other benefits

France Pensions

France Pensions

Great Britain Pensions

Great Britain Pensions

If inflation decreases 0.5% If inflation increases 0.5%

(1,102)

(688)

(157)

1,253

752

175

(440)

(156)

502

170

(1,102) 1,253

0

(4)

0

4

(340)

(15) 17

386

Sensitivity analysis

Sweden

Pensions US

Pensions France

Pensions Great Britain

Pensions US

Other benefi ts

Average duration of the obligation, years 20.8 10.5 14.1 17.7 10.2

The analysis below presents the sensitivity on the defi ned benefi t obliga-

tions when changes in the applied assumptions for dicount rate and infl a-

tion are made. The sensitivity analysis is based on a change in an assump-

tion while holding all other assumptions constant. In practice, this is not

probable, and changes in some of the assumptions may be correlated.

147