Volvo 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Restructuring in Japan. In Japan, the

total market for heavy-duty trucks in 2013

rose by 6% to 33,800 vehicles (32,000) as an

effect of government incentives to stimulate the

economy, signifi cant invest ments in public con-

struction projects and a weaker currency that

increased the competitiveness of the ex port indus-

try. UD Trucks’ market share in the heavy-duty seg-

ment incresed to 18.7% (17.5).

The Japanese market is one of the Group’s larg-

est, due, amongst others, to high sales of service

and spare parts. At the same time, the Japanese

market has declined sharply since the peak years of

the early 1990s and the Group is carrying out a

number of activities to strengthen the performance

in the country. Measures are being taken to lower

costs and enhance effi ciency in the sales channels

within the framework of the REX, Retail Excellence,

program which in cludes reducing the number of

employees in sup port functions while increasing

the number of employees who generate income.

A program was announced at the start of 2013

aimed at improving the overall effi ciency of the Jap-

anese production system. The program involves

consolidating manufacturing to the main plant in

Ageo and reducing production capacity in both

engines and truck assembly.

Deal with DFCV in China approved

In January 2013, AB Volvo signed an agreement

with the Chinese vehicle manufacturer Dongfeng

Motor Group Company Limited (DFG) to acquire

45% of a new subsidiary of DFG, Dongfeng Com -

mercial Vehicles (DFCV), which will include the

major part of DFG’s medium and heavy-duty com -

mercial vehicles business. The transaction was

approved by the Chinese National Development and

Reform Commission (NDRC) in January 2014 but

completion is subject to certain conditions, includ-

ing the approvals from other Chinese authorities.

The deal is expected to be fi nalized in mid 2014.

During 2013, the Chinese market for heavy-

duty trucks totaled approximately 774,100 vehi-

cles, while the corresponding fi gure for the medi-

um-duty market was 286,800 vehicles. DFCV

occupies a strong position in both the heavy-duty

and medium-duty segments, with deliveries of

120,631 heavy-duty trucks and 50,995 medi-

um-duty trucks, corresponding to market shares of

15.6% and 17.8%, respectively.

Eicher Pro Series – a strategic milestone for

VECV

In 2013, the total market for commercial vehicles

over 5 tons in India declined by 25% to 297,100

trucks (394,700). The Volvo Group’s joint venture

with Eicher Motors, VE Commercial Vehicles

(VECV), signifi cantly outperformed the market.

VECV’s deliveries of Eicher vehicles decreased by

16% to 40,550 units (48,262) and the domestic

market share subsequently increased to 13.8%

(12.7), the highest to date. In buses, Eicher’s share

rose to 13.5% (12.0), while it remained overall sta-

ble in the medium- duty and heavy-duty segments

at 30.4% (31.4) and 4.4% (3.9) respectively.

VECV has made extensive investments in re cent

years, which have been fi nanced by the compa-

ny’s own cash fl ow. They include a new factory for

medium-duty engines that delivers to the entire

Volvo Group, a new paint shop, new cab line, tool-

ing for new products, new gear plant and a new

facility for bus body building. Investments were

also made in research and development related to

new products. The re sults of these investments

were seen in Decem ber with VECV’s launch of the

Eicher Pro Series, developed specifi cally for India

and other se lected emerging markets. The Eicher

Pro Series covers the entire 5 to 49 ton gross vehi-

cle weight (GVW) range. A stepwise rollout of the

Eicher Pro Series began in February 2014.

Volvo CE advances positions in China

The vast majority of net sales in China stem from

the sale of construction equipment. The Chinese

construction equipment market recovered in the

autumn of 2013 after a period of weak develop-

ment. The market increased by 3% (de cline: 37).

For Asia excluding China, the market increased by

2% (11).

With a volume totaling 256,200 wheel loaders

and excavators in 2013, the Chinese market is by

far the world’s largest market, and the Volvo Group

remains number one in these segments. During

2013, Volvo CE with the brands Volvo and SDLG

had a combined market share of 14.6% (15.0) in

wheel loaders and excavators.

In December, Volvo CE signed an agreement to

acquire the hauler business from Terex, a transac-

tion that is expected to be completed in the sec-

ond quarter of 2014. In addition to strengthening

Volvo CE’s penetration in the core earthmoving

segment, the acquired business will extend the

company’s presence in light mining. The deal also

includes a 25.2% holding in Inner Mongolia North

Hauler Joint Stock Co (NHL), which manufactures

and sells rigid haulers under the Terex brand in

China with a leading position in the market.

Strong positions for Volvo Buses

Volvo Buses has a strong position in India and is one

of the most well-known brands in the market. 5,000

buses from Volvo are in operation in India. In 2013,

preparation for the introduction of a value brand on

the Indian market was initiated.

During the year, Volvo Buses delivered its fi rst

low-fl oor city buses to Shanghai. China is a large

market for electric buses. Sunwin Bus, a Volvo

Buses and SAIC Motor joint-venture, de livered 311

fully electric buses on the Chinese market in 2013.

UD Quester for emerging markets

On August 26, UD Trucks launched Quester, a new

heavy-duty truck range developed specifi cally for

emerging markets. With Quester, the Volvo Group

will address a completely new customer segment

and the trucks are an integrated part of the Volvo

Group’s strategy to increase sales in emerging

markets across Asia Pacifi c and other regions.

Read more about UD Quester on the next page.

Volvo Group in Asia

• Net sales: SEK 53,512 M (65,458)

• Share of net sales: 20% (22)

• Number of employees: 17,953

(17,642)

• Share of Group employees: 19% (18)

• Largest markets: China, Japan,

South Korea and Turkey.

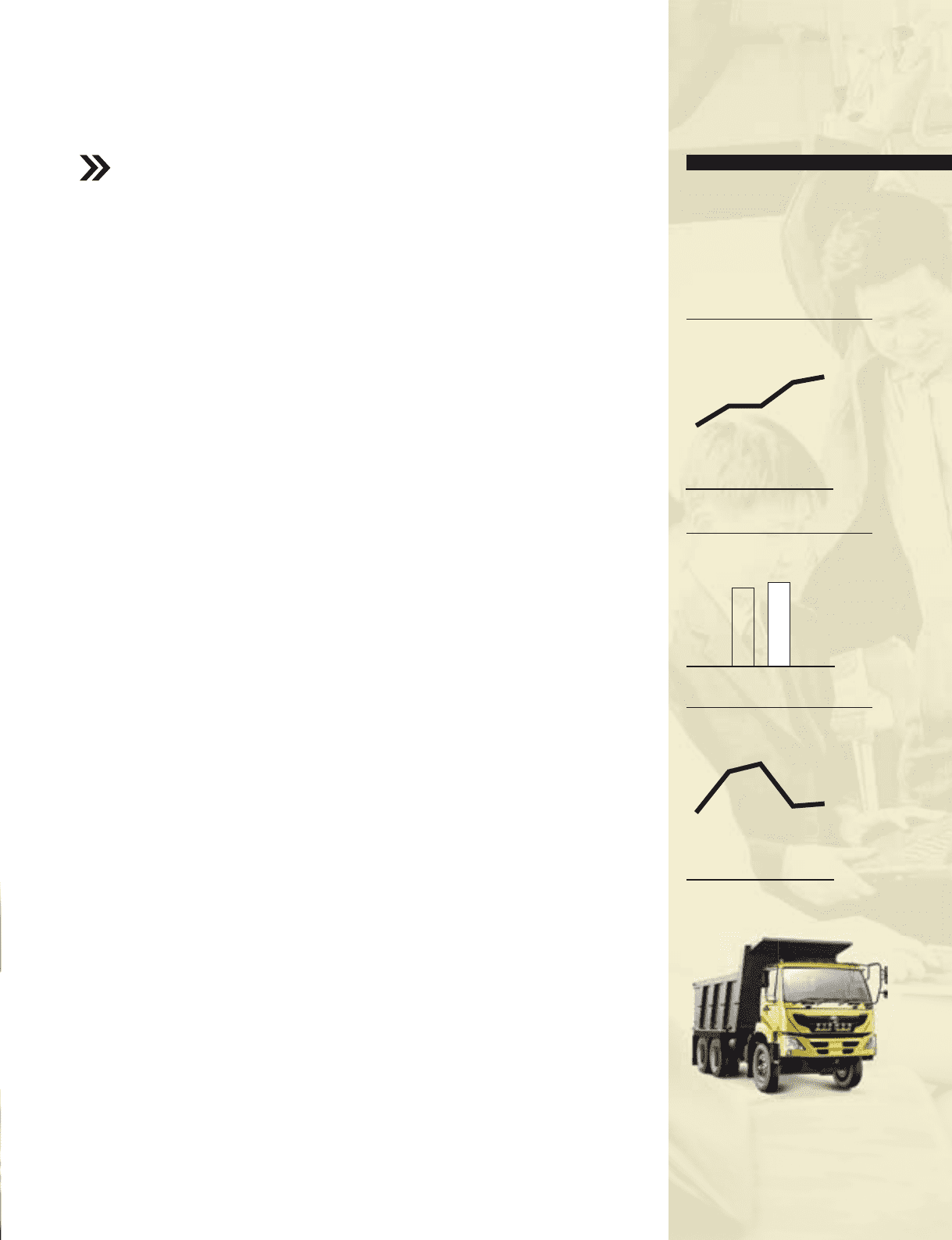

Market development, heavy-duty

trucks, Japan, Thousands

Market shares, heavy-duty trucks,

Japan, %

Market development, construction

equipment, China, Thousands

The Eicher brand has continuously

strengthened its position as an innova-

tive force on the Indian truck market.

The launch of the Pro Series adds to

the reputation.

1312111009

3432252519

1312111009

261253399371230

17.5

12 18.7

13

63