Volvo 2013 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

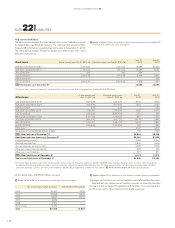

Hedge accounting

During 2013, the Volvo Group has applied hedge accounting for financial

instruments used to hedge interest and currency risks on loans only when

hedge accounting requirements are fulfilled. The changes in the fair value

of the hedge instruments outstanding and the changes in the carrying

amount of the loan are recognized in the income statement. When the

requirements for hedge accounting are not considered to be fulfilled,

unrealized gains and losses up until the maturity date of the financial

instrument are recognized in net financial items in the income statement.

In accordance with IAS 39, derivatives used for the hedging of forecast

electricity consumption have been recognized at fair value in the balance

sheet. During 2013, the Volvo Group applied hedge accounting for these

financial instruments.

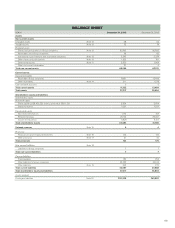

Dec 31, 2013 Dec 31, 2012

SEK M Carrying

value Fair

value Carrying

value Fair

value

Assets

Financial assets at fair value through the income statement1

The Volvo Group’s outstanding interest and currency riskderivatives (A)5Note 16 2,542 2,542 3,671 3,671

The Volvo Group’s outstanding raw materials derivatives Note 16 5 5 23 23

B/S Marketable securities Note 18 2,591 2,591 3,130 3,130

5,138 5,138 6,824 6,824

Loans receivable and other receivables

B/S Accounts receivable Note 16 29,415 – 26,516 –

Customer financing receivables2Note 15 83,861 – 80,989 –

Other interest-bearing receivables Note 16 509 – 1,291 –

113 , 78 5 108,796 –

Financial assets available for sale1

Holding of sharesin listed companies Note 5 1,490 1,490 1,122 1,122

Holding of sharesin non-listed companies Note 5 460 – 498 –

1,950 1,490 1,620 1,122

B/S Cash and cash equivalents Note 18 26,968 26,968 25,207 25,207

Liabilities Note 22

Financial liabilities at fair value through the income statement1

The Volvo Group’soutstanding interest and currency risks derivatives32,324 2,324 2,832 2,832

The Volvo Group’s outstanding raw materials derivatives 55 55 84 84

2,379 2,379 2,916 2,916

Financial liabilities valued at amortized cost4

Long term bond loans and other loans 83,309 86,888 79,592 85,060

Short term bank loans and other loans 4 9 , 8 11 49,937 50, 274 49,455

133,120 136 ,825 129,866 134,515

B/S Trade Payables 53,901 – 46,472 –

1 IFRS 7 classifies financial instruments based on the degree that market values

have been utilized when measuring fair value. All financial instruments measured

at fair value held by Volvo are classified as level 2 with the exception of shares and

participations, which are classified as level 1 for listed instruments and level 3

for unlisted instruments. Refer to Note 5 for more information regarding valua-

tion principles. None of these individual shareholdings is of significant value for

Volvo. The valuation of level 2 instruments is based on market conditions using

quoted market data existing at each balance sheet date. The basis for the inter-

est is the zero-coupon-curve in each currency which is used to calculate the

present value of all the estimated future cash-flows. The fair value of forward

exchange contracts is discounted to balance sheet date based on the forward

rates for each currency as per balance sheet date.

2 Volvo does not estimate the risk premium for the customer financing receivables

and chooses therefore not to disclose fair value for this category.

3 Includes a fair value of a loan related to hedge accounting negative SEK 1,157 M

(negative 1,495), netted against derivatives used to hedge the risk positive SEK

1,171 M (1,477). For further information on hedging of currency and interest rate

risks on loans see below.

4 In the Volvo Group consolidated financial position, financial liabilities include

loan-related derivatives amounting to negative SEK 1,899 M (negative 1,976).

5 The Volvo Group’s gross exposure from positive derivates amounts to SEK 3,713M

(5,148). The exposure is the sum of positive derivatives reported assets to an

amount of SEK 2,542 (3,671) and positive derivatives of SEK 1,171 M (1,477)

netted against fair value of a loan reported as liability. Refer to footnote 3 above.

The gross exposure is reduced by 41% (43%) by netting agreements and cash

deposits to SEK 2,203 M (2,948).

For further information refer to Note 4 Goals and policies in financial risk

management.

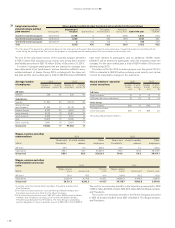

In previous years, the Volvo Group has applied hedge accounting for

certain net investments in foreign operations. The ongoing result of such

hedges is recognized as a separate item in other comprehensive income.

In the event of a divestment, the accumulated result from the hedge is

recognized in the income statement.

Refer to page 163 for supplementary information on hedge accounting and to

Note 4 for information regarding Goals and policies in financial risk management.

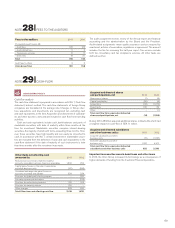

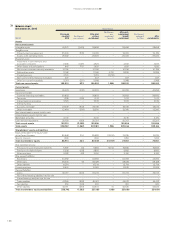

Information regarding carrying amounts and fair values

In the table below, carrying amounts are compared with fair values for all

of the Volvo Group’s financial instruments.

161