Volvo 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

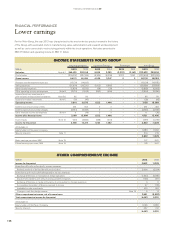

Net sales

Net sales for the Volvo Group decreased by 9%

to SEK 272,622 M in 2013, compared with SEK

299,814 M in the preceding year.

Operating income

Volvo Group’s operating income amounted to

SEK 7,138 M (18,069).

Operating income for the Industrial Operations

decreased to SEK 5,616 M compared with SEK

16,573 M in the preceding year. The Customer

Finance operations’ operating income rose to

SEK 1,522 M (1,496).

Net fi nancial items

Net interest expense amounted to SEK 2,429 M,

compared with SEK 2,496 M in the preceding

year.

Income taxes

The tax expense for the year amounted to

SEK919 M (4,116) corresponding to a tax rate

of 20% (27). The tax expense was positively

impacted by a revaluation of deferred tax and a

tax credit in Brazil.

Income for the period and earnings

per share

The income for the period amounted to SEK

3,802 M (11,378), corresponding to diluted earn-

ings per share of SEK 1.76 (5.61). The return on

shareholders’ equity was 5.0% (14.7).

The Volvo Group

Net sales by business area, SEK M 2013 2012 %

Trucks 178,474 189,156 (6)

Construction Equipment 53,437 63,558 (16)

Buses 16,707 19,587 (15)

Volvo Penta 7,550 7,631 (1)

Volvo Aero – 5,219 –

Eliminations and other 9,252 7,048 31

Industrial Operations1265,420 292,198 (9)

Customer Finance 9,539 9,783 (2)

Reclassifi cations and eliminations (2,336) (2,167) (8)

Volvo Group 272,622 299,814 (9)

1 Adjusted for acquired and divested units and changes in currency rates, net sales

decreased by 2%.

Change in operating income,

SEK bn

Change

(excluding

currency) Currency

impact Total

Operating income 2012 18.1

Change in gross income Industrial operations1(1.6) (5.4) (7.0)

Change in gross income Customer fi nancing 0.3 0 0.3

Higher credit losses2(0.5) 0 (0.5)

Change in group structure (1.4) 0 (1.4)

Lower capitalization of development cost (1.3) 0.1 (1.2)

Lower research and development

expenditures 0.1 0.4 0.5

Higher selling and administrative expenses (2.6) 1.5 (1.1)

Revaluationof assets held for sale

(Volvo Rents) (1.5) 0 (1.5)

Volvo profi t sharing program 0.2 0 0.2

Restructuring and effi ciency program 0.8 0 0.8

Other (0.1) 0 (0.1)

Operating income 2013 7.1

1 During 2013 gross income was affected by lower volumes which was partly

offset by an improvement in price variances and warranty cost.

2 Of the total credit losses SEK 0.3 billion are related to customer fi nancing.

Operating income (loss) by business area, SEK M 2013 2012

Trucks 6,145 10,779

Construction Equipment 2,592 5,667

Buses (190) 37

Volvo Penta 626 549

Volvo Aero – 775

Eliminations and other (3,557) (1,235)

Industrial Operations 5,616 16,573

Customer Finance 1,522 1,496

Volvo Group 7,138 18,069

Operating margin, % 2013 2012

Trucks 3.4 5.7

Construction Equipment 4.9 8.9

Buses (1.1) 0.2

Volvo Penta 8.3 7.2

Volvo Aero – 14.9

Industrial Operations 2.1 5.7

Volvo Group 2.6 6.0

Net sales, SEK bn

12111009

310265218 300

13

273

Operating income, SEK M

2012 2013

Q4

996

Q3

2,398

Q2

3,262

Q1

482

Q4

1,200

Q3

2,920

Q2

7,709

Q1

6,240

109109