Volvo 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The North American market declined some-

what in the wake of slow economic growth.

Demand in Brazil was strong throughout the year

while the Japanese market was supported by eco-

nomic measures by the government. The truck

market in India was low, refl ecting the slowdown in

the economy while the Chinese market picked up

somewhat compared to 2012.

Varying market conditions

In 2013, the heavy-duty truck market in Europe 30

(EU plus Norway and Switzerland) increased 8%

to 240,200 trucks compared with 221,800 in

2012. For 2014 the total market is expected to be

at a level of about 230,000 heavy-duty trucks.

In2013, the total North American retail market

for heavy-duty trucks decreased by 5% to

236,300 vehicles (249,600). For 2014, the total

market is expected to reach a level of about

250,000 heavy-duty trucks.

In 2013, the Brazilian market increased by 19%

to 103,800 heavy-duty trucks (87,400). For 2014

the total market in Brazil is expected to remain at

the level of about 105,000 heavy-duty trucks.

In Japan the total market for heavy-duty trucks

rose by 6% to 33,800 vehicles (32,000). For 2014

the total market in Japan is expected to remain at

the level of about 35,000 heavy-duty trucks.

In India, the total market for heavy-duty trucks

declined by 33% to 131,700 trucks (195,100). The

total Indian market for medium- duty trucks

declined by 19% to 76,300 trucks (94,200). For

2014 the total market in India is expected to reach

a level of about 145,000 heavy-duty trucks and

about 88,000 medium- duty trucks.

In China, the total market for heavy-duty trucks

reached 774,100 vehicles (636,000). The total

market for medium-duty trucks was 286,800 vehi-

cles (290,300). For 2014 the total market in China

is expected to reach a level of about 700,000

heavy-duty trucks and about 280,000 medium-

duty trucks.

In general the Volvo Group maintained or

in creased its market positions in the main markets.

In Europe the combined market share for heavy-

duty trucks amounted to 24.3% (25.7) and in North

America it was 18.8% (18.3). In Brazil the market

share in heavy-duty trucks increased to 20.0%

(18.2) while it increased to 18.7% (17.5) in Japan.

In India the market share for Eicher amounted to

30.4% (31.4) in the medium-duty segment and to

4.4% (3.9) in the heavy-duty segment.

Orders and deliveries

In 2013, a total of 200,274 trucks where delivered

from the Group’s wholly-owned operations, a

decrease of 2% compared to 2012. Deliveries

decreased in all markets except South America.

Order intake to the Group’s wholly-owned oper-

ations increased by 12% to 214,301 trucks with

increases noted in all markets.

Lower earnings

In 2013, net sales in the truck operations

de creased by 6% to SEK 178,474 M (189,156). Ad -

justed for changes in exchange rates, net sales

increased by 1%.

Operating income excluding restructuring

charges amounted to SEK 6,824 M (12,219), while

the operating margin excluding restructuring

charges was 3.8% (6.5). Restructuring charges

amounted to SEK 679 M (1,440). The lower profi t-

ability compared to 2012 is mainly an effect of a

negative currency impact of SEK 2,698 M, higher

costs for R&D due to reduced capitalization of

R&D investments, higher costs in the manufactur-

ing system and selling expenses associated with

the changeover to new generations of trucks.

Extensive product renewal

The activity level in the Group’s truck operations

was very high during the year. In Europe, Volvo

Trucks launched the new Volvo FM, Volvo FMX,

Volvo FL and Volvo FE. In June, Renault Trucks pre-

sented a new, comprehensive truck program com-

prising its T, K, C and D series for long- distance

haulage, construction and distribution. In addition,

the new Euro 6 engines were launched.

The renewal of the Group’s truck program con-

tinued with the launch of UD Quester, an all-new

series of heavy-duty trucks developed specifi cally

for growth markets in Asia and other areas. In India,

VECV, the Group’s joint venture together with

Eicher Motors, started manufacturing the new 5

liter and 8 liter engines for UD Quester and the

medium-duty truck program in Europe. Towards the

end of the year the Eicher Pro Series, a complete

new range of 11 trucks and buses, was revealed. In

Brazil the new Volvo VM was launched and In

North America, new powertrain packages were

among the product news.

The new trucks, which shall contribute to the

Group’s long-term growth and profi tability, were

very well received by both dealers and customers.

The Group’s new and stronger product programs

have also provided dealers with stronger faith in

the future and motivation for them to continue to

invest and contribute to the development of the

Group’s brands.

Restructuring to strengthen

competitiveness

On January 1, 2013, the Volvo Group introduced a

new organization for its truck dealer networks in

Europe, the Middle East and Africa (EMEA). The

reorganization aims to capitalize more effectively on

opportunities for the Group’s brands and products

in line with the new strategy for the truck operation.

In October, there was a directional decision to

implement changes in the European truck manu-

facturing operations in order to increase effi ciency

and strengthen competitiveness. By optimizing the

industrial structure in Europe, the Group will be

able to build trucks in a much more effi cient way

with lower cost per truck.

At the start of 2013 a program aimed at improv-

ing the overall effi ciency of the Japanese produc-

tion system was announced. The program involves

consolidating manufacturing to the main plant in

Ageo and reducing production capacity in both

engines and truck assembly. Measures are also

ongoing in Japan to lower costs and enhance effi -

ciency in the sales channels within the framework

of the REX program (Retail Excellence).

Net sales, SEK bn

1312111009

178.5

189.2 178.5198.9167.3138.9

Net sales by market

Mkr 2013 2012

Europe 73,640 76,365

North America 40,314 42,650

South America 23,318 21,172

Asia 26,740 33,404

Other markets 14,462 15,566

Total 178,474 189,156

Deliveries by market

Number of trucks 2013 2012

Europe 82,088 84,355

North America 44,755 47,806

South America 29,137 23,443

Asia 28,692 31,757

Other markets 15,602 16,899

Total 200,274 204,260

Non- consolidated operations

Eicher (100%) 31,422 39,063

DND (100%) 213 450

Total volumes 231,909 243,773

Market shares, heavy-duty trucks, %

EUROPE

JAPAN

NORTH AMERICA

BRAZIL

10.4 7.9 7.910.9

18.2 20.0

17. 5 18 . 7

15.6 10.1 8.016.3

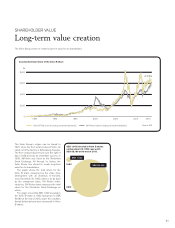

Operating income (loss)*

and operating margin*

SEK M

%

6,824

12

12,219

6.5

13

6,824

3.8

11

18,227

9.2

10

10,112

6.0

09

(10,805)

(7.8)

*Excl. restructuring changes

73