Volvo 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

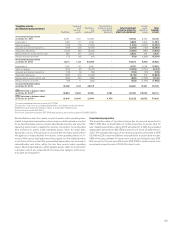

Cash and cash equivalents include high liquid interest-bearing securities

that are considered easily convertible to cash. Interest-bearing securities

that fail to meet this defi nition are recognized as marketable securities.

Marketable securities

Marketable securities comprise mainly of interest-bearing securities, dis-

tributed as shown below:

Dec 31,

2013 Dec 31,

2012

Government securities 387 131

Banks and fi nancial institutions 917 494

Real estate fi nancial institutions 1,287 2,505

B/S Marketable securities

as of December 31 2,591 3,130

Cash and cash equivalents

Dec 31,

2013 Dec 31,

2012

Cash in banks 23,765 22,160

Bank certifi cates1456 1,019

Time deposits in banks 2,747 2,028

B/S Cash and cash equivalents

as of December 31 26,968 25,207

1 Bank certifi cates which matures within three months of the date of acquisition.

Cash and cash equivalents as of December 31, 2013, include SEK 0.2

billion (0.2) that is not available for use by the Volvo Group and SEK 7.7

billion (9.4) where other limitations exist, mainly liquid funds in countries

where exchange controls or other legal restrictions apply. Therefore it is

not possible to immediately use the liquid funds in other parts of the Volvo

Group, however normally there is no limitation for use for the Volvo Group’s

operation in the respective country.

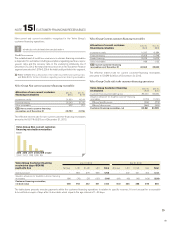

ACCOUNTING POLICY

Earnings per share is calculated as income for the period, attributable to

the Parent Company’s shareholders, divided by the Parent Company’s

average number of shares outstanding for the fi scal year. Diluted earnings

per share is calculated as income for the period attributable to the Parent

Company’s shareholders divided by the average number of shares out-

standing plus the average number of shares that would be issued as an

effect of ongoing share-based incentive programs. If during the year there

were potential shares redeemed or expired during the period, these are

also included in the average number of shares used to calculate the earn-

ings per share after dilution.

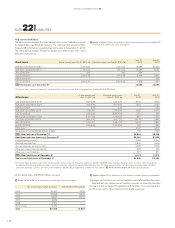

The share capital of the Parent Company is divided into two series of

shares, A and B. Both series carry the same rights, except that each

Series A share carries the right to one vote and each Series B share car-

ries the right to one tenth of a vote. The shares quota value is SEK 1.20.

Cash dividend 2013, decided by the Annual General Meeting 2012,

was SEK 3.00 (3.00) per share or totally SEK 6,083.7 M (6,082.5).

During 2013 AB Volvo transferred, free of consideration, 420,856 treas-

ury B-shares, with a total quota value of 505,027.20 SEK, to participants in

the long-term, share-based incentive program for Group and senior exec-

utives in the Volvo Group, as accelerated allotment. The transferred treasury

shares represent an insignifi cant portion of the share capital of AB Volvo.

During 2013 AB Volvo converted a total of 27,245,422 Series A shares

to Series B shares.

Unrestricted equity in the Parent Company as of December 31, 2013

amounted to SEK 24,693 M (31,346).

Refer to Note 27 regarding the Volvo Group long-term incentive program.

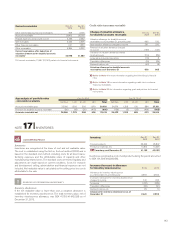

Information regarding

number of shares Dec 31,

2013 Dec 31,

2012

Own Series A shares 20,728,135 20,728,135

Own Series B shares 79,592,353 80,013,209

Total own shares 100,320,488 100,741,344

Own shares in % of total registered

shares 4.71 4.73

Outstanding Series A shares 498,570,818 525,816,240

Outstanding Series B shares 1,529,528,914 1,501,862,636

Total outstanding shares 2,028,099,732 2,027,678,876

Total registered Series A shares 519,298,953 546,544,375

Total registered Series B shares 1,609,121,267 1,581,875,845

Total registered shares 2,128,420,220 2,128,420,220

Average number of

outstanding shares 2,027,915,094 2,027,521,257

Earnings per share

The long-term share-based incentive programs decided by the Annual

General Meeting 2011 create a dilution effect in 2013 of 0.01 SEK.

ACCOUNTING POLICY

NOTE 18 MARKETABLE SECURITIES AND LIQUID FUNDS

NOTE 19 EQUITY AND NUMBER OF SHARES

144

FINANCIAL INFORMATION 2013