Volvo 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

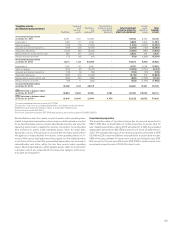

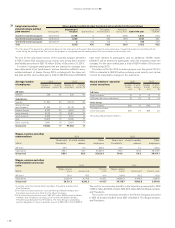

Net provisions for post-employment benefi ts Sweden

Pensions US

Pensions France

Pensions

Great

Britain

Pensions

US

Other

benefi ts Other

plans Total

Net provision for post-employment benefi ts

as of December 31, 2012 (6,203) (4,537) (1,996) 97 (3,714) (2,482) (18,835)

of which reported as:

B/S Provisions for post-employment benefi ts (6,203) (4,537) (1,996) 97 (3,714) (2,482) (18,835)

Net provisions for post-employment benefi ts

as of December 31, 2013 (3,104) (1,770) (2,349) (41) (3,158) (1,878) (12,300)

of which reported as:

B/S Prepaid pensions – 11 – – – 11 22

B/S Provisions for post-employment benefi ts (3,104) (1,781) (2,349) (41) (3,158) (1,889) (12,322)

Actual return on plan assets amounted to 2,348 (2,137).

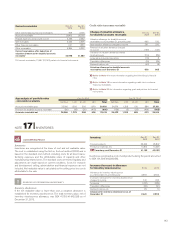

Fair value of plan assets

with a quoted market price Dec 31,

2013 Dec 31,

2012

Cash and cash equivalents 232 419

Equity instruments 11,247 9,440

Debt instruments 11,423 9,939

Real estate 149 260

Derivatives 7 11

Investments funds 784 629

Assets held by insurance company 573 541

Other assets 17 0

Total 24,432 21,239

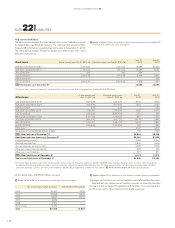

Investment strategy and risk management

The Volvo Group manages the allocation and investment of pension plan

assets with the purpose of meeting the long term objectives. The main

objectives are to meet present and future benefi t obligations, provide suf-

fi cient liquidity to meet such payment requirements and to provide a total

return that maximizes the ratio of the plan assets in relation to the plan

liabilities by maximizing return on the assets at an appropriate level of risk.

The fi nal investment decision often resides with the local trustee, but the

investment policy for all plans ensures that the risks in the investment

portfolios are well diversifi ed. The risks related to pension obligations, e.g.,

longevity and infl ation, as well as buy out premiums and matching strate-

gies are monitored on an ongoing basis in order to limit the Volvo Group’s

exposure.

In the last couple of years, some of the defi ned benefi t plans have been

closed to new entrants and replaced by defi ned contribution plans in

order to reduce risk for the Volvo Group.

In Sweden the minimum funding target is decided by PRI Pensions-

garanti, this is mandatory in order to stay in the system and get insurance

for the pension liability. The minimum contribution is decided by the com-

pany and should equal at least the pension benefi ts expected to be earned

during the coming year.

In the United States the minimum funding target is decided by the com-

pany in order to avoid penalties, keep fl exibility and avoid extensive fi ling

with the IRS and participants. The minimum contribution should equal at

least the benefi ts expected to be earned during the coming year + 1/7 of

the underfunding.

In Great Britain there are no minimum funding requirements. For each

plan there is a contribution plan, which is well defi ned, in place to bring the

schemes to full funding within a reasonable time frame. The contribution

plans are to to be approved by regulators.

In 2014, the Volvo Group estimates to transfer an amount of SEK 1-2

billion to pension plans.

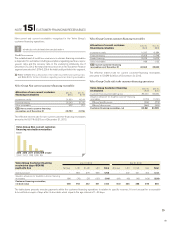

Plan assets by category as of December 31, 2012

Cash and cash equivalents, 718 (3%)

Equity instruments, Volvo, 333 (1%)

Equity instruments, other, 10,336 (42%)

Debt instruments, 10,968 (45%)

Real estate, 855 (3%)

Investments funds, 628 (3%)

Assets held by insurance company, 525 (2%)

Other assets, 255 (1%)

Cash and cash equivalents, 1,109 (4%)

Equity instruments, Volvo, 343 (1%)

Equity instruments, other, 12,193 (44%)

Debt instruments, 11,438 (41%)

Real estate, 839 (3%)

Investments funds, 786 (3%)

Assets held by insurance company, 702 (3%)

Other assets, 243 (1%)

Plan assets by category as of December 31, 2013

149