Volvo 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

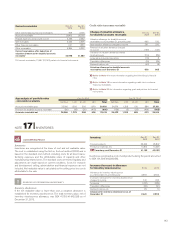

Current liabilities

Current liabilities Dec 31,

2013 Dec 31,

2012

Bank loans 10,992 9,172

Other loans 40,560 40,841

B/S Current liabilities as of December 31151,552 50,013

1 Of which loans raised to fi nance the credit portfolio of the customer fi nancing

operations amount to 44,188 (39,259) and fi nancial derivatives at fair value

amount to 1,753 (43).

Bank loans include current maturities of non-current loans 3,254 (2,586).

Other loans include current maturities of non-current loans, 21,848 (22,173),

and commercial paper, 13,528 (13,535). Non-interest-bearing current

liabilities accounted for 88,746 (79,467), or 63% (61) of the Volvo Group’s

total current liabilities.

Other current liabilities Dec 31,

2013 Dec 31,

2012

Advances from customers 3,280 3,929

Wages, salaries and withholding taxes 8,261 7,860

VAT liabilities 1,971 1,692

Accrued expenses and prepaid income 11,161 10,910

Deferred leasing income 1,882 1,793

Residual value liability 2,186 1,705

Other fi nancial liabilities 160 254

Other liabilities 4,492 4,392

B/S Other current liabilities

as of December 31 33,393 32,535

Current liabilities also include trade payables of 53,901 (46,472), current

tax liabilities of 1,120 (460) and non interest-bearing and interest-bearing

liabilities held for sale, as disclosed in Note 3. Secured bank loans at year-

end 2013 amounted to 0 (113). The corresponding amount for other

current liabilities amounted to 1,747 (1,581). Of current liabilities including

trade payables, 105,693 (97,992) pertains to fi nancial instruments.

Refer to Note 30 Financial instruments.

Refer to Note 23 for disclosures regarding assets pledged.

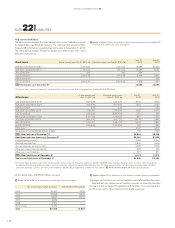

Assets pledged Dec 31,

2013 Dec 31,

2012

Property, plant and equipment – mortgages 84 97

Assets under operating leases 57 150

Receivables 4,897 3,661

Cash, loans andmarketable securities 40 32

Other assets pledged – 39

Total 5,078 3,979

Total liabilities for which assets are pledged amounted to 4,928 (3,722).

In 2013 an asset-backed securitization was completed. Under the

terms of the transaction, 4,297 of securities were issued tied to US-based

loans, secured by Customer Finance receivables recognized on the

balance-sheet with trucks and construction equipment assets as collaterals.

NOTE 23 ASSETS PLEDGED

153