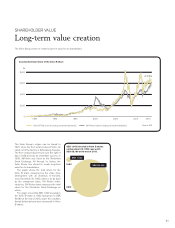

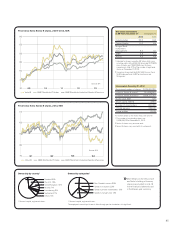

Volvo 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Construction Equipment (Volvo CE)

is the third largest and, at over 180 years

old, the longest established global producer of

products and services for the construction, ex -

trac tion, waste processing and materials han-

dling industries. The company boasts a portfolio

that exceeds 200 machines and a comprehen-

sive range of supporting products and services.

Main equipment includes excavators, articulated

haulers, wheel loaders and a range of smaller

equipment such as backhoe and skid steer load-

ers. The road machinery range includes motor

graders, compactors, pavers and milling machines.

The Chinese-built range of SDLG branded prod-

ucts includes excavators, loaders and compac-

tors. The company’s offering also includes ser-

vices such as customer support agreements,

at tach ments, fi nancing, leasing and used equip -

ment sales.

Volvo CE equipment is distributed through a

global network of independent and Volvo- owned

dealerships. SDLG branded products are dis-

tributed through separate sales channels.

Lower volumes

Measured in units sold, the total world market

for heavy, compact and road machinery equip-

ment increased by 2% in 2013, compared to

2012. The European market was down by 4%,

while Asia (excluding China) was up 2% and

demand in China itself increased by 3%. North

and South America proved more resilient, record-

ing market growth during 2013, of 2% and 4%

respectively. Volvo CE sold 70,800 machines

compared with 75,500 in 2012.

The important Chinese market, where VolvoCE

remains the market leader in wheel loader and

ex cavator sales, showed signs of increased sta-

bility, if not quite a market recovery. Elsewhere,

there were improving trends in the Middle East

and some European countries too. Demand in

the important mining segment was weak during

the year.

During 2013 net sales declined by 16% to

SEK 53,437 M (63,558). Net sales declined in

all markets. Adjusted for changes in exchange

rates, net sales declined by 12%.

Operating income declined to SEK 2,952 M

(5,667) and the operating margin amounted to

4. 9% (8.9). Profi t abilit y was negatively impac ted

by lower sales, a negative product mix, price pres-

sure and an unfavorable exchange rate devel-

opment amounting to SEK 623 M.

New product development

In April Volvo CE attended the construction

equipment industry’s largest exhibition – Bauma

– announcing its technical solution to the Tier 4

Final/Stage IV emissions regulations as well as

displaying new products such as the ECR25D,

ECR58D and ECR88D short radius compact

excavators and the P6870C asphalt paver. Prod-

uct introductions were supported by new Volvo

branded attachments, fi nancing solutions, ap -

proved used equipment, genuine Volvo parts,

cus tomer support agreements and fl eet man-

agement solutions.

Production and distribution

In 2013 Volvo CE further expanded the produc-

tion footprint. In May the company opened a

new excavator plant in Europe’s second-largest

market: Russia. The 20,660 square meter fac-

tory in Kaluga represents a SEK 350 M invest-

ment and is initially producing four models of

Volvo excavators, spanning 20 to 50 tons.

Volvo CE also inaugurated wheel loader pro-

duction in its Shippensburg facility in the U.S.,

along with a new headquarters for its Americas

sales operation. Volvo CE also announced that

it was moving production of backhoe loaders

from Mexico to its main Latin American produc-

tion facility in Pederneiras, Brazil.

SDLG started production of its excavators in

Brazil. It was also announced that SDLG would

enter the North American market, initially offer-

ing two wheel loaders through a selected group

of dealers. SDLG also entered into a number of

distribution agreements to sell machines through-

out EMEA, Asia Pacifi c and North America, while

in its Chinese home market the creation of SDLG

Financial Services offers customers improved

fi nancial services.

2013 also saw the remote telematics system

Caretrack reach a signifi cant milestone: there

are now 50,000 machines worldwide with the

monitoring system.

Acquisition of hauler business from Terex

In December Volvo CE agreed to acquire the

off-highway hauler business of the Terex Cor-

poration for a purchase consideration of approx.

SEK 1 billion on a cash and debt free basis. The

acquisition improves Volvo CE’s penetration in

the core earthmoving segment and extends its

presence in light mining. The deal, which is sub-

ject to regulatory approval, includes the main

production facility in Motherwell, Scotland and

two product ranges that offer both rigid and

articulated haulers. It also includes the distribu-

tion of haulers in the U.S. as well as a 25.2%

holding in Inner Mongolia North Hauler Joint

Stock Co (NHL), which manufactures and sells

rigid haulers under the Terex brand in China

with a market-leading position. In the fi rst nine

months of 2013 the businesses in the acquisi-

tion (excluding NHL) had net sales amounting

to approx. SEK 1.1 billion and the operating

income was approx. SEK 35 M.

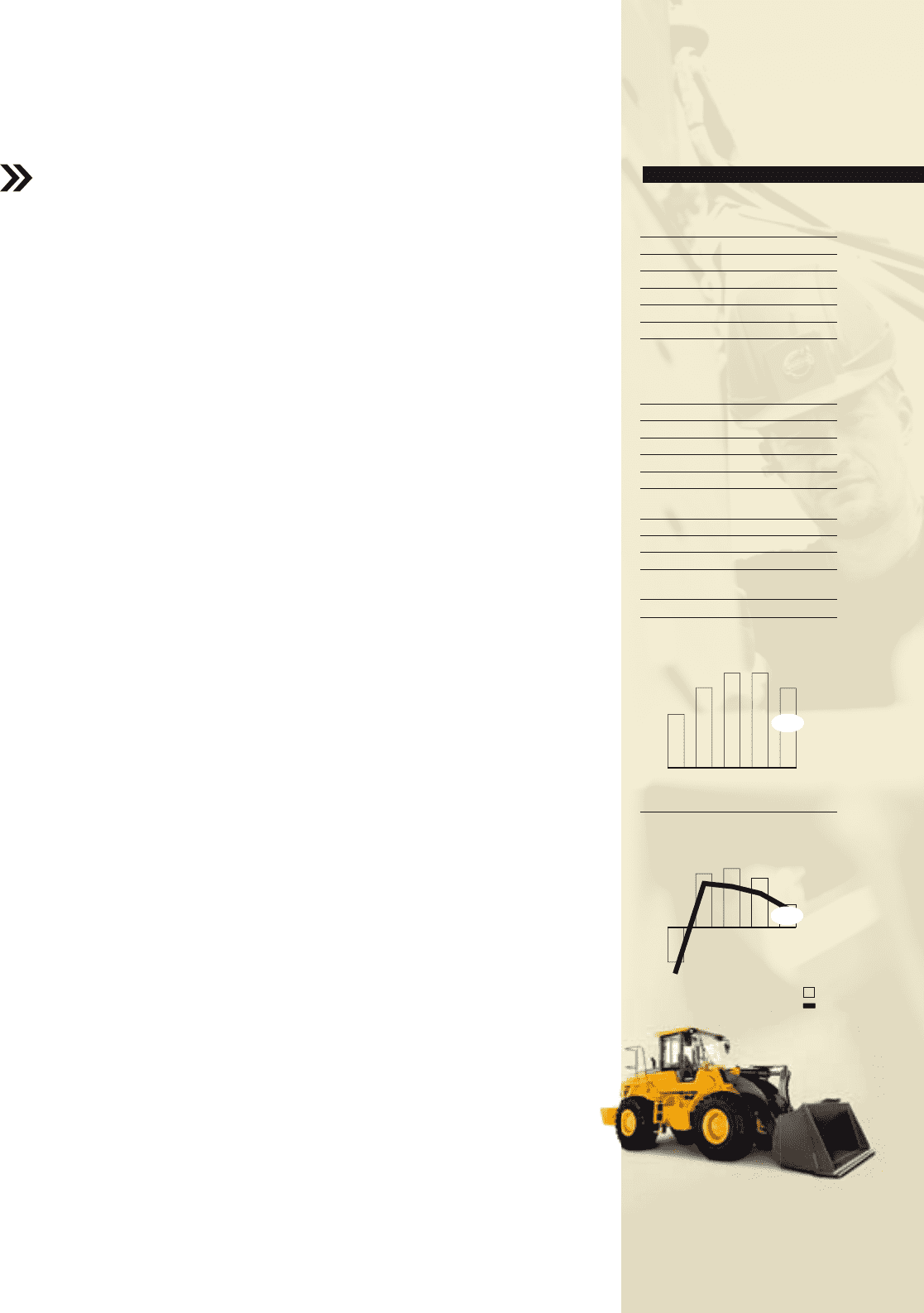

Net sales by market

SEK M 2013 2012

Europe 16,356 16,518

North America 8,319 12,027

South America 3,314 3,788

Asia 21,911 27,033

Other markets 3,539 4,193

Total 53,437 63,558

Deliveries by market

Number of

machines 2013 2012

Europe 13,522 12,545

North America 5,240 6,782

South America 3,568 3,908

Asia 44,892 49,263

Other markets 3,564 2,982

Total

deliveries 70,786 75,480

Of which

Volvo 38,155 40,331

SDLG 32,631 35,149

Of which

in China 27,559 30,780

Net sales

SEK bn

Operating income (loss)

and operating margin

SEK M

%

2,592

12

5,667

8.9

13

2,592

4.9

11

6,812

10.7

10

6,180

11.5

09

(4,005)

(11.2)

1312111009

53.4

63.6 53.463.553.835.7

loader

from

Volvo

Construction

Equip

ment, designed specifi cally to meet the

needs of customers in

C

hina and othe

r

emergi

ng

markets

.

%

8.9

4.9

10

.7

11.5

(

11.2

)

T

he L105 i

s

th

e

a mid-

s

iz

e

d wh

ee

l

loa

der

fr

om

Vol

vo

Con

str

uct

ion

Eq

uip

-

77