Volvo 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

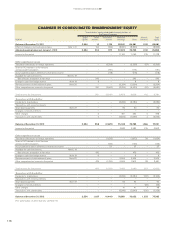

Total new fi nancing volume in 2013 amounted

to SEK 47.0 billion (46.6). Adjusted for changes in

exchange rates, new business volume in creased

by 5.9% compared to 2012. In total, 51,466 new

Volvo Group vehicles and machines (50,994)

were fi nanced during the year. In the markets

where fi nancing is offered, the average pene-

tration rate was 27% (27).

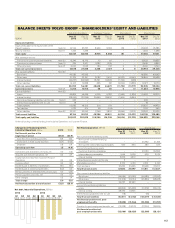

As of December 31, 2013, the net credit port-

folio amounted to SEK 103,873 M (99,690). The

funding of the credit portfolio is matched in terms

of maturity, interest rates and currencies in

accordance with Volvo Group policy. For further

information see note 4 to the Consolidated fi nan-

cial statements.

The operating income for the year amounted

to SEK 1,522 M compared to SEK 1,496 M in

the previous year. Return on shareholders’ equity

was 12.1% (12.5). The equity ratio at the end of

the year was 8.1% (8.1). Improvements in gross

income and operating expenses were partially

offset by higher provisions.

During the year, credit provision expenses

amounted to SEK 923 M (639) while write-offs

of SEK 719 M (577) were recorded. Third quar-

ter provisions and write-offs were higher than

normal due to deterioration of collateral posi-

tions and values related to non-performing loans

and leases in Spain stemming from the global

fi nancial crisis in 2009 and 2010 caused by the

continuing recession and protracted legal pro-

cesses in that country. The write-off ratio for 2013

was 0.71% (0.58). At the end of December 31,

2013, credit reserves were 1.31% (1.23) of the

credit portfolio.

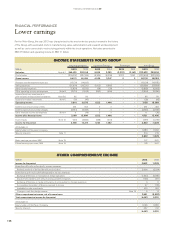

Income Statement Customer Finance, SEK M 2013 2012

Finance and lease income 9,539 9,783

Finance and lease expenses (5,534) (6,036)

Gross income 4,005 3,747

Selling and administrative expenses (1,640) (1,694)

Credit provision expenses (923) (639)

Other operating income and expenses 79 83

Operating income (loss) 1,522 1,496

Income taxes (468) (434)

Income (loss) for the period 1,054 1,062

Return on Equity, % 12.1 12.5

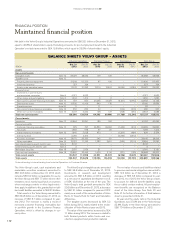

Key ratios, Customer Finance1 2013 2012

Credit portfolio net, SEK M 103,873 99,690

Operating income, SEK M 1,522 1,496

Return on shareholders’ equity, % 12.1 12.5

Total penetration rate, % 27 27

Penetration by business area1, %

Volvo CE 36 37

Volvo Trucks 30 30

Renault Trucks 21 23

MackTrucks 21 19

Buses 16 21

UD Trucks 12 13

1 Share of unit sales fi nanced by Volvo Financial Services in relation to the total num-

ber units sold by the Volvo Group in markets where fi nancial services are offered.

Customer Finance Operations

111111