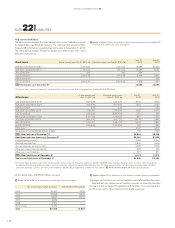

Volvo 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

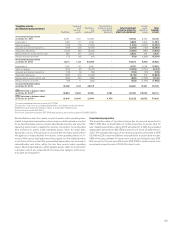

Current receivables Dec 31,

2013 Dec 31,

2012

Other interest-bearing fi nancial receivables 909 2,574

Accounts receivable 29,415 26,516

Prepaid expenses and accrued income 2,356 2,362

VAT receivables 3,033 3,506

Other fi nancial receivables 1,411 1,220

Other receivables 5,854 5,202

Current receivables, after deduction of

valuation allowances for doubtful accounts

receivable142,978 41,380

1 Of current receivables, 31,497 (31,143) pertains to fi nancial instruments.

Credit risks in accounts receivable

Change of valuation allowance

for doubtful accounts receivable Dec 31,

2013 Dec 31,

2012

Valuation allowance for doubtful accounts

receivables as of December 31, preceding year 665 720

New valuation allowance charged to income 291 220

Reversal of valuation allowance charged

to income (159) (147)

Utilization of valuation allowance related

to actual losses (114) (89)

Acquired and divested operations (16) 8

Translation differences (19) (39)

Reclassifi cations, etc. (42) (8)

Valuation allowance for doubtful accounts

receivables as of December 31 606 665

Refer to Note 4 for more information regarding the Volvo Group’s fi nancial

risks.

Refer to Note 15 for more information regarding credit risk in customer

fi n a n c i n g r e c e i v a b l e s .

Refer to Note 30 for information regarding goals and policies for fi nancial

instruments.

Age analysis of portfolio value

– Accounts receivable

Dec 31, 2013 Dec 31, 2012

Not Due 1–30 31–90 >90 Total Not Due 1–30 31–90 >90 Total

Accounts receivable gross 27,056 1,293 593 1,079 30,020 24,579 1,208 510 884 27,181

Provision for doubtful accounts receivable (90) (18) (25) (473) (606) (156) (3) (25) (481) (665)

Accounts receivable net 26,966 1,275 568 606 29,415 24,423 1,205 485 403 26,516

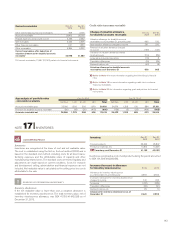

Inventories

Inventories are recognized at the lower of cost and net realizable value.

The cost is established using the fi rst-in, fi rst-out method (FIFO) and is

based on the standard cost method, including costs for all direct manu-

facturing expenses and the attributable share of capacity and other

manu facturing-related costs. The standard costs are tested regularly and

adjustments are made based on current conditions. Costs for research

and development, selling, administration and fi nancial expenses are not

in cluded. Net realizable value is calculated as the selling price less costs

attributable to the sale.

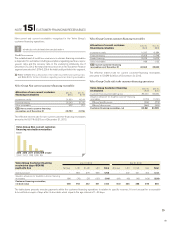

Inventory Dec 31,

2013 Dec 31,

2012

Finished products 26,339 25,847

Production materials, etc . 14, 814 14,246

B/S Inventory as of December 31 41,153 40,093

Inventories recognized as cost of sold products during the period amounted

to SEK 191,509 M (208,958).

Increase (decrease) in allowance

for inventory obsolescence 2013 2012

Allowance for inventory obsolescence

as of December 31, preceding year 2,593 2,604

Increase in allowance for inventory obsolescence

charged to income 510 456

Scrapping (452) (389)

Translation differences (39) (91)

Reclassifi cations, etc. 29 13

Allowance for inventory obsolescence as of

December 31 2,641 2,593

ACCOUNTING POLICY

Inventory obsolescence

If the net realizable value is lower than cost, a valuation allowance is

established for inventory obsolescence. The total inventory value, net of

inventory obsolescence allowance, was SEK 41,153 M (40,093) as of

December 31, 2013.

SOURCES OF ESTIMATION UNCERTAINTY

!

NOTE 17 INVENTORIES

143