Volvo 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Closely linked to the GDP development

The Volvo Group is one part of the transport

industry that connects production with con-

sumption. We are what you might call the circu-

latory system. Demand for transport capacity

and thus for many of the Group’s products is

closely linked to the GDP trend.

The extent of investment in infrastructure,

which drives demand for building and construc-

tion equipment, is also closely linked to the

GDP trend. Increased global wealth means that

there is a long-term need to build roads, airports,

railways, factories, offi ces, shopping centers, as

well as housing and recreational facilities. The

registrations of new trucks on a particular mar-

ket often follows the same pattern as economic

growth in the region.

– The transport industry is largely in tune with

the overall economic development, but demand

for our products is also to a large extent deter-

mined by expectations about the future busi-

ness conditions, says Johan Adler, Head of Eco-

nomic Research in the Volvo Group.

Short-term factors affecting demand

In the short term, demand is affected by a number

of factors including fuel prices, interest rates, the

implementation of new emission regulations, etc.

New emission standards have traditionally re -

sulted in more expensive, more technically com-

plex trucks. This has often generated an ad vance

purchasing effect, a pre-buy, as haulage compa-

nies have taken the opportunity to update their

fl eets just before the new regulations come into

force. At the same time, new regulations have

positive effects on the environment.

For instance, the EU moved to the Euro 6

emission standard at year-end 2013. The new

standard entails signifi cant cuts in emissions of

nitrogen oxides and particulates, which is good

for the environment. In order to reach these

cuts, more advanced and thus more expensive

engine technology is needed. During the

autumn of 2013 there was an increase in

demand for Euro 5 trucks as some customers

chose to invest in these trucks ahead of the

new emission standards.

Markets move at different paces

The transportation industry is directly linked to

economic developments, but the global econo-

mies do not move at the same pace. Countries

that are heavily dependent on exports, such as

Sweden and Germany, are more affected when

consumers in other countries tighten their belts.

Countries like the USA and Brazil are also

impacted by a slowdown, but to a lesser degree,

as they have such large domestic markets and

a relatively small part of what they produce is

exported.

– The fact that the Volvo Group is global is an

enormous advantage. If we had not been estab-

lished on the growth markets, we wouldn’t have

been in the position we currently enjoy, says

Johan Adler.

Growth rates in different parts of the world

According to Consensus Economics, global GDP

grew by 2.4% in 2013 compared with 2.6% in

2012. GDP in the EU was fl at following a decline

of 0.4% in 2012. U.S. GDP increased by 1.9%

(2.8%). Japan’s GDP expanded by 1.7% (1.4%).

Growth in countries such as Brazil, India and

China continued to be relatively subdued in

2013. For 2014, global GDP is expected to grow

by 3.1%. The expected acceleration in global

GDP growth in 2014 is largely driven by the

improvements in the U.S. and Europe.

The transportation industry is cyclical with swings up and down in the short term. Add new emission

standards, political decisions and expectations about future business conditions, all of which impact

customers’ decisions to purchase now or wait until later. However, in the longer term, the industry’s

growth is closely linked to an increasing need for transportation as economies grow.

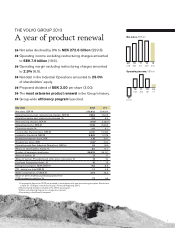

We are active in industries with long-term growth

Economic growth in the U.S.,

Europe and Brazil

Annual GDP-growth, %

0

Source: Consensus Economics

EU

Brazil

12

1.6

2.7

1.8

13

(0.4)

1.0

2.8

(0.0)

2.4

1.9 The U.S.

11

2.1

7.5

2.5

10

(4.5)

(0.3)

(2.8)

09

Economic growth in Asia

Annual GDP-growth, %

Asia/

Pacific*

India

Japan

* China, Hong Kong, South Korea, Taiwan,

Indonesia, Malaysia, Singapore, Thailand,

Phillippines, Vietnam, Australia, New

Zealand, India, Japan, Sri Lanka

Source: Consensus Economics

12

4.9

6.2

1.4

9.3

13

4.6

5.0

7.7

1.7

4.6

4.7

7.7 China

11

7.7

9.3

(0.4)

10.4

10

2.9

8.6

4.7

9.2

09

(5.5)

0

GDP growth (left axis)

New heavy-duty trucks registration growth (right axis)

(6)

(5)

(4)

(3)

(2)

(1)

0

1

2

3

4

5

6

%%

(60)

(50)

(40)

(30)

(20)

(10)

0

10

20

30

40

50

60

1210 1106 07 08 0905 13

The Volvo business moves in close tandem

with macroeconomic development

Euro area GDP and heavy-duty trucks registration growth

7