Volvo 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

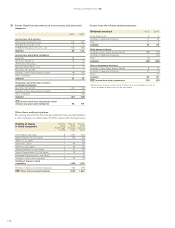

Divestments

In May 2013 the consultancy company DRD, wholly-owned by UD Trucks

with product development operations and approximately 500 employees,

was divested. The divestment resulted in a capital gain of SEK 99 M in the

second quarter 2013.

In September 2013, the Volvo CE Central European distribution network

operations was divested. The divestment resulted in a capital gain of SEK92

in the third quarter 2013.

The divestment of Volvo Aero was fi nalized during 2013.

In addition to that the Volvo Group has not made any other divestments

during 2013, which solely or jointly have had a signifi cant impact on the

Volvo Group’s fi nancial statements.

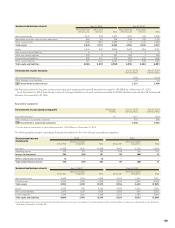

The impact on the Volvo Group’s balance sheet and cash-fl ow statement

in connection with the divestment of subsidiaries and other business units

are specifi ed in the following table.

Divestments 2013 2012

Intangible assets – (3,220)

Property, plant and equipment (140) (1,786)

Assets under operating lease (162) (244)

Shares and participations – (17)

Inventories (127) (2,505)

Other receivables (914) (1,395)

Cash and cash equivalents (87) (323)

Other provisions 36 1,108

Other liabilities 472 3,385

Divested net assets (922) (4,997)

Goodwill (27) (300)

Total (949) (5,297)

Additional purchase price – 653

Cash and cash equivalents received 1,090 5,240

Cash and cash equivalents,

divested companies (87) (323)

Effect on Group cash

and cash equivalents 1,003 4,917

Effect on Group net

fi nancial position 537 5,594

Assets and liabilities held for sale

As of December 31, 2013, the Volvo Group recognized assets amounting to

SEK 8,104 M and liabilities amounting to SEK 350 M as assets and liabil-

ities held for sale. This referred mainly to the divestment of Volvo Rents in

North America. Volvo Rents offers rental of comprehensive range of m a-

chines intended for the construction and engineering industry, including

Volvo CE products. Volvo Rents has operations in the US, Canada and

Puerto Rico and has about 2,100 employees. As part of its strategic effort

to focus on the core business, the Volvo Group has agreed to divest Volvo

Rents. Per December 31, 2013, Volvo Rents were classifi ed as assets held

for sale and valued at fair value, a revaluation was therefore recognized

within Other operating income and expense amounting to SEK 1.5 billion.

The fair value is based on the purchase price stated in the sale and pur-

chase agreement signed between the buyer and the seller, the purchase

price is considered as a level 1 in accordance with the fair value hierarcy in

IFRS13. Translation differences on foreign operations of 13 was included

in other comprehensive income.

There was also real estate amounting to SEK 1,014 M classifi ed as assets

held for sale at year end 2013. For the comparison year 2012, there were

no assets or liabilities classifi ed as held for sale.

Assets and liabilities held for sale Dec 31,

2013 Dec 31,

2012

Intangible assets – –

Tangible assets 7,185 –

Inventories 221 –

Accounts receivable – –

Other current receivables 684 –

Other assets 14 –

B/S Total assets 8,104 –

Trade payables 76 –

Provisions 127

Other current liabilities 137 –

Other liabilities 10

B/S Total liabilities 350 –

Acquisitions and divestments after the end of the period

Volvo Rents in North America was divested per January 31, 2014. The Volvo

Group has not made any other signifi cant acquisitions or divestments

after the end of the period that have had any signifi cant impact on the

Volvo Group.

121121