Volvo 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo strong in improved truck market

The South American market for heavy-

duty trucks increased to 151,500 trucks in

2013 compared with 145,500 the year before.

Brazil is the largest market by far in South

America and accounted for 69% of the total

market in the region. In 2013, the total Brazilian

market for heavy-duty trucks rose by 19% to

103,800 trucks compared with 87,400 trucks

in 2012, positively impacted by the slightly

improved trend in the Brazilian economy, a

good crop season and support from a favorable

government fi nancing for purchases of trucks,

known as the Finame program.

Increased market shares in Brazil

Volvo’s success in the Brazilian market contin-

ued in 2013. In the segment for trucks above 16

tons, the market share in Brazil rose to 20.0%

compared with 18.2% in 2012 and 17.1% in 2011.

Volvo has gained market share continuously in

recent years. In 2010 the market share was

15.0% and in 2009 it was 13.3%.

Volvo has also strengthened its position in the

medium heavy-duty segment in recent years,

due to the success of the Volvo VM, and had a

market share of 12.0% in 2013. The new Volvo

VM line for Latin American was introduced in

August 2013 at an event in Trancoso in the

Northeast of Brazil. The offering was further

enhanced with a new cab exterior, several new

models and the I-Shift automated gearbox.

Greater interest in electromobility

The South American bus market improved dur-

ing the year. In Brazil, the market was positively

affected by Finame and procurement for the

World Cup. Interest in Bus Rapid Transit solu-

tions remains high in the region. Volvo Buses

sold 190 buses to San Salvador. The buses will

operate in the city’s BRT system.

The total heavy bus market in Brazil amounted

to 4,200 buses (4,400). With a market share of

19% (25), Volvo Buses is the third largest bus

brand in heavy buses in Brazil. In all of South

America, Volvo Buses deliveries decreased by

5% to 2,434 vehicles (2,560).

There is a clear trend towards electromobility

in South America, with interest in hybrid and

electric vehicles. Volvo Buses secured a break-

through order in the region for 200 hybrid buses

for Bogotá in Colombia. The buses will form part

of the city’s Bus Rapid Transit system, TransMilê-

nio. It was also signifi cant that the order com-

prised a total solution that includes complete vehi-

cle maintenance and the access to hybrid battery

capacity at a fi xed monthly cost.

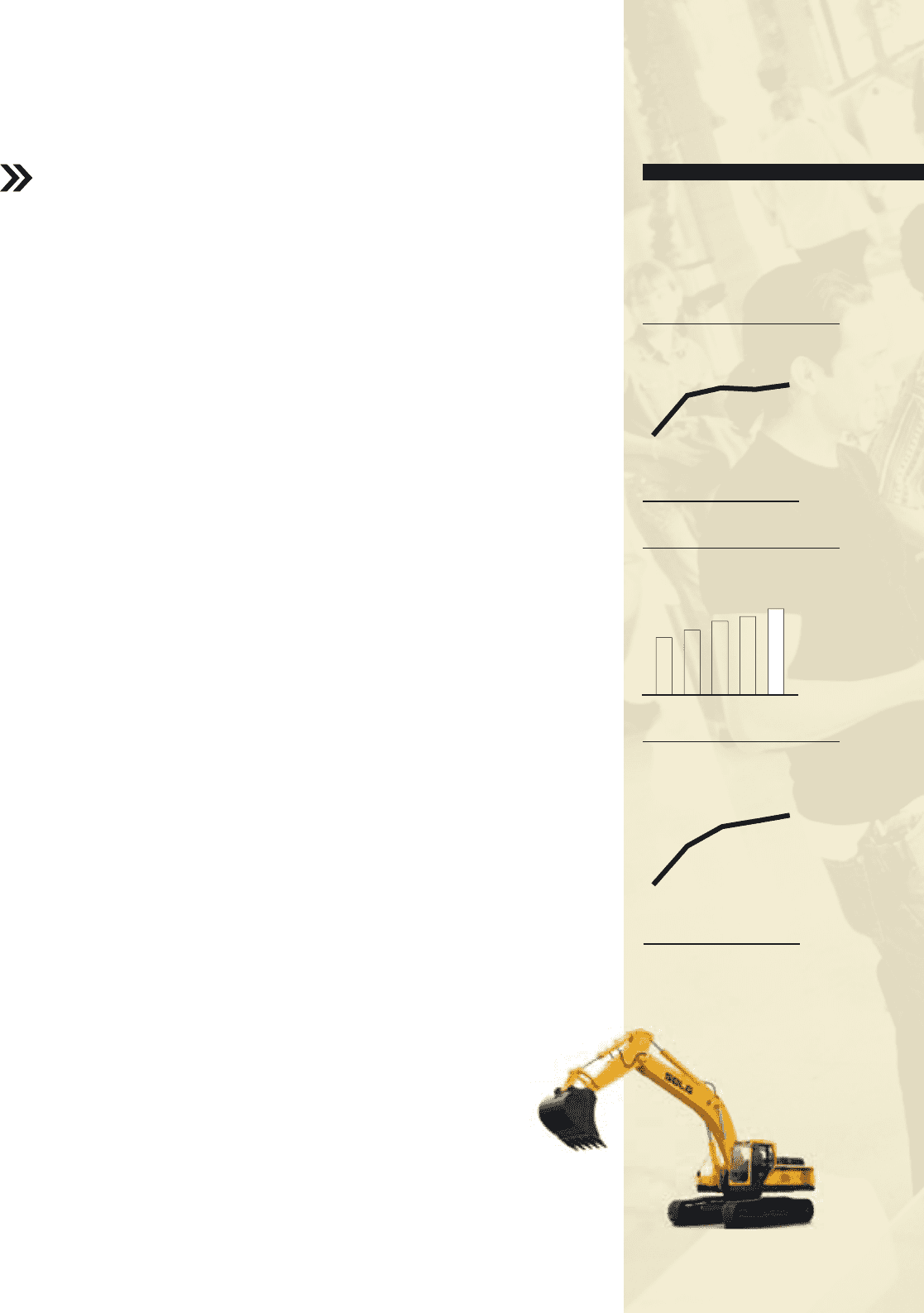

Volvo CE expands production in Brazil

Following the two good years in 2011 and 2012,

the trend in the construction equipment market

continued to be good in 2013. In total, the market

increased by 4% in 2013 compared with 2012.

However, Volvo CE’s deliveries in South

America declined by 9% to 3,568 machines in

2013, one of the reasons for which was the

weaker demand from the mining industry.

Manufacturing of SDLG excavators began in

August in a new plant at Volvo CE’s facility in

Pederneiras, Brazil. Four crawler excavators be -

tween 13.8 and 24.3 tons will initially be manufac-

tured. SDLG excavators have been sold in Brazil

for more than four years and during this period

the company has established itself as one of the

leading suppliers in the value segment.

During the year Volvo CE also decided to

consolidate its production capacity in the

Americas by relocating the manufacturing of

Volvo- branded backhoe loaders from Tultitlan,

Mexico to Pederneiras, Brazil. The fi rst backhoe

loader manufactured at the facility in Peder-

neiras left the plant at the end of October.

Volvo Group in South America

• Net sales: SEK 29,758 M (29,164)

• Share of net sales: 11% (10)

• Number of employees: 6,275 (5,977)

• Share of Group employees: 6% (6)

• Largest markets: Brazil, Peru, Chile

and Argentina.

Market development, heavy-duty

trucks, South America, Thousands

Market shares, heavy-duty trucks,

Brazil, %

Volvo Construction Equipment

has its South American production

located in Pederneiras in the

state of São Paulo, Brazil.

Market development, construction

equipment, South America,

Thousands

1312111009

15214614813986

1312111009

4644423521

13

18.2 20.0

12

17.1

11

15.0

10

13.3

09

Volvo Constr

uct

ion

Eq

uip

has its South America

n p

n

r

loc

ate

d i

n P

ede

rne

e

e

ira

i

sta

s

te

e

of

o

São Paulo,

59