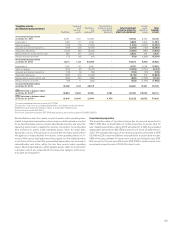

Volvo 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

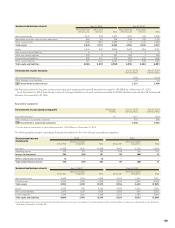

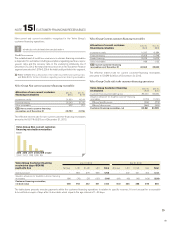

Intangible assets, acquisition costs Entrance fees,

industrial programs

Capitalized product

and software

development Other intangible

assets2Total intangible

assets Goodwill1

Acquisition cost as of Dec 31, 2011 22,588 224 29,737 6,148 58,697

Capital expenditures3–935,385225,500

Sales/scrapping – (14) (1,738) (11) (1,763)

Acquired and divested operations 588 (3,182) (2,109) 52 (4,651)

Translation differences (1,380) (11) (1,465) (550) (3,406)

Reclassifi ed to assets held for sale 297 3,198 1,958 60 5,513

Reclassifi cations and others – (19) (23) (80) (122)

Acquisition cost as of Dec 31, 2012 22,093 289 31,745 5,641 59,768

Capital expenditures3–1543,750513,955

Sales/scrapping – – (5) (18) (23)

Acquired and divested operations 21 – (3) (3) 15

Translation differences (734) 24 (790) (426) (1,926)

Reclassifi edfrom assets held for sale – – – – –

Reclassifi cations and other 32 48 (162) (132) (214)

Acquisition cost as of Dec 31, 2013 21,412 515 34,535 5,113 61,575

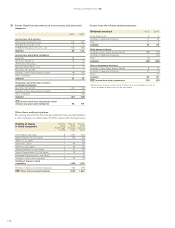

Accumulated amortization

and impairment Entrance fees,

industrial programs

Capitalized product

and software

development Other intangible

assets2Total intangible

assets Goodwill1

Accumulated amortization and impairment

as of Dec 31, 2011 – 33 18,331 2,555 20,919

Amortization and impairment5–552,7273523,134

Sales/scrapping – – (1,734) (11) (1,745)

Acquired and divested operations – (1,633) (547) (29) (2,209)

Translation differences – (1) (936) (173) (1,110)

Reclassifi ed to assets held for sale – 1,602 572 24 2,198

Reclassifi cations and other – (6) (38) (73) (117)

Accumulated amortization and impairment

as of Dec 31, 2012 – 50 18,375 2,645 21,070

Amortization and impairment5–183,2822973,597

Revaluation 1,458 – – – 1,458

Sales/scrapping – – (5) (11) (16)

Acquired and divested operations – – (3) (3) (6)

Translation differences – 4 (685) (118) (799)

Reclassifi edfrom assets held for sale – – – – –

Reclassifi cations and other – 48 (210) (155) (317)

Accumulated amortization and impairment

as of Dec 31, 2013 1,458 120 20,754 2,655 24,987

B/S Net value in balance sheet

as of December 31, 2012422,093 239 13,370 2,996 38,698

B/S Net value in balance sheet

as of December 31, 2013419,954 395 13,781 2,458 36,588

1 Includes on the date of IFRS adoption, costs of 14,184 and accumulated amortization of 3,863.

2 Other intangible assets mainly consist of trademarks and distribution networks.

3 Includes capitalized borrowing costs of 35 (295).

4 Costs less accumulated, amortization and impairments.

5 Of which impairments 4 (83).

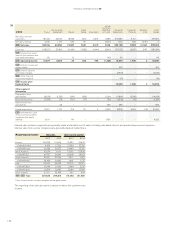

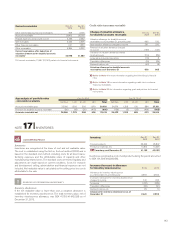

Goodwill per Business Area Dec 31,

2013 Dec 31,

2012

Trucks 10,915 11,620

Construction Equipment 7,536 7,462

Buses 996 1,039

Volvo Rents – 1,469

Other business areas 507 503

Total goodwill value 19,954 22,093

137