Volvo 2013 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

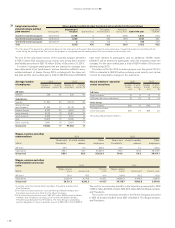

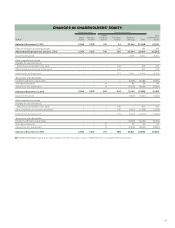

Income statement

full year, 2012 Volvo Group

SEK M

Previously

reported

2012

Restatement

joint ventures

After joint

venture

restatement

Restatement

post-

employment

benefi ts

After post-

employment

benefi t

restatement

Restatement

hedging of

fi r m fl o w s

After

restatements

Net sales 303,647 (3,833) 299,814 – 299,814 – 299,814

Cost of sales (235,085) 3,281 (231,804) 412 (231,392) (223) (231,615)

Gross income 68,562 (552) 68,010 412 68,422 (223) 68,199

Research and development expenses (14,794) 81 (14,713) 78 (14,635) – (14,635)

Selling expenses (28,248) 180 (28,068) 174 (27,894) – (27,894)

Administrative expenses (5,669) 88 (5,581) 18 (5,563) – (5,563)

Other operating income and expenses (2,160) 60 (2,100) 4 (2,096) – (2,096)

Income from investments in Joint

Venturesand associated companies (23) 122 99 – 99 – 99

Income from other investments (47) 5 (42) – (42) – (42)

Operating income 17,622 (17) 17,604 686 18,290 (223) 18,067

Interest income and similar credits 510 (57) 453 – 453 – 453

Interest expenses and similar charges (2,476) 20 (2,456) (493) (2,949) – (2,949)

Other fi nancial income and expenses (301) 0 (301) – (301) 223 (78)

Income after fi nancial items 15,355 (54) 15,301 193 15,494 0 15,494

Income taxes (4,097) 45 (4,052) (64) (4,116) – (4,116)

Income for the period 11,258 (9) 11,249 129 11,378 0 11,378

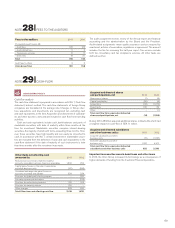

Consolidated other

comprehensive income

Income for the period 11,258 (9) 11,249 129 11,378 0 11,378

Exchange differences on translation

of foreign operations (3,916) 208 (3,708) 313 (3,395) – (3,395)

Share of OCI related to Joint Ventures and

associated companies – (191) (191) – (191) – (191)

Exchange differences on hedge

instruments of net investment

in foreign operations 0–0–0–0

Accumulated translation difference reversed

to income (118) – (118) – (118) – (118)

Available for sale investments (4)347343 –343 –343

Cash fl ow hedges 8–8–8–8

Remeasurements of defi ned benefi t plan – – – (2,234) (2,234) – (2,234)

Other comprehensive income,

net of income taxes (4,030) 364 (3,666) (1,921) (5,587) 0 (5,587)

Total comprehensive income

for the period 7,228 355 7,583 (1,792) 5,791 0 5,791

Attributable to

Equity holders of the parent company 7,092–––––5,655

Minority interests 136–––––136

7,228 – – – – – 5,791

167