Volvo 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

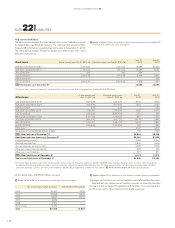

Transactions between AB Volvo and its subsidiaries, which are related par-

ties to AB Volvo, have been eliminated in the group and are not disclosed

in this note.

The Volvo Group engages in transactions with some of its associated

companies. The transactions consist mainly of sales of vehicles to dealers

and purchases of engines.

2013 2012

Sales to associated companies 2,138 1,670

Purchase from associated companies 2,609 702

Receivables from associated companies,

Dec 31 301 242

Liabilities to associated companies,

Dec 31 707 632

The increase in sales to associated companies is mainly explained by Ara-

bian Vehicle & Truck Industry Ltd. The increase in purchases is explained by

Deutz AG, which is an associated company from September 2012. Com-

mercial terms and market prices apply for the supply of goods and services

to/from associated companies.

The Volvo Group engages in transactions with its joint ventures. The trans-

actions consist mainly of sales of vehicles and parts and purchase of engine

long blocks and services. Commercial terms and market prices apply for

the supply of goods and services to/from joint ventures.

2013 2012

Sales to joint ventures 763 741

Purchase from joint ventures 192 80

Receivables from joint ventures, Dec 31 143 91

Liabilities to joint ventures, Dec 31 58 108

The increase in purchases from joint ventures is explained by purchases

of engine long blocks from VE Commercial Vehicles, Ltd.

Until December 2012 Renault s.a.s was a related party to the Volvo Group

due to its holding in AB Volvo. In December 2012 Renault s.a.s sold their

Volvo shares. Sales to and purchases from Renault s.a.s. and its subsidiar-

ies for the comparison year 2012 amounted to 29 and 1,719. Sales were

mainly from Renault Trucks to Renault s.a.s. and consisted of components

and spare parts. Purchases were mainly made by Renault Trucks from

Renault s.a.s. and primarily consisted of light trucks. Renault Trucks has a

license from Renault s.a.s. for the use of the trademark Renault.

During 2012, AB Volvo divested an apartment to a former member of the

Group management for a market value of 10.

Refer to Note 5 regarding the Volvo Group’s share in associated companies.

NOTE 25 TRANSACTIONS WITH RELATED PARTIES

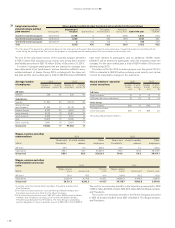

Government grants are fi nancial grants from governmental or suprana-

tional bodies received by the Volvo Group in exchange for fulfi llment of

certain conditions.

Governmental grants related to assets are presented in the balance sheet

by deducting the grants in arriving at the carrying amount of the asset.

Governmental grants related to income are reported as a deferred income

and recognized in the income statement over the periods necessary to

match the related costs. If the costs incur before the grants have been

received, but there is an agreement that grants will be received, grants are

recognized in the income statement to compensate the relevant costs.

In 2013, government grants of 400 (492) were received, and 467 (342) was

recognized in the income statement. The amount includes tax credits of

245 (165) related to product development, which were primarily received in

France and in the United States. Other grants were mainly received from

Swedish, Chinese and US governmental organizations and from the Euro-

pean Commission.

NOTE 26 GOVERNMENT GRANTS

ACCOUNTING POLICY

155