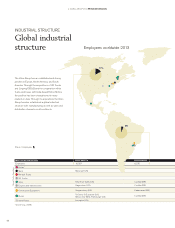

Volvo 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Varying market conditions. In 2013,

the heavy-duty truck market in Europe

30 (EU’s 28 Member States plus Norway and

Switzerland) increased to 240,200 heavy-duty

trucks compared with 221,800 in the preceding

year, with a positive impact from a number of

customers, primarily in the second half of the

year, choosing to prebuy new trucks before the

transition to the new Euro 6 emission regula-

tions. These new regulations entail considera-

ble reductions in nitrogen oxide and particulate

emissions, as well as a price increase by truck

manufacturers to offset the more advanced

technology required.

The European market for construction equip-

ment, measured in number of machines sold, de -

clined by 4% in 2013 compared with the preced-

ing year. The market showed signs of stabilizing

at low levels in the autumn.

The European bus market in 2013 was at the

same low level as in 2012, with continuous price

pressure as a result.

The market for leisure boat engines remained

very weak while the performance of industrial

en gines was better, for example, due to higher

demand for diesel-powered gensets in Western

Europe.

Decreased market shares in

heavy-duty trucks

The performance of the Group’s truck opera-

tions was split in terms of market shares in

2013. Volvo strengthened its shares, boosted

by the strength of its new products that were

available with both Euro 5 and Euro 6 engines.

Volvo held a market share of 16.3% (15.6) in the

heavy-duty segment. Renault Trucks’ market

shares in heavy-duty trucks declined to 8.0%

(10.1), one of the reasons for which was the

transition to the new trucks, which were only

available for customers to test at the end of the

year. The Group’s total market share in heavy-

duty trucks amounted to 24.3% (25.7).

New trucks and new engines

Starting with the Volvo FH in autumn 2012,

theVolvo Group’s truck operations underwent an

ex tensive process of product renewal in 2013,

with the launch of brand-new Volvo FM, Volvo

FMX, Volvo FL and Volvo FE. In May, Volvo intro-

duced new trucks with a Euro 6 engine program

ranging from the smallest medium-duty 5-liter

engine to the heavy-duty 13-liter version. In June,

Renault Trucks presented a new, comprehen-

sive truck program comprising its T, K, C and D

series for long-distance haulage, construction

and distribution.

In the autumn production was more and more

switched over to the new trucks at the same time

as the European system gradually changed to

Euro 6 engines, primarily for Volvo Trucks. This

led to greater complexity and higher costs for

production since both the old and new genera-

tions of trucks were manufactured in parallel.

The launch of the new products also entailed

higher costs.

Restructuring of the truck operations

On January 1, 2013, the Volvo Group introduced

a new organization for its sales and marketing

of trucks in Europe, the Middle East and Africa

(EMEA). The reorganization aims to capitalize

more effectively on opportunities for the Group’s

brands and products and to lower costs. The

reorganization also entails an optimization of

the dealer and service networks in Eastern and

Central Europe was carried out, with the aim to

considerably increase the service availability,

primarily for Renault Trucks. The number of ser-

vice points is expected to increase by 30–40%

for Renault Trucks and by 10% for Volvo in this

part of Europe.

In October, a strategic decision was made to

implement changes in the European truck

manufacturing operations in order to increase

effi ciency and strengthen competitiveness. The

goals are to gradually, over the next two years,

relocate the cab trim operations from Umeå

to Gothenburg, Sweden, to concentrate the

manufacturing of heavy-duty trucks to one

assembly line in Gothenburg and to concen-

trate the assembly of medium-duty trucks to

Blainville, France.

Upgrade of bus program

During the year, Volvo Buses’ entire product

program underwent a major upgrade. The most

signifi cant change was the three brand-new

Euro 6 engines. The model program was also

strengthened with a new hybrid articulated bus

with fuel consumption that is up to 30% lower

than current diesel models. Volvo Buses also

started fi eld tests with its fi rst plug-in hybrids in

Gothenburg in May. The technology means that

energy consumption can be reduced by a full

60% compared with current diesel buses.

New engines from Volvo CE and

Volvo Penta

During the year, Volvo CE introduced engines

that meet the new emission requirements in

both North America and Europe, Tier 4 Final/

Stage IV. The engines improve fuel economy by

up to 5% compared with earlier models and

reduce total running costs.

Also Volvo Penta has upgraded its industrial

engines, and a full series from 5 liter up to 16

liter with Tier 4 Final/Stage IV technology will

be offered from 2014.

Volvo CE opened an excavator

plant in Russia

As the second largest market in Europe, Russia

is one of Volvo CE’s core regions for long-term

growth. In May, Volvo CE opened a 20,660

square meter excavator plant in Kaluga in Rus-

sia. The plant represents a SEK 350 M invest-

ment and has been developed using technology

to reduce carbon emissions. It is the Volvo CE’s

fi rst plant in Russia.

Volvo Group in Europe

• Net sales: SEK 105,320 M (111,606)

• Share of net sales: 39% (37)

• Number of employees: 52,334 (53,434)

• Share of Group employees: 55% (56)

• Largest markets: France, the UK,

Sweden and Germany.

1312111009

240222242179165

Market development, heavy-duty

trucks, Europe, Thousands

13121312

8.010.116.315.6

Volvo Renault Trucks

Market shares in Europe,

heavy-duty trucks, %

1312111009

1181221259476

Market development, construction

equipment, Europe, Thousands

Volvo Penta is a world-leading supplier

of engines and complete power systems

for marine and industrial applications.

Vol

vo

Pen

ta

is

aw

orl

d-l

ead

ing

su

ppl

ie

53