Volvo 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

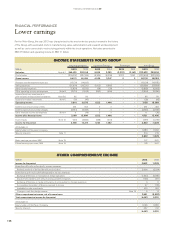

The cash fl ow within Industrial Operations was

positively affected by the operating income and

negatively affected by the increased working

capital. Accounts receivables increased with SEK

4.8billion, inventories increased SEK3.2billion

and the trade payables increased SEK7.9 billion.

Financial items and paid income taxes had a

SEK 4.9 billion negative effect on cash fl ow

within Industrial Operations, mainly through

payments of interests and income tax.

Operating cash fl ow within Customer Finance

was a negative SEK 7.6 billion (neg: SEK

14.8 billion), mainly due to increased customer

fi nancing-receivables.

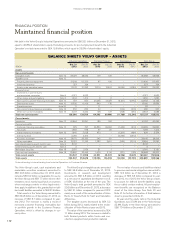

Investments

The industrial operations’ investments in fi xed

assets and capitalized R&D during 2013 amount-

ed to SEK 12.2 billion (14.6).

Capital expenditures in Trucks amounted to

SEK 8.4 billion (10.7). Capital expenditures

within Trucks have also this year to a large

extent been driven by investments relating to

the extensive product renewal with the com-

pletely new Renault Trucks range, new Volvo

trucks, new heavy-duty trucks for growth mar-

kets, UD Quester, and a new Volvo VM in Brazil.

Also Euro 6 emission regulations, and product

related investments in production have had a

large impact. There are also larger investments

in the Kaluga-plant in Russia. During 2013 the

Volvo Group continued to invest in the dealer

network and workshops, mainly in Europe and

Asia (mainly Japan), but also in Latin America.

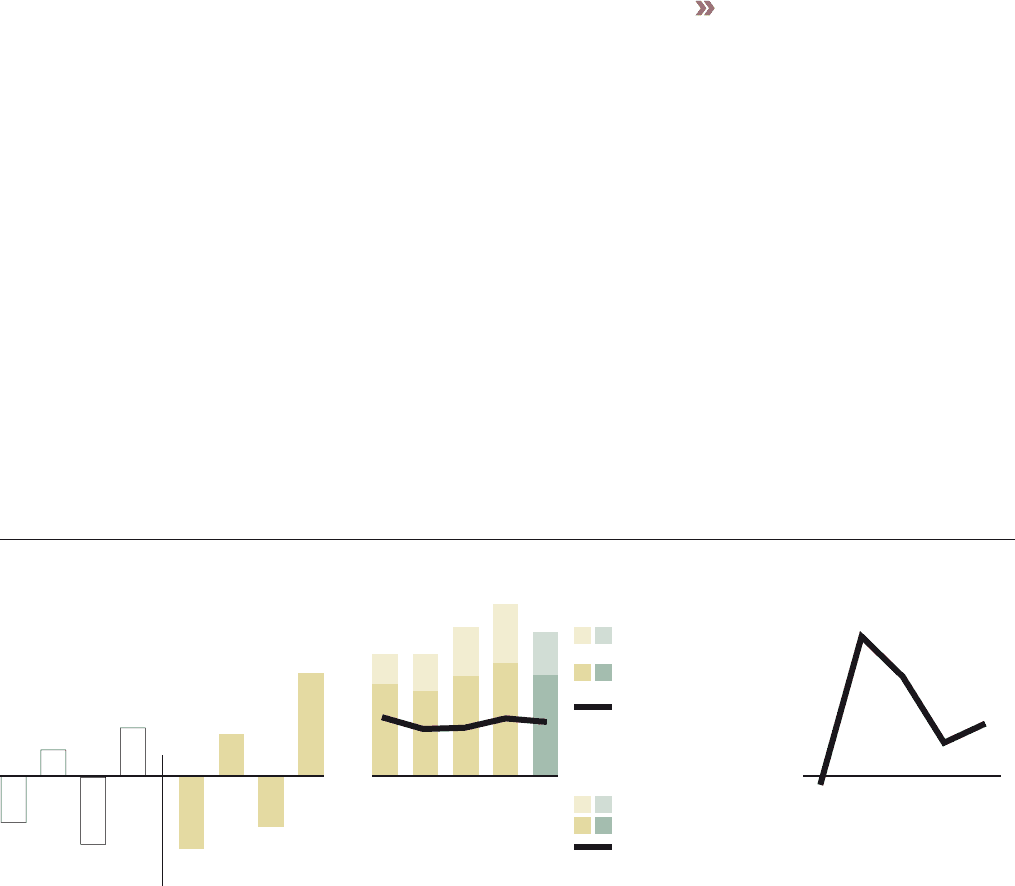

Capital expenditures, Industrial Operations

12111009

Capital expenditures,

% of net sales

13

4.0

7.1

5.0

7.7

4.1

8.5

4.9

9.5

4.6

8.5

Property, plant and

equipment, SEK bn

Capitalized development

costs, SEK bn

3.2

2.6 4.1 5.1 3.7

Self-fi nancing ratio,

Industrial Operations %

Cash-flow from operating activities

divided by net investments in fixed

assets and leasing assets.

12111009

72

13

112210294(16)

Operating cash fl ow,

Industrial Operations, SEK bn

20132012

Q4

10.3

Q3

(5.3)

Q2

4.1

Q1

(7.6)

Q4

4.7

Q3

(7.2)

Q2

2.5

Q1

(4.9)

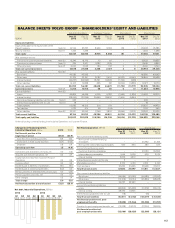

Capital expenditures for Construction Equip-

ment amounted to SEK 2.3 billion (1.7). The

major investments during 2013 related to the

new excavator plant in Kaluga, Russia; continu-

ation of the investment program in the North

American hub in Shippensburg, where the new

sales offi ce has been inaugurated as well as

start-up of wheel loader production. The Jinan

Technology center in China has been fi nalized

during the year. The product related invest-

ments during the year refer mainly to the latest

emission regulations in Europe and North

America.

The investments in Buses were SEK 0.4

billion (0.3), and in Penta SEK 0.3 billion (0.2).

Investments in Volvo Rents were considera-

bly lower during 2013 than previous year. Dur-

ing 2012 the rental fl eet was renewed and

expanded, affecting both investments in leas-

ing assets and other assets. Total investments

in leasing assets for Industrial operations

during 2013 amounted to SEK 1.5 billion (3.6).

During 2014, investments in property, plant

and equipment are expected to be on the same

level as in 2013. The investments will mainly

cover optimization of the industrial footprint,

dealer investments and product related tooling;

with a large share related to the Volvo Group

strategic objectives.

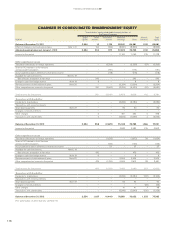

Acquisitions and divestments

In September 2012 AB Volvo increased its share-

holding in Deutz AG to just over 25% which had a

negative impact on cash fl ow of SEK 1.1 billion.

Acquired and divested operations 2013 had

a positive impact on cash fl ow of SEK 0.9 billion

(positive 3.4).

Financing and dividend

Net borrowings increased cash and cash equiv-

alents by SEK 13.0 billion during 2013 (14.1).

During the year dividend of SEK 6.1 billion,

corresponding to SEK 3.00 per share, was paid

to the shareholders of AB Volvo.

Change in cash and cash equivalents

The Volvo Group’s cash and cash equivalents

increased by SEK 1.8 billion during the year

and amounted to SEK 27.0 billion at Decem-

ber 31, 2013.

Refer to Note 29 for principles for preparing

the cash fl ow analysis.

115115