Volvo 2013 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198

|

|

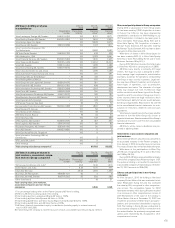

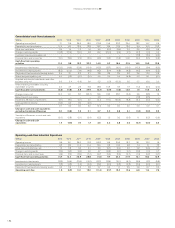

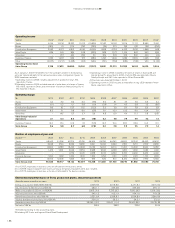

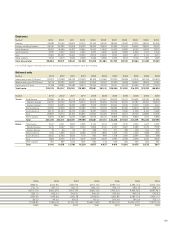

Key ratios

2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003

Gross margin, %121.1 21.9 23.7 23.3 13.9 21.3 22.6 22.7 21.8 21.6 19.2

Research and development expenses

as percentage of net sales15.7 5.0 4.4 5.0 6.3 4.9 4.0 3.4 3.3 3.8 3.9

Selling expenses as percentage

of net sales110.1 9.0 8.0 8.8 11.4 8.7 8.9 8.0 8.5 9.1 9.1

Administration expenses as

percentage of net sales12.2 1.9 2.3 2.2 2.8 2.3 2.6 2.6 2.7 2.6 3.0

Return on shareholders’ equity, % 5.0 12.9 23.1 16.0 (19.7) 12.1 18.1 19.6 17.8 13.9 0.4

Interest coverage, times12.1 6.7 9.6 5.9 (4.7) 8.8 20.7 26.1 16.7 11.0 1.9

Self-fi nancing ratio, % 84 18 118 270 137 5 153 189 116 163 152

Self-fi nancing ratio Industrial

Operations, % 112 72 210 294 (16) 78 265 235 173 268 243

Financial position, Industrial

Operations, SEK M (19,828) (22,978) (19,346) (24,691) (41,489) (29,795) (4,305) 23,076 18,675 18,110 (2,426)

Net fi nancial position as percentage

of shareholders’ equity1(46.8) (29.3) (25.2) (37.4) (70.9) (39.7) (5.7) 29.2 23.7 25.8 (3.3)

Shareholders’ equity as percentage

of total assets 22.4 25.7 24.3 23.3 20.2 22.7 25.7 33.7 30.6 31.3 31.4

Shareholders’ equity as percentage

of total assets, Industrial Operations 27.0 30.9 28.5 26.9 23.8 28.4 30.8 40.6 40.4 40.0 40.5

Shareholders’ equity excluding minority

interest as percentage of total assets 22.0 25.2 23.9 23.0 20.0 22.6 25.6 33.6 30.5 31.2 31.3

1 Pertains to the Industrial Operations. For periods up to and including 2006, Volvo Financial Services is included and consolidated according to the equity method.

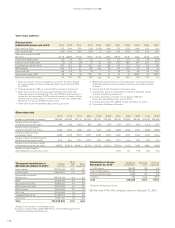

Exports from Sweden

SEK M 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003

Volvo Group, total 88,560 84,314 91,065 72,688 41,829 96,571 88,606 80,517 71,133 62,653 49,300

185