Volvo 2013 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

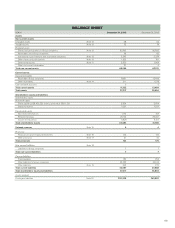

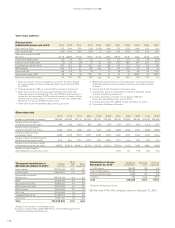

Provisions for pensions and similar benefi ts correspond to the actuarially

calculated value of obligations not insured with third parties or secured

through transfers of funds to pension foundations. The amount of pen-

sions due within one year is included. AB Volvo has insured the pension

obligations with third parties. 0 (0) of the amount pertains to contractual

obligations within the framework of the PRI (Pension Registration Insti-

tute) system.

The Volvo Pension Foundation was formed in 1996. Plan assets amount-

ing to 224 were contributed to the foundation at its formation, corresponding

to the value of the pension obligations at that time. Since its formation, net

contributions of 25 have been made to the foundation.

AB Volvo’s pension costs amounted to 100 (90).

The accumulated benefi t obligation of all AB Volvo’s pension obliga-

tions as of December 31, 2013 amounted to 688 (670). The benefi t obli-

gation has been secured partly through provisions in the balance sheet

and partly through transfer of funds to pension foundations. Net asset

value in the Pension Foundation, market to market, accrued to AB Volvo

was 36 higher than the corresponding pension obligations.

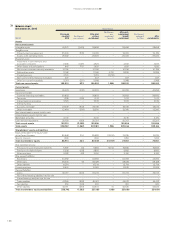

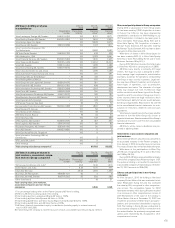

Non-currentdebt matures as follows:

2020 or later 7

B/S Total non-current liabilities 7

Dec 31,

2013 Dec 31,

2012

Wages, salaries and withholding taxes 119 121

VAT liabilities 22 –

Accrued expenses and prepaid income 183 116

Other liabilities 18 33

B/S Total other liabilities 342 270

No collateral is provided for current liabilities.

Contingent liabilities amounted to 232,308 (243,887) of which 232,297

(243,877) pertaining to Group companies.

Guarantees for various credit programs are included in amounts corre-

sponding to the credit limits. These guarantees amount to 223,669

(235,806), of which guarantees on behalf of Group companies totalled

223,669 (235,806).

At the end of each year, the utilized portion amounted to 126,364

(127,076), including 126,353 (127,065) pertaining to Group companies.

Other provisions include provisions for restructuring measures of 31 (39).

PROVISIONS FOR POST-

EMPLOYMENT BENEFITS

NOTE16

Dec 31,

2013 Dec 31,

2012

Accounts receivable 31 45

Prepaid expenses and accrued income 248 339

Other receivables 32 694

B/S Total other receivables 311 1,078

The valuation allowance for doubtful receivables amounted to 2 (3) at the

end of the year.

176

FINANCIAL INFORMATION 2013

OTHER PROVISIONS

NOTE17

NON-CURRENT LIABILITIES

NOTE18

OTHER LIABILITIES

NOTE19

CONTINGENT LIABILITIES

NOTE 20

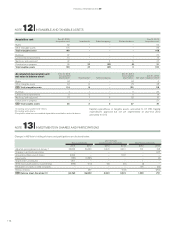

Dec 31,

2013 Dec 31,

2012

Accumulated additional depreciation

Land 3 3

Machinery and equipment 2 1

B/S Total untaxed reserves 5 4

NOTE 15 UNTAXED RESERVES

NOTE 14 OTHER RECEIVABLES