Volvo 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IFRS 13 Fair Value Measurement

IFRS 13 establishes a single source of guidance for fair value measurement

and disclosures of fair value measurements. IFRS 13 does not change the

requirement regarding which items should be measured or disclosed at fair

value. The standard is to be applied prospectively and comparative disclo-

sures is not required. IFRS 13 requires us to take into account factors that

are specifi c to the transaction and to the asset or liability. According to

IFRS13, an entity shall take into account the effect of its credit risk when

measuring fair value of fi nancial liabilities. In many cases, the transaction

price will equal the fair value. IFRS 13 applies to all transactions and bal-

ances (fi nancial or non-fi nancial) for which IFRSs require or permit fair value

measurements, except for share-based payment transactions and leasing

transactions. IFRS 13 is effective from January 1, 2013. The standard has

not had any material effect on the Volvo Group.

Amendments to IAS 36 Impairment of Assets

The amendments to IAS 36 refer to a disclosure requirement about recov-

erable amount which was made as a consequence of IFRS 13. This disclo-

sure requirement has been removed and disclosures regarding recovera-

ble amount are restricted to when an impairment loss is recognized. The

effective date is January 1, 2014 but earlier application is permitted. Volvo

Group is applying the amendments as from January 1, 2013.

Other new or revised accounting standards or new interpretations

effective from January 1, 2013 have not had any material impact on the

Volvo Group’s fi nancial statements.

New accounting principles for 2014 and later

When preparing the consolidated fi nancial statements as of December 31,

2013, a number of standards and interpretations has been published, but

has not yet become effective.

IFRS 9 Financial instruments

IFRS 9 is published in three parts: Classifi cation and Measurement, Im -

pairment and Hedge Accounting, which will replace the current IAS 39. A

joint position regarding how the implementation of IFRS 9 will impact the

Volvo Group will be taken in conjunction with the fi nal version of all three

components of the project being published. The mandatory effective date

has been removed from the standard (previously January 2015), thus this

date is at present not known.

Other new or revised accounting standards are not considered to have a

material impact on the Volvo Group’s fi nancial statements.

The Volvo Group’s most signifi cant accounting policies are primarily

described together with the applicable note. Refer to Note 1, Accounting

Policies for a specifi cation. The preparation of AB Volvo’s Consolidated

Financial Statements requires the use of estimates and assumptions that

may affect the recognized amounts of assets and liabilities at the date of

the fi nancial statements. In addition, the recognized amounts of net sales

and expenses during the periods presented are affected. In preparing these

fi nancial statements, management has made its best judgments of cer-

tain amounts included in the fi nancial statements, materiality taken into

account. Actual results may differ from previously made estimates. In

accordance with IAS 1, the company is required to disclose the assump-

tions and other major sources of estimation uncertainties that, if actual

results differ, may have a material impact on the fi nancial statements.

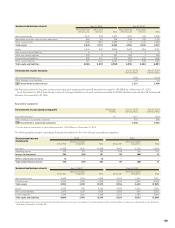

!The sources of uncertainty which has been identifi ed by the Volvo

Group and which are considered to fulfi ll these criteria are pre-

sented in connection to the items considered to be affected. The table

below discloses where to fi nd these descriptions.

Source of estimation uncertainty Note

Buy-back agreements and residual value

guarantees 7, Income

Deferred taxes 10, Income taxes

Impairment of goodwill and other intangible

assets 12, Intangible assets

Impairment of tangible assets 13, Tangible assets

Credit loss reserves 15,

16,

Customer-fi nancing

receivables

Receivables

Inventory obsolescence 17, Inventories

Assumptions when calculating pensions and

other post-employment benefi ts

20, Provisions for post-

employment benefi ts

Product warranty costs 21, Other provisions

Legal proceedings 21, Other provisions

Residual value risks 21, Other provisions

NOTE 2 KEY SOURCES OF ESTIMATION UNCERTAINTY

119