Volvo 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

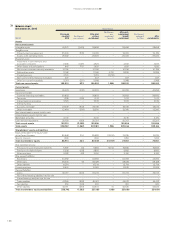

Interest income and similar credits amounting to 8 (0) included interest in

the amount of 0 (0) from subsidiaries. Interest expenses and similar

charges totalling 1,139 (1,509) included interest of 1,136 (1,504) to sub-

sidiaries.

Other fi nancial income and expenses include exchange rate gains and

losses, cost for credit facilities, costs for credit rating, fi nancial costs per-

taining to changed taxable income previous years and costs for registra-

tion of AB Volvo shares.

Group contributions amounted to a net of 832 (5,628). Allocation to addi-

tional depreciation has been made during the year with 1 (0).

Dividend of 31 (35) was received from VE Commercial Vehicles Ltd.

Income include write-down of participation in Blue Chip Jet HB with

5(–) and in Blue Chip Jet II HB with 26 (19).

INCOME FROM INVESTMENTS IN JOINT

VENTURES AND ASSOCIATED COMPANIES

NOTE 6

Income from other investments includes a dividend of 5 (5) from Eicher

Motors Ltd. The shares in Johanneberg Science Park AB and Lindholmen

Science Park AB were written down by 4 (–).

INCOME FROM OTHER INVESTMENTS

NOTE 7

INTEREST INCOME AND EXPENSES

NOTE 8

OTHER FINANCIAL INCOME

AND EXPENSES

NOTE 9

ALLOCATIONS

NOTE 10

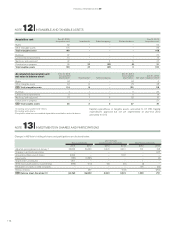

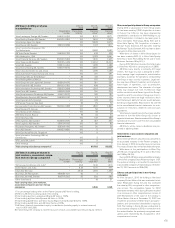

2013 2012

Current taxes (254) 4

Deferred taxes 587 (1,096)

I/S Total income taxes 333 (1,092)

Current taxes consist of an expense of 1 (2) related to this year and an

expense of 253 (income 6) related to prior years.

Deferred taxes relate to estimated tax on the change in tax-loss carry-

forwards and temporary differences. Deferred tax assets are recognized

to the extent that it is probable that the amount can be utilized against

future taxable income.

Deferred taxes related to change in tax-loss carryforwards amount to

an income of 590 (expense 1,081) and to changes in other temporary

differences to an expense of 3 (15).

The table below discloses the principal reasons for the difference

between the corporate income tax of 22% and the tax for the period.

2013 2012

Income before taxes (1,954) 6,193

Income tax according to applicable tax rate 430 (1,629)

Capital gains/losses (23) 754

Non-taxable dividends 380 253

Non-taxable revaluations of shareholdings (227) (37)

Other non-deductible expenses (15) (71)

Other non-taxable income 42 18

Adjustment of current taxes for prior periods (253) 6

Withholding tax (1) (2)

Recognition and derecognition of deferred tax assets

due to change in tax rate – (384)

I/S Income taxes for the period 333 (1,092)

Specifi cation of deferred tax assets Dec 31,

2013 Dec 31,

2012

Tax-loss carryforwards 2,394 1,804

Provision for post-employment benefi ts 149 141

Provision for restructuring measures 7 9

Other deductible temporary differences – 10

B/S Deferred tax assets 2,550 1,964

NOTE 11 INCOME TAXES

173